Best Decentralized Exchanges (DEX) on Solana

Summary: Solana decentralized exchanges offer fast transactions, minimal fees, and access to tokens ranging from meme coins to perpetual futures. However, each DEX has a unique offering, such as specialized liquidity pools, orderbook trading, or prediction markets.

Traders might be chasing meme coins, swapping tokens, trading perpetuals, or looking for advanced features like prediction markets. We've pinpointed the top Solana DEXs for every scenario in 2025:

- Jupiter - Deepest Liquidity Aggregation for Token Swaps

- Raydium - Largest AMM Pools on Solana

- Orca - Lowest Fees With User-Friendly Interface

- Meteora - Dynamic Pools for Volatility Management

- PumpSwap - Best Meme Coin Launchpad Integration

- Drift - Advanced Perpetuals and Prediction Markets

- Lifinity - Oracle-Based Market Making Reducing Impermanent Loss

Jupiter is Solana’s top decentralized exchange, aggregating deep liquidity from all Solana DEXs, offering gasless swaps, advanced perpetual trading, and real-time trade routing for minimal slippage.

Supported Wallets

Phantom, Solflare, Sollet, Backpack, and more

30-Day Volume

Over $45 billion aggregated volume on spot

Exchange Type

Liquidity aggregator and perpetual trading DEX

Best DEX on Solana in 2025

With meme coins like BONK, POPCAT, TRUMP, PENGU, and the recent launch of PUMP, Solana's decentralized exchanges have become critical infrastructure, connecting wallets like Phantom to thousands of tokens. Increased competition among these exchanges has intensified the battle for liquidity.

Doing this review was a breeze, as half our team has been deep in Solana's trenches since the NFT mania of 2021, actively trading on these platforms. We tested dozens of DEXs based on speed, fees, liquidity depth, and user experience, to bring you the cream of the crop for 2025.

We've summarized our top 7 in the table below:

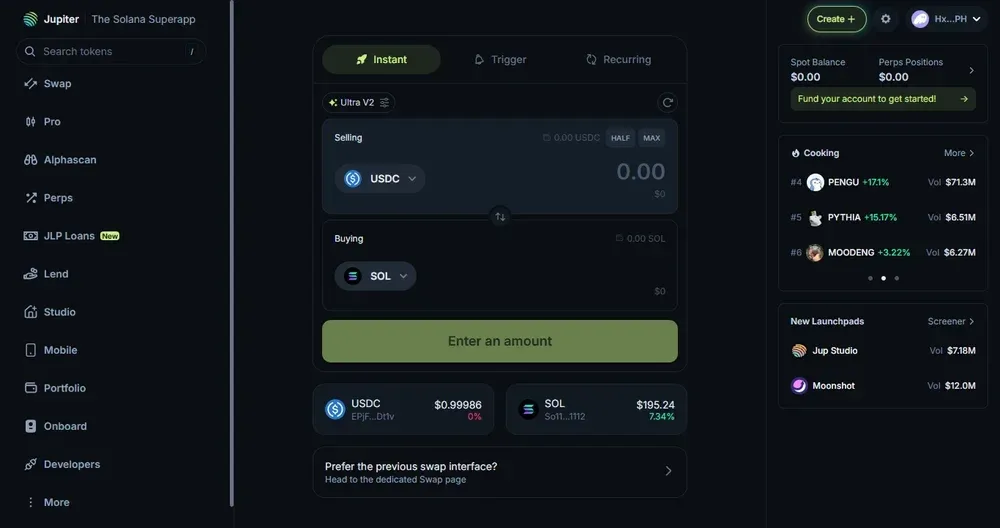

1. Jupiter

Jupiter ranks first on or list as Solana’s top decentralized exchange, offering spot and perpetual trading with gasless swaps and Quick Accounts for instant, signless transactions. We particularly value its Ultra Mode with Real-Time Slippage Estimation (RTSE) and MEV Protect feature, which mitigates sandwich attacks.

Advanced users benefit from Jupiter Pro's analytics dashboard, recurring orders (DCA), and the borrow-fee-based perpetual market structure. Its aggregator engine, Juno, continuously learns from executed trades, automatically refining trade routing for minimal slippage.

