Best DEX Aggregator

Explore our expert analysis of the best DEX aggregators in the DeFi space, designed to guide traders to the top liquidity pools with ease.

Summary: Selecting a DEX aggregator is essential for active DeFi traders. It's crucial to choose a service that is reliable, secure, and easy to use. Aggregators play a key role in helping traders find the best liquidity pools across different decentralized exchanges, ensuring efficient trade execution with minimal slippage.

We have carefully evaluated the top five DEX aggregators in the market to assist traders with their choices. Our analysis focused on the ability to tap into various liquidity pools, support for cross-chain trading, security protocols, fee structures, and user-friendly trading interfaces.

- Rango Exchange - Best DEX and Cross-Chain Aggregator

- LlamaSwap - Best Pure DEX Aggregator

- Jupiter Exchange - Top Aggregator on Solana

- OpenOcean - Best Choice for Non-EVM Chains

- ParaSwap - Top DEX Aggregator for Stablecoins

Get the daily newsletter keeping 200,000 investors ahead of the market.

Top Decentralized Exchange Aggregators

Our detailed analysis of more than 15 platforms identified the leading decentralized exchange aggregators in the cryptocurrency industry. We evaluated essential features, including the variety of liquidity sources, cross-chain functionality, smart-contract security, incentives for liquidity providers, and robust security measures. This analysis led us to find and pinpoint the top 5, each excelling in their own niche.

1. Rango Exchange

Rango Exchange is the best DEX and cross-chain aggregator, facilitating asset transfers across over 60 chains with a single interface. It utilizes its advanced API to manage transactions via DEXs, DEX aggregators, bridges, and cross-chain protocols, ensuring efficient interoperability and swap capabilities. Rango boasts $2.75 billion in processed volume over 2.01 million swaps and is trusted by more than 543,300 wallets.

High security and reliability underline Rango’s service, integrating over 100 DEXs and bridges, backed by two rounds of security audits without any exploits. This platform simplifies cross-chain transactions with a strong focus on security, user-friendliness, and providing access without KYC requirements. With support for 25+ wallets and a reputation for high efficiency and trust, Rango is essential for users navigating the decentralized finance space.

2. LlamaSwap

LlamaSwap stands out as a top meta DEX aggregator in DeFi, combining leading platforms like 1inch, OpenOcean, and Matcha. This approach ensures users receive the best trading rates without extra fees. LlamaSwap, built by the Defillama team, prioritizes security with trusted aggregator router contracts, offering safe and dependable transactions.

The platform smartly adjusts gas fees to avoid transaction failures and refunds any unused gas, showcasing its focus on user satisfaction. Additionally, using LlamaSwap keeps users eligible for potential aggregator airdrops, maintaining the same perks as direct trades on those platforms. This makes LlamaSwap a key DeFi player, known for its efficiency, security, and user-friendly trading environment.

3. Jupiter Exchange

Jupiter Exchange shines as a top Solana DEX aggregator, particularly after the rise of memecoins such as WIF and BODEN on the Solana network. It provides an unmatched range of tokens and excels in discovering the best swap routes, leading to its popularity among both developers and users. The platform supports high volumes of trading and attracts a large number of users, demonstrating its strong position in the market.

The design of Jupiter's infrastructure effectively addresses the evolving needs of the cryptocurrency markets, particularly as interest in unique tokens like memecoins grows. Its powerful swap engine and comprehensive tools simplify integration for developers and enhance the trading experience for users, solidifying its reputation as a leading DEX aggregator within Solana.

4. OpenOcean

OpenOcean excels as a versatile DEX aggregator, handling transactions across non-EVM chains such as Solana and a broad range of EVM chains. This platform connects seamlessly to over 30 chains and sources from over 1,000 distinct liquidity providers. Its expansive reach includes major EVM chains like Ethereum, BNB Chain, and Polygon, alongside critical non-EVM chains such as Solana and TRON, underscoring its flexibility.

