Bybit Review 2026: Fees, Security & Features

Bybit is a global exchange that is best-in-class for two things: low-fee spot execution and deep perpetuals liquidity, delivered through a fast all-in-one app with Earn products and a built-in Web3 wallet.

In our tests, the trading experience is built around speed. Spot and Derivatives sit side by side in the Trade tab, liquid pairs fill quickly, and the fee schedule stays competitive as volume increases.

The only trade-off is complexity and jurisdiction rules. The app has a lot of surfaces and toggles, and depending on where you live you can run into KYC gates, withdrawal checks, or product limits that change what you can access.

Bybit is the second largest crypto exchange in the world with over 80 million registered users and a daily trading volume exceeding $20 billion across both order books.

Available Assets

2,400+ Cryptocurrencies (Spot, Futures & Options)

Trust & Security

Audited 1:1 Proof-of-Reserves and Globally Licensed

Deposit Methods

Bank Transfer, Debit Card, Credit Card, PayPal and more

About Bybit

Bybit was founded in 2018 by Ben Zhou, who remains CEO. In 2022, Bybit relocated its global headquarters from Singapore to Dubai as the UAE expanded its crypto regulatory framework. As of 2026, it has grown to serve 80 million users and is the second-largest exchange worldwide.

Today, Bybit positions itself as a full-stack exchange, combining trading with yield and Web3 tools. Core services include spot trading, futures/perpetuals, a VIP fee program, automated trading bots (grid and DCA styles), copy trading, and an Earn section for yield products.

Bybit also runs a P2P marketplace and supports crypto and fiat deposit flows through its funding tools, plus a Bybit-branded Web3 offering that includes wallet functionality and on-chain features. It is available in over 160 countries globally and offers a multilingual user interface.

Bybit Features

Bybit is built as a trader-first platform, so its features focus on fast execution, deep derivatives tools, and a wide set of add-ons that go beyond basic spot buying.

Trading Types

Bybit supports everything from simple spot trades to complex derivatives products, so you can start with basic orders and scale up into margin, perps, futures, and options as your strategy becomes more advanced.

- Spot trading: Buy and sell 480+ coins and 640+ spot trading pairs on the standard spot order book.

- Spot margin trading: Borrow against collateral to increase spot exposure. Bybit flags liquidation risk using a Maintenance Margin Rate (MMR) threshold in its margin guidance.

- Perpetual contracts: Trade 710 trading pairs with leveraged perpetuals that track spot prices without an expiry date. Bybit supports USDT perpetual and USDC perpetual lines within its trading products.

- Futures contracts: Dated contracts (expiry-based) are included alongside USDC perpetual/futures in Bybit’s trading products.

- Inverse contracts: Contracts margined in the base coin (e.g., BTC-margined BTCUSD). Bybit explains inverse perps and how margin/P&L are calculated in the base asset.

- Options trading: Bybit offers European-style, cash-settled options (calls and puts). Its docs describe USDC options and also outline options settled in USDT in a newer help article.

- Leveraged tokens: Included as a supported product inside the Unified Trading Account (UTA) product list.

- Unified Trading Account (UTA): An all-in-one account mode that lets you access core products (spot, margin, derivatives, options) with cross-collateral support and different margin modes.

.webp)

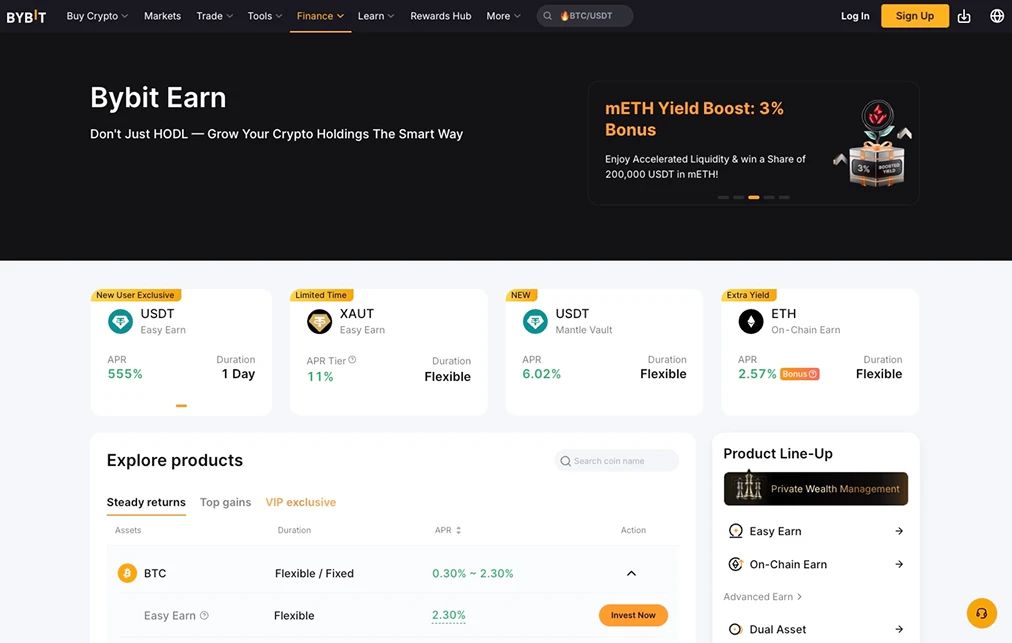

Earn Options

Bybit Earn is the platform’s yield hub, offering a mix of simple staking products and higher-risk structures where returns depend on market conditions and lock periods.