Jupiter’s perpetuals uniquely use oracle-driven pricing instead of orderbooks, implementing hourly borrow fees that fairly reward liquidity providers based on token utilization. Large trades trigger simulated price impact fees, safeguarding liquidity pools from exploitation.

Jupiter Highlights:

- Fees: 0-0.1% spot; 0.06% perps base; hourly borrow fees.

- Assets: 10,000+ tokens aggregated.

- Max Leverage: SOL 100x, ETH/wBTC 150x.

- 30-day Volume: $29.19B aggregator; $16.14B perps.

2. Raydium

Raydium is Solana’s largest AMM by trading volume and token listings, uniquely integrating liquidity pools directly into OpenBook’s order book. It supports three major pool types: Concentrated Liquidity (CLMM) pools represented by NFTs, Constant Product (CPMM) pools, and legacy AMMv4 pools.

Core features include LaunchLab, a meme coin launch platform using bonding curves (similar to Pump); Fusion Pools, enabling dual-yield farming; and AcceleRaytor, an IDO platform for vetted projects. Raydium also features perpetual futures trading, built on Orderly Network, with gasless orders and zero maker fees.

Raydium’s "Burn & Earn" program allows projects to permanently renounce control of their liquidity pools while continuing to earn trading fees. After the initial pool setup, liquidity tokens are burned, ensuring pools remain locked, which incentivizes long-term project sustainability and security.

Raydium Highlights:

- Fees: 0.01-2% pools; 0% maker, 0.025% taker (perps).

- Assets: 90,000+ tokens.

- Max Leverage: 100x (BTC, ETH, SOL); 10-20x others.

- 30-day Volume: $23.90B spot; $0.41B perps.

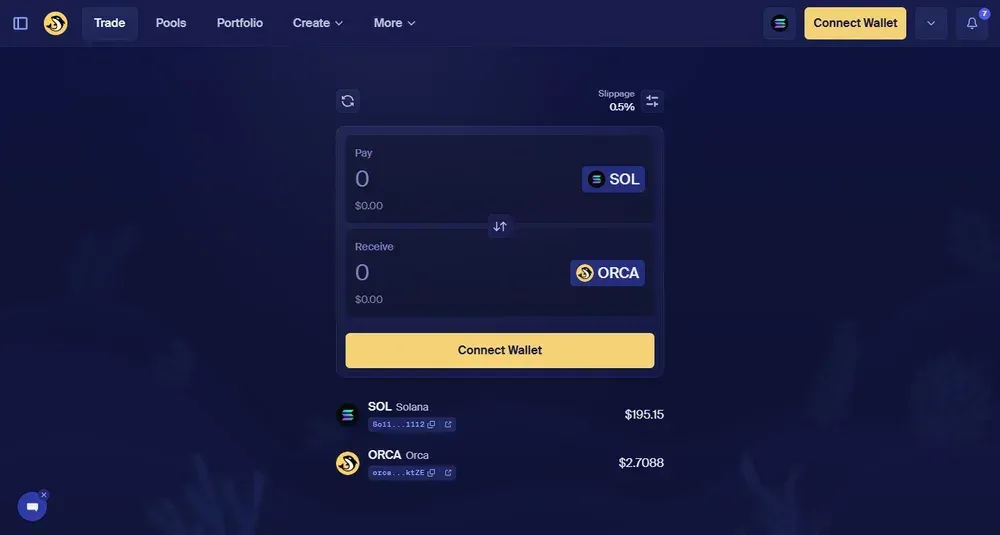

3. Orca

Orca specializes in concentrated liquidity AMM pools (Whirlpools) and permissionless token creation on Solana. Its infrastructure supports both Adaptive Fee pools, which automatically adjust trading fees during market volatility, and Fixed Fee pools with stable rates.

Major features include the Liquidity Terminal for simplified management of positions, built-in yield farming for specific trading pairs, and double-audited open-source smart contracts. Orca also allows governance participation through the ORCA token, letting holders vote on protocol decisions.

Permissionless pool creation lets token projects list assets instantly without approvals, increasing accessibility for new tokens. Pool creators set initial pricing, fee tiers, and liquidity ranges independently, directly controlling how their token trades from the outset.