The platform enhances trading experiences by offering no-gas limit orders, extensive multi-chain swaps, and up to 50x leverage on perpetual futures. OpenOcean also boasts an ETH Liquid Staking Aggregator to increase staking returns. Equipped with a potent v3 Smart-API, supported by popular wallets like MetaMask and Rabby Wallet, it guarantees deep liquidity and efficient market navigation.

5. ParaSwap

ParaSwap excels in the DeFi aggregator landscape, specializing in stablecoin swaps between USDC and USDT. It achieves the lowest slippage and optimal liquidity by integrating multiple decentralized exchanges and lending platforms into one secure interface. Handling significant trading volumes exceeding $50 billion and conducting over 14 million transactions on 7 active blockchains, ParaSwap stands out for its reliability and efficiency in DeFi.

Security is a top priority for ParaSwap, underscored by regular independent audits of its smart contract integrity. The addition of a mobile app enhances accessibility, enabling users to seamlessly manage cryptos and participate in NFT P2P trading. With strong liquidity, innovative features like the on-chain Request for Quotes system, and minimal slippage, ParaSwap remains a premier choice for traders looking for reliable and secure stablecoin exchanges in the DeFi environment.

What is a DEX Aggregator?

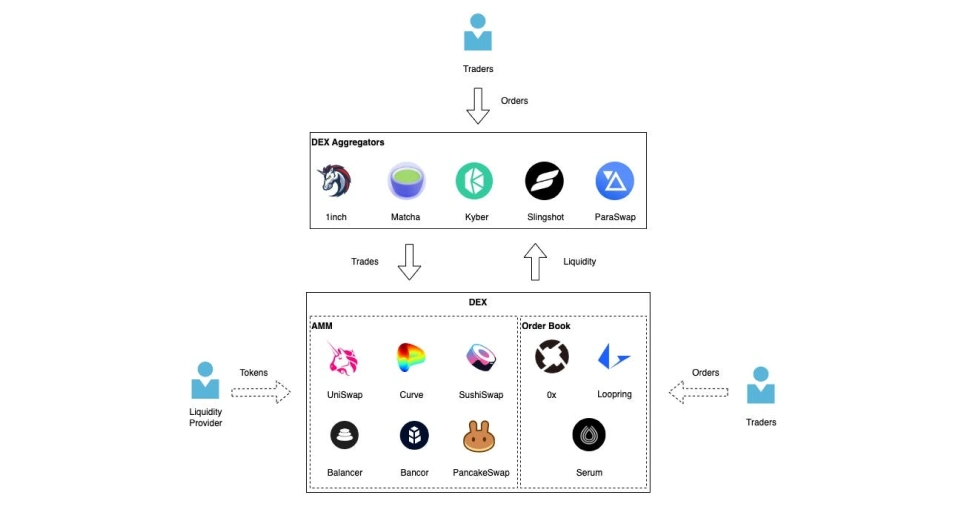

A DEX aggregator is a platform designed to enhance cryptocurrency trading by consolidating liquidity from a variety of decentralized exchanges (DEXes). This integration allows users to access the best trade prices and minimize slippage by comparing rates from multiple exchanges within a single interface in decentralized finance (DeFi).

By aggregating resources, these platforms enable traders to carry out transactions more effectively, tapping into larger liquidity pools than available on any single DEX. DEX aggregators improve the trading experience within the DeFi ecosystem by offering better price discovery, lowering transaction costs, and providing easier access to a wide array of assets.

Are DEX Aggregators Safe?

DEX aggregators generally offer a high level of security since they do not hold users' funds and utilize the security protocols of the underlying decentralized exchanges they aggregate. However, like all platforms, they are not entirely risk-free and depend on the security of their smart contracts and those of the DEXes they integrate.

It's important for users to review the security measures and audit results of specific aggregators to ensure they are using a trusted platform.

Bottom Line

In conclusion, selecting the right DEX aggregator is vital for optimizing trading strategies in DeFi. Our reviewed platforms stand out in their respective areas, offering robust security, deep liquidity, and user-friendly interfaces, critical for achieving the best trading outcomes. As diverse as they are effective, these aggregators enhance price discovery, minimize slippage, and broaden access to various crypto assets across multiple blockchains.

.webp)