What is Ethena? USDe, sUSDe, USDtb & More

Summary: Ethena is a decentralized finance protocol that creates stablecoins like USDe and sUSDe, offering APY up to 19% through delta-neutral futures strategies and crypto-backed collateral.

It also issues USDtb, backed by tokenized real-world assets including BlackRock’s BUIDL fund, and uses the ENA governance token to support protocol management and recent treasury partnership campaigns.

Ethena is a synthetic dollar DeFi protocol that provides various stablecoin products like USDe, alongside a globally accessible dollar savings asset, sUSDe.

Supported Blockchains

24 (Ethereum, Arbitrum, TON)

Annual Percentage Yield (APY)

Up to 19% for sUSDe

Total Value Locked (TVL)

$9.5 billion from 756k users

What is Ethena?

Ethena is a decentralized protocol issuing three stablecoins: USDe (synthetic dollar), sUSDe (yield-bearing token), and USDtb (Treasury-backed stablecoin). Inspired by Arthur Hayes' "Dust on Crust", Ethena bridges DeFi, CeFi, and TradFi, meeting global demand for yield-bearing, dollar-denominated assets.

USDe earns interest through liquid staking income and delta-neutral hedging, with circulating supply now surpassing $8.4 billion. Ethena mitigates custodial risks by securing assets off-exchange via institutional providers like Copper, Ceffu, and Fireblocks, ensuring transparency through regular attestations.

By August 2025, sUSDe achieved a market cap of approximately $5.05 billion, and USDtb attracted over $3.1 billion in inflows within just 20 days. In total, Ethena manages roughly $9.5 billion in total value locked (TVL) according to DefiLlama, generating about $130 million annually in protocol fees.

How USDe Works

USDe maintains its $1 peg through delta-neutral hedging. In practice, Ethena accepts crypto collateral (such as Ethereum) and immediately takes an equivalent short position in perpetual futures markets. Like balancing a seesaw, when crypto prices drop, gains from the short positions offset these losses, stabilizing USDe’s value.

Minting new USDe triggers this hedging process, protecting the stablecoin from volatility.

Below we have outlined the core processes that make USDe work:

- Purchase USDe: Users can buy USDe via decentralized liquidity pools or directly mint USDe by depositing assets like USDT, and redeem USDe by burning tokens to retrieve the collateral.

- Delta-Neutral Hedging: Spot crypto-assets provided as collateral are balanced with equivalent short futures positions, stabilizing the value of USDe around $1 despite market volatility.

- Collateralization: USDe is always fully backed 1:1 by deposited crypto-assets, avoiding the risks associated with under-collateralized or algorithmic stablecoins.

- Off-Exchange Custody: Collateral assets remain securely stored in institutional-grade custody systems, minimizing counterparty risk by never transferring direct control to exchanges.

- Protocol Revenue: Ethena earns revenue mainly through funding rates on perpetual futures and the yield generated from holding stablecoin collateral.

- Staking USDe: Users stake USDe to receive sUSDe, automatically earning rewards generated from protocol revenue without additional effort, reflected in the increasing value of sUSDe.

We strongly recommend exploring the official Ethena documentation, which clearly explains these processes (with great visuals). You'll comfortably understand each concept in less than five minutes.