Orca Highlights:

- Fees: 0.01-2% pools.

- Assets: 20,000+ tokens.

- Max Leverage: None.

- 30-day Volume: $14.39B spot.

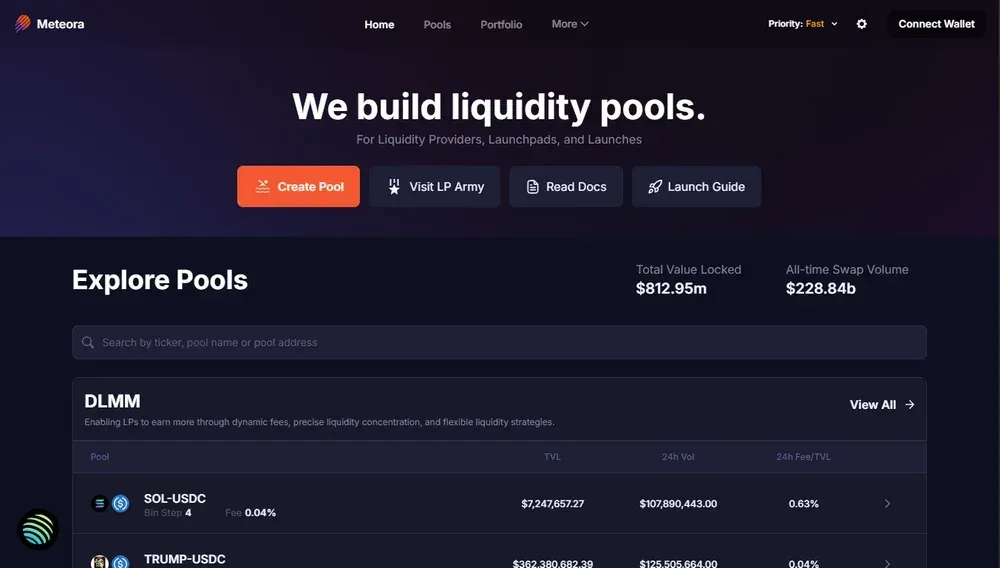

4. Meteora

Meteora offers dynamic liquidity pools customized to liquidity providers, token launches, and launchpads. It supports Dynamic AMM (DAMM v1/v2), Dynamic Liquidity Market Maker (DLMM), and Dynamic Bonding Curve (DBC) pools optimized for yield and volatility management.

The features we fell in love with the most when testing Meteora include Alpha Vaults, an anti-bot mechanism ensuring fair token distribution. Additionally, Stake2Earn vaults share revenue with token stakers, Dynamic Vaults generate yield from idle liquidity, and Meteora Lock offers customizable vesting schedules.

Meteora’s innovative Universal Curve gives liquidity providers unprecedented flexibility. LPs define exact price points using a customizable 16-point liquidity curve, enabling strategies such as infinite-range liquidity or replicating other AMM models within a single pool.

Meteora Highlights:

- Fees: About 5-20%.

- Assets: ~1,000 tokens across 3,000 pairs.

- Max Leverage: 0x (no perps).

- 30-day Volume: $17.55B.

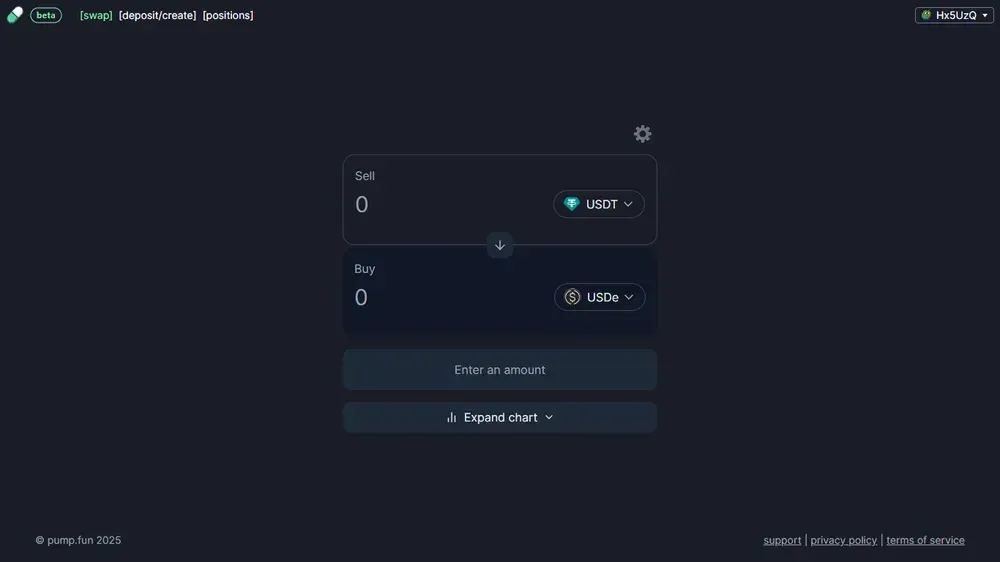

5. PumpSwap

PumpSwap is Pump.Fun's response to Raydium's LaunchLab, heating up Solana's ongoing meme coin wars. Previously, meme tokens minted on Pump had to migrate liquidity to Raydium, but now PumpSwap lets creators skip Raydium entirely, fragmating meme coin trading liquidity into two platforms.

Pump's DEX charges a 0.3% trading fee, with 0.2% going to liquidity providers and 0.05% to the protocol. Notably, the remaining 0.05% is uniquely redirected back to token creators, giving them an incentive linked directly to their coin’s trading volume.

In July 2025, PumpFun's native token, PUMP, raised $600 million through a token sale hosted on top centralized exchanges, including Bybit, Kraken, and KuCoin. Initially controversial due to its funding model, the sale allocated 33% of the total 1 trillion token supply, valuing the platform at approximately $4 billion.

PumpSwap Highlights:

- Fees: 0.3% trading fee (0.2% LPs, 0.05% protocol, 0.05% creators).

- Assets: ~500 tokens across ~9,000 trading pairs.

- Max Leverage: 0x (no perps).

- 30-day Volume: $9.88B.

6. Drift

Drift is Solana’s go-to DEX for perpetual trading, offering 101x leverage on majors like BTC, ETH, and SOL, and up to 10x for popular altcoins. Its unique Just-in-Time liquidity auctions reduce slippage, matching orders via a decentralized keeper network, while its AMM acts as a reliable liquidity backstop.

Unlike typical DEXs, Drift combines perpetuals, spot, lending, and prediction markets in one interface, letting traders seamlessly manage multiple strategies with shared collateral. Drift also incentivizes market makers through rebates and specialized liquidity pools, rewarding high-volume users.

Drift’s new prediction market, BET, is gaining traction, allowing traders to speculate on real-world events using any supported collateral, not just stablecoins. BET users benefit from zero liquidation risk if fully collateralized in USDC and can earn yield while holding positions.

Drift Highlights:

- Fees: Perps: -0.01% maker rebate, 0.03%-0.10% taker; Spot: -0.02% maker rebate, 0.05% taker.

- Assets: 20+ trading pairs.

- Max Leverage: 101x (SOL, BTC, ETH), 5-10x (altcoins).

- 30-day Volume: $9.2B perps; $100M spot.