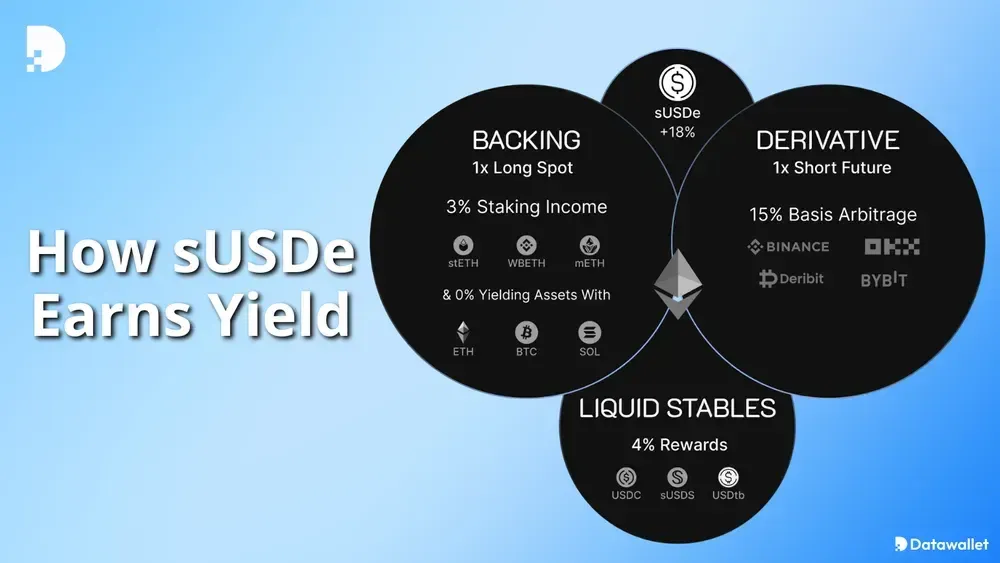

How Does sUSDe Earn Yield?

sUSDe earns yield through rewards generated from Ethena’s sustainable protocol revenues, primarily funding rates from delta-neutral derivatives positions. In 2025, these derivatives provided an average annual yield of approximately 19%, supported by positive funding rate spreads in crypto markets.

Additionally, sUSDe yield includes returns from fixed rewards on liquid stablecoins (around 7% of backing assets) and staking Ethereum (6% of backing assets). Historically, ETH staking rewards yielded around 6% annually in 2021, trending toward 3% by early 2025 as Ethereum staking participation increased.

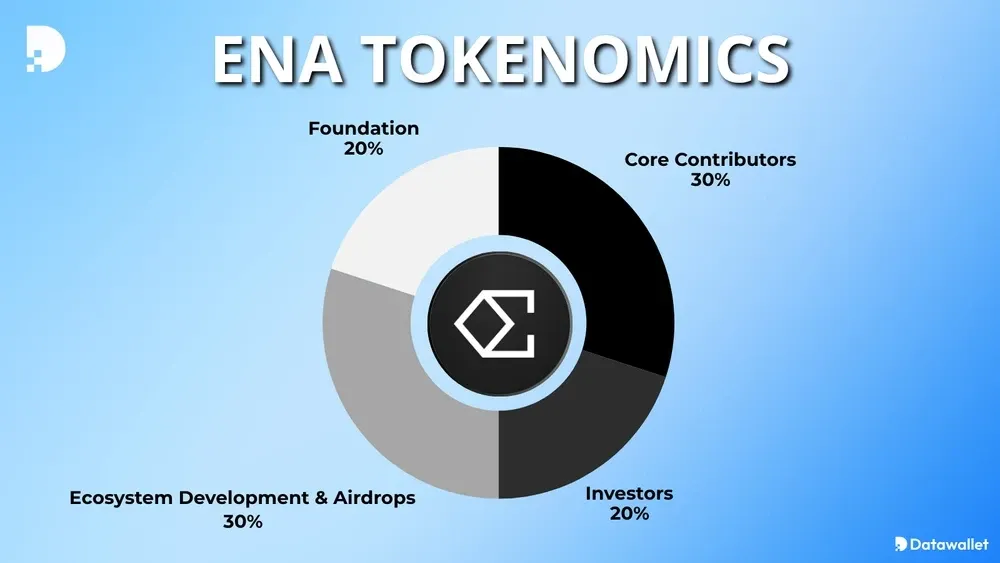

Ethena (ENA) Tokenomics

ENA is Ethena’s governance token, launched April 2, 2024, with a fixed total supply of 15 billion and 1.425 billion tokens initially circulating. Its distribution uses shard-based eligibility and vesting to reward committed users while sustaining ongoing incentive campaigns and decentralized governance.

Below is a breakdown of the ENA token allocation:

- Core Contributors (30%): Tokens for the Ethena Labs team and advisors, subject to a one-year cliff followed by a three-year linear vesting period.

- Investors (20%): Allocated to early backers supporting protocol development, with a one-year cliff and three-year linear vesting thereafter.

- Foundation (20%): Dedicated to protocol advancement, risk management, audits, and initiatives to expand USDe adoption beyond crypto-native markets.

- Ecosystem Development & Airdrops (30%): Funds incentives like Shard and Sats Campaigns, cross-chain expansions, exchange partnerships, and future DAO-controlled initiatives.