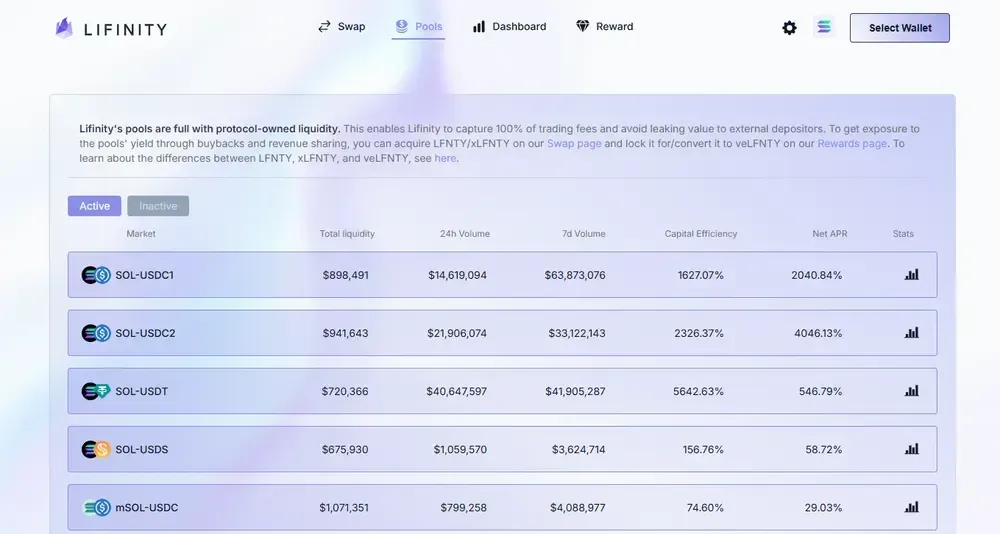

7. Lifinity

Lifinity is Solana’s first proactive market maker, built to to eliminate impermanent loss by pricing assets using its custom oracle. Unlike standard AMMs, Lifinity's concentrated liquidity pools automatically rebalance based on live oracle pricing, optimizing capital efficiency without constant user adjustments.

Its tokenomics are equally innovative, featuring protocol-owned liquidity and a versatile veToken model with flexible unlocking. Lifinity also launched a collection of 10,000 animated NFTs called Flares, directly seeding its liquidity pools and redistributing revenue through buybacks.

Through its Market Making as a Service (MMaaS), Lifinity allows projects to provide their own assets while keeping market-making profits. Alternatively, its Liquidity as a Service (LaaS) model lets Lifinity handle liquidity provisioning in exchange for volume-based compensation.

Lifinity Highlights:

- Fees: ~0.003% (+ aggregator fees).

- Assets: 1,000+ tokens.

- Max Leverage: No leverage (spot only).

- 30-day Volume: $2B spot.

What Exactly is a Solana DEX?

A decentralized exchange on Solana is a blockchain trading platform with a Web2 interface, allowing users to swap SPL tokens like SOL, USDC, and meme coins directly from their wallets. Unlike centralized exchanges, transactions occur automatically via smart contracts, ensuring users maintain full control of their funds.

Solana DEXs include AMMs like Raydium, decentralized orderbooks like Drift, and DEX aggregators like Jupiter. Collectively, these platforms give access to 100,000+ coins, from wrapped assets such as BTC, ETH, and XRP to newly-launched meme tokens like TRUMP, WIF, JENNER, and countless others.

Users can trade on a Solana DEX by connecting a compatible Solana wallet, such as Phantom or Solflare, and funding it through exchanges, onchain P2P, or third-party fiat gateways. Once funded, users execute swaps without registration, although fiat onramps may require identity verification (KYC).

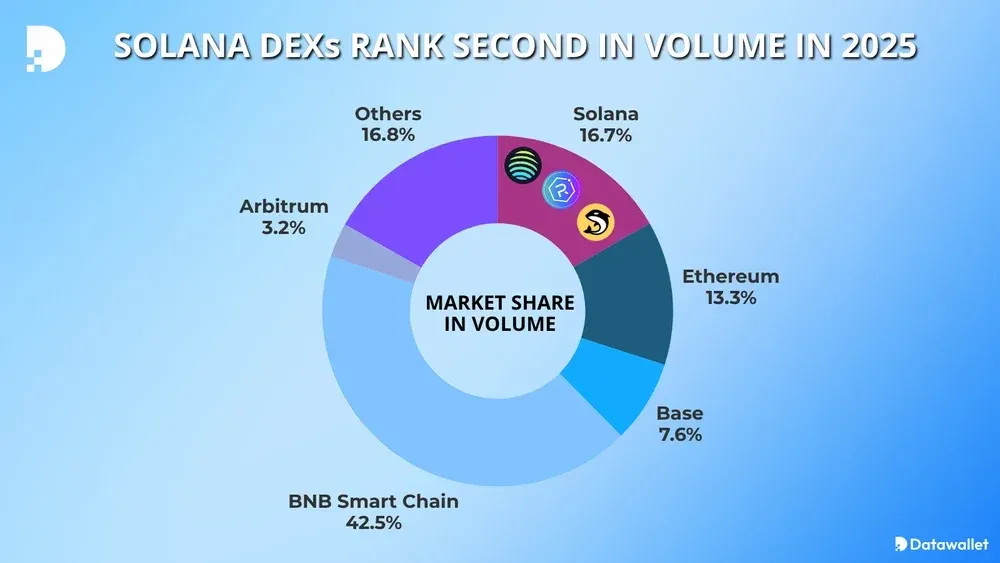

Key Solana DEX Trading Stats (2025)

Solana currently ranks second in decentralized exchange trading volume, trailing only BNB Chain but surpassing Ethereum and other competitors. Here's a breakdown of key statistics:

- Monthly Volume: Solana DEXs facilitated $69.81 billion in trading volume, capturing 17.54% market share as of Q2 2025, down from its 2024 peak.

- Total Value Locked (TVL): Solana’s TVL reached $3.83 billion, a 165% increase since our last update of this article in October 2024.

- Spot Market Leaders: Raydium leads with approximately 34% of spot trading volume, followed by Meteora (22%), Orca (19%), and PumpSwap (15%).

- Perps Market: Jupiter and Drift dominate the decentralized perpetuals exchange segment with a combined 92% share ($27 billion volume), compared to under $0.9 billion from Raydium and Orderly.

- Protocol Fees: Meteora collected the highest monthly protocol fees on Solana ($145 million), followed by Jupiter ($72 million), PumpSwap ($49 million), and Axiom (a trading app) at $46 million.

To our surprise, Solana still lacks a widely adopted crypto options trading platform, with previous attempts like Cega (sunsetting after acquisition) and Zeta Markets (pivoting into Bullet, a new derivatives and lending platform) failing to establish dominance.

How Do Solana DEX Fees Compare to Ethereum?

Solana DEXs typically charge less than $0.002 per transaction due to the network’s parallel execution model and low compute pricing. Some platforms, like Jupiter and PumpSwap, support gasless swaps through fee relayers, removing the need for users to hold SOL when executing trades.

Ethereum DEXs became cheaper following the Dencun upgrade and Uniswap v4's singleton pool design, which reduced calldata costs and gas fragmentation. With Pectra now live, execution-layer transactions are more efficient, with most swaps on Ethereum Layer 2s costing less than $0.01.

In our test swapping 1 ETH to USDC across three Ethereum DEXs (Uniswap v4, Balancer & Curve) and three Solana DEXs (Jupiter, Raydium & Meteora), average fees were $0.61 on Ethereum and $0.0016 on Solana.

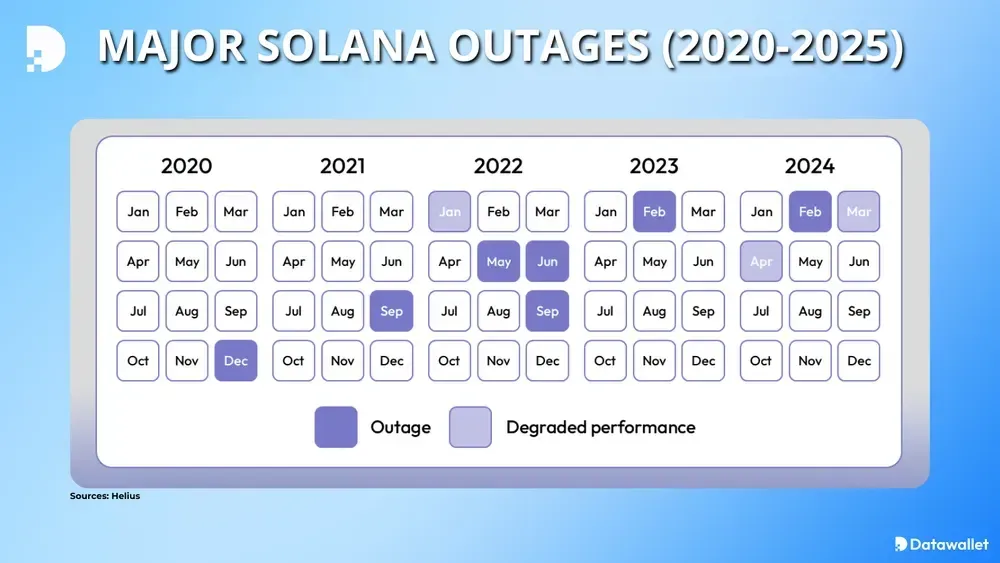

Risks of Trading on Solana DEXs

Trading on decentralized exchanges built on Solana carries specific risks investors should consider before connecting their wallets and making their first trade. Here are six critical risks to consider:

- High Token Failure Rate: 90% of tokens launched on popular meme coin trading platforms like Pump.Fun and LetsBonk lose over 80% of their value within days.