Interestingly, the top 2,000 wallets by shard count, along with holders of Pendle’s YT token, received 50% of their ENA tokens fully liquid at launch, with the remaining 50% vested linearly over six months. Smaller holders receive fully liquid tokens to lower barriers and encourage broader onchain usage.

What is USDtb?

USDtb is a digital dollar fully backed by tokenized US Treasury assets, primarily BlackRock’s USD Institutional Digital Liquidity Fund Token (BUIDL). Unlike traditional stablecoins, USDtb’s reserves are custodied independently by institutional providers such as BNY Mellon, Coinbase, and Fireblocks.

As of August 2025, USDtb achieved a circulating supply exceeding $1.44 billion, with an instantaneous redemption capacity surpassing 100%. Backing includes over $1.11 billion in BUIDL holdings, supplemented by stablecoin reserves like USDC ($324 million) and USDT ($9.2 million)

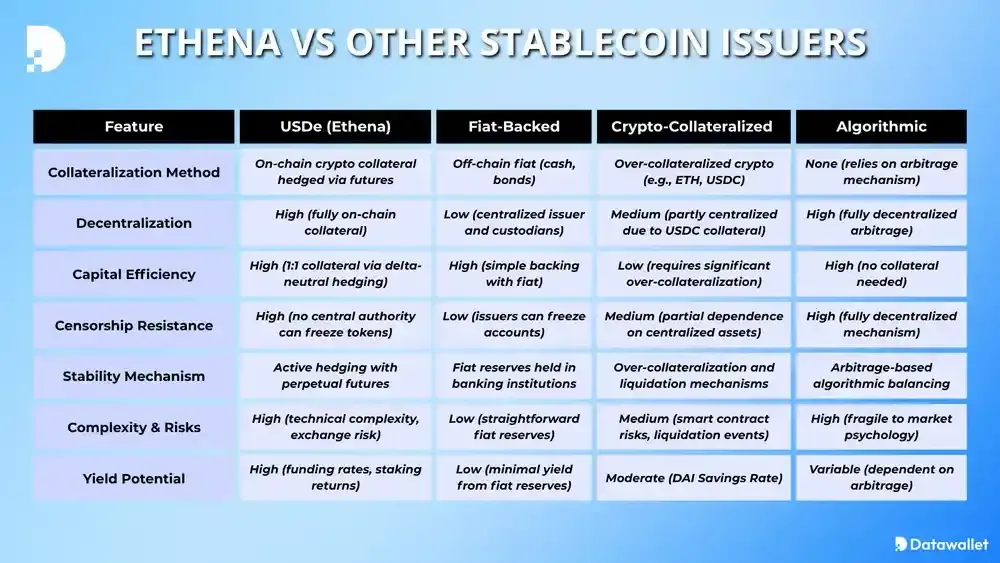

How USDe Compares to Other Stablecoins

Ethena's USDe represents a new approach in stablecoin design, differentiating itself entirely from traditional fiat-backed, crypto-collateralized, and algorithmic stablecoins. It combines decentralized backing with capital efficiency through tokenized RWAs, setting itself apart in terms of transparency and yield potential.

USDe vs. Fiat-Backed Stablecoins (USDT/USDC)

Traditional stablecoins like USDT and USDC rely on cash or bonds stored off-chain, creating centralization risks linked to banks and issuers. In contrast, USDe uses crypto assets held entirely on-chain, employing smart-contract-based hedging strategies without dependence on banks.

- USDe vs USDT/USDC Advantage: USDe is censorship-resistant and fully transparent.

- USDe vs USDT/USDC Drawback: USDe introduces complexity and exposure to crypto-market volatility.

USDe vs. Crypto-Collateralized Stablecoins (DAI)

Unlike Sky's USDS (formerly MakerDAO’s DAI), which demands excessive over-collateralization, USDe achieves capital efficiency with a 1:1 collateral ratio via delta-neutral hedging. However, this introduces centralization risk due to reliance on CEXs for hedging, unlike simpler decentralized models.

- USDe vs USDS (DAI) Advantage: USDe provides higher capital efficiency and potential yield.

- USDe vs USDS (DAI) Drawback: Dependence on centralized exchanges increases counterparty risk.

USDe vs. Algorithmic Stablecoins (e.g., TerraUST)

Algorithmic stablecoins like TerraUST maintain(ed) stability solely through arbitrage mechanisms, lacking tangible collateral, making them vulnerable during crises. USDe, however, is fully collateralized with crypto assets and maintains stability through active hedging rather than algorithmic arbitrage alone.