- Regulatory Scrutiny: Platforms such as Pump.Fun and Raydium have faced lawsuits alleging the illegal sale of unregistered securities.

- Network Downtime: Solana has suffered at least seven major outages since 2020, impacting traders’ ability to execute critical trades.

- Front-Running: Solana's decentralized nature allows bots to front-run transactions, increasing user slippage by an average of 1-3%.

- Liquidity Risk: Meme coins on Solana often see 95% liquidity drops after their initial pump, trapping traders in illiquid positions.

- Smart Contract Risk: Solana protocols have historically suffered smart contract exploits and vulnerabilities like Mango Markets flash loan losing $100 million.

Our Favorite Exchange for Trading Solana Meme Coins

Let’s flip the script a bit. When you think about trading Solana meme coins, you probably immediately imagine Raydium or PumpSwap. But what if we told you the real alpha isn’t even on Solana?

Hyperliquid, which actually runs on its own blockchain, is currently the best place for trading Solana meme tokens. Here’s why: it’s fully decentralized, anonymous, offers single-click on-chain perps, and lets you trade meme coin launches with up to 3-10x leverage the second they hit the market.

Don’t believe us? When $PUMP launched, guess who had the deepest liquidity and highest open interest, beating even CEXs like Bybit and KuCoin? Yup, Hyperliquid. Within hours, Hyperliquid had more than $400 million in open interest, completely stealing the spotlight from every other exchange, centralized or not.

The Best Part: Phantom Wallet recently integrated Hyperliquid perps, letting you fund your perpetual trading balance directly with SOL from your Solana wallet. Your SOL is automatically converted to USDC on Hyperliquid in less than a minute, completely skipping bridging or manual swaps.

Final Thoughts

Raydium, Jupiter, Orca, and PumpSwap remain the core Solana DEXs, each excelling in different areas like Raydium’s concentrated liquidity, Jupiter’s aggregator for best-price trades, Orca’s low-cost swaps, and PumpSwap’s built-in revenue sharing for meme coin creators.

But if you’re after even deeper liquidity, faster execution, and leveraged trading (especially for new meme coin launches), Hyperliquid is your secret weapon, now directly accessible using Phantom Wallet and SOL.

Frequently asked questions

How Do I Securely Use a Solana DEX?

Always trade using a burner wallet with limited funds, carefully verify DEX URLs, and regularly revoke token approvals on wallets like Phantom or Solflare.

Can I Trade NFTs on Solana DEXs?

Most DEXs don't directly support NFT trading; instead, they use Solana NFT marketplaces like Tensor, Magic Eden, OpenSea, or Solanart.

Are Solana DEXs Compatible with Ethereum Assets?

Yes, through token bridges like Portal or Wormhole, you can trade Ethereum ERC20 tokens (wrapped as SPL tokens) on Solana DEXs.

How Do I Report Taxes for Solana DEX Trades?

You can track your Solana DEX trades using crypto tax tools like CoinLedger or Koinly, which directly import transactions and calculate your taxes.

Do Solana DEXs Support Stablecoin Trading?

Yes, Solana DEXs widely support stablecoins, including popular options like USDC, USDT, and newer alternatives like PayPal's PYUSD and Ethena's USDe.

%2520(1).webp)

Written by

Tony Kreng

Lead Editor

Tony Kreng, who holds an MBA in Business & Finance, brings over a decade of experience as a financial analyst. At Datawallet, he serves as the lead content editor and fact-checker, dedicated to maintaining the accuracy and trustworthiness of our insights.

%2520(1).webp)

.webp)

.webp)