- USDe vs Algo Stablcoins Advantage: USDe has tangible backing, significantly reducing collapse risk.

- USDe vs Algo Stablcoins Drawback: Operational complexity is higher due to the active hedging.

Ethena Labs Treasury Partnership

Ethena Labs has partnered with StablecoinX Inc., which recently raised $360 million to strategically acquire Ethena’s native governance token, ENA. StablecoinX plans to list its Class A shares on the Nasdaq exchange under the ticker "USDE," directly linking equity markets to Ethena.

StablecoinX is allocating $260 million from the capital raise to purchase locked ENA tokens from an Ethena Foundation subsidiary. Funds will be deployed consistently, approximately $5 million daily over the next six weeks, accounting for about 8% of ENA’s circulating supply.

Importantly, the Ethena Foundation retains veto authority over future ENA sales by StablecoinX, ensuring ongoing strategic alignment and long-term token accumulation.

Ethena Risks

Ethena’s innovative stablecoin model includes risks like derivatives exposure, smart contract vulnerabilities, counterparty reliance, regulatory uncertainty, and adoption challenges.

Here are the primary risks users should consider:

- Funding Rate Risk: Stability and yield depend on derivatives funding rates, which could turn negative during prolonged market downturns or volatility.

- Liquidation Risk: If the price spread between collateral assets (e.g. WBETH or mETH) and their derivatives widens significantly, positions may be forcibly liquidated.

- Custodial Risk: Reliance on off-exchange custodians like Copper or Fireblocks means operational disruptions or failures could impact asset availability and settlement.

- Exchange Failure Risk: Ethena’s derivative hedging takes place on centralized exchanges; the failure or insolvency of these exchanges could disrupt positions.

- Backing Asset Risk: Using assets like Lido's stETH as collateral introduces potential risks if these tokens significantly diverge in value from native Ethereum.

- Stablecoin Risk: Holdings of centralized stablecoins (e.g. USDC, USDT) expose the protocol to custodial risk, issuer solvency issues, and regulatory actions.

- Margin Collateral Risk: The use of stablecoin-margined perpetual futures, especially in USDT, creates direct exposure to the stability of those stablecoins.

- Smart Contract Risk: Ethena’s complex smart contracts remain vulnerable to undiscovered bugs, exploits, or integration issues despite thorough audits.

Recent Challenges: In March 2025, Germany's regulator BaFin ordered Ethena GmbH to halt offering USDe, citing non-compliance with Europe's MiCA stablecoin regulations. Ethena swiftly pivoted from Europe, winding down its EU operations by April and refocusing efforts under the US GENIUS Act framework.

Final Thougths

In our opinion, Ethena comes with a clear risk-reward tradeoff: you get a high-yield stablecoin by taking on more complexity. Users should weigh those risks, stay informed (e.g. on funding rate trends and protocol updates), and perhaps use Ethena as part of a diversified strategy.

Going forward, Ethena’s trajectory will be shaped by how well it can confront regulations. The protocol’s recent pivot to launch USDtb under US regulatory frameworks shows a pragmatic streak, acknowledging that bridging to traditional finance can unlock new markets.

Frequently asked questions

How does Ethena handle oracle security for its stablecoins?

Ethena relies on trustworthy decentralized oracle networks to ensure accurate pricing data for its delta-neutral hedging positions. This minimizes price manipulation risk, maintaining reliable peg stability across all Ethena-issued stablecoins.

Can users outside the US mint or redeem USDtb directly?

USDtb minting and redemption involve compliance checks like KYC and AML, limiting direct access to eligible jurisdictions. Users outside permitted regions typically access USDtb through secondary markets or decentralized exchanges.

What role does Ethena’s Reserve Fund serve in protecting users?

Ethena maintains a Reserve Fund designed to cover potential protocol losses during extreme market events or prolonged negative funding scenarios.

This buffer helps preserve stablecoin collateral integrity and ensures peg reliability under stress conditions.

Does Ethena support cross-chain integration or interoperability?

Ethena is actively exploring cross-chain integrations to expand USDe's utility, currently supporting 24 blockchains in total. Such integrations would increase liquidity, accessibility, and usability across diverse crypto communities.

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.

.webp)