- Bybit Earn (product suite): Bybit groups Earn into Easy Earn, On-Chain Earn, Advanced Earn, and Liquidity Mining, designed for different risk levels and experience.

- Launchpool: Stake supported tokens (varies by campaign) to earn project tokens, with redemption rules described in Bybit’s Launchpool FAQ.

- Dual Asset: A short-term, outcome-based product tied to price direction over a set period, described by Bybit as a trading tool with higher returns and higher complexity.

- Crypto Loans: Bybit offers over-collateralized crypto loans (Flexible and Fixed Rate) that let you borrow against your crypto without selling it, with repayment controls such as manual repayments, partial repayments, and optional auto-repayments.

Additional Services

Beyond trading and earning, Bybit adds convenience tools like automation, conversions, and fiat/P2P routes that help users fund accounts, execute strategies faster, and manage positions more efficiently.

- Trading bots: Built-in automation tools, including Spot Grid, DCA, and futures-focused bots such as Futures Grid, listed on Bybit’s trading bot pages.

- Copy trading: A dedicated copy trading product where users can follow and mirror strategies based on trader performance metrics shown on the platform.

- Convert (instant swaps): Convert supports instant mode (immediate execution at the quoted rate) and limit mode (only converts when price conditions match).

- P2P trading: A peer-to-peer desk for buying/selling major coins using fiat payment methods. Its P2P platform supports 80+ payment methods, depending on region and listing.

- Web3 Wallet: Bybit includes a Seed Phrase Wallet inside the app, letting you hold assets in a self-custody wallet and access supported Web3 functions.

- Bybit Pay: An in-app crypto payments feature for sending and receiving funds to other Bybit users.

- OTC Trading: An over-the-counter desk for executing large block trades off the public order book, typically with direct counterparty settlement and quoted pricing.

- Demo Trading: A simulated trading mode that mirrors real market conditions using virtual funds, so you can practice order placement and test strategies without risking real capital.

.webp)

Bybit User Reviews

Across review sites, Bybit gets two very different reactions: mobile app users tend to rate it strongly for speed and features, while complaint-heavy sites focus on account checks, withdrawals, and support delays.

Here is a quick summary of the exchange’s ratings and reviews:

- Trustpilot: 3.2/5 from 6,942 reviews.

- Apple App Store: 4.7/5 from 46K ratings.

- Google Play: 4.5/5 from 1.39M reviews and 10M+ downloads.

The takeaway: Bybit’s app experience reviews far better than its customer service complaint profile.

.webp)

Is Bybit Safe?

Bybit is reasonably safe for active trading when you treat it like an exchange, not a bank: use strong account security, keep only the capital you need on-platform, and test withdrawals early. The exchange regularly conducts Proof of Reserves audits, which are publicly available.

Account Safety Measures

Bybit has a solid set of account-level protections, and you should turn on the ones that stop the most common attacks (SIM swaps, phishing, session hijacks, and new-withdrawal address drains):

- Two-factor authentication (2FA): Bybit supports Google Authenticator-style 2FA for login and sensitive actions.

- Passkeys: Bybit supports passkeys (FIDO-style) for stronger authentication tied to your device biometrics.

- Fund password: A separate password used for security checks and withdrawal requests, adding a barrier even if your login is compromised.

- Secure Transaction Approval: Lets you assign a primary device to confirm higher-risk actions before they execute.

- Anti-phishing code: A custom code that appears in official emails/SMS so you can spot fake messages.

- Trusted devices + device review: A device list you can audit and clean up so only your known devices stay authorized.

- New Address Withdrawal Lock: Adds friction when a new withdrawal address is added, which helps against “add address → drain funds” attacks.

- Account deactivation for suspicious activity: A last-resort control if you suspect compromise.

- Authenticity checks: Bybit provides an Authenticity Check to help confirm you’re interacting with real Bybit channels and pages.

Security History

Bybit’s biggest safety test was the February 21, 2025, breach of an Ethereum cold wallet, where attackers manipulated the Safe multisig signing experience so Bybit’s signers believed they were approving a routine internal transfer, while the underlying transaction handed control of the wallet to the attacker and enabled the drain.

The stolen assets were taken from an exchange-controlled wallet rather than individual user wallets, and Bybit publicly stated customer assets remained fully backed while it kept withdrawals running through the immediate rush, with reporting citing hundreds of thousands of withdrawal requests processed after the breach.

Bybit’s early response centered on transparency, rapid withdrawal processing, and recovery efforts, including a program offering up to 10% of recovered funds as a bounty to security teams and responders. In the months that followed, Bybit and partners described a security overhaul that included multiple audits and “50+” new measures, plus tighter key-management controls.

Is Bybit Regulated?

Bybit operates through separate legal entities depending on where you live, which means its regulatory status is jurisdiction-specific. In practice, you should treat Bybit as a group: some parts are licensed for defined crypto services in specific markets, while other markets are served under different legal and marketing arrangements.

Here are the countries where Bybit holds licenses:

- Austria / EU (MiCA): Bybit EU GmbH is authorised by Austria’s FMA as a Crypto-Asset Service Provider (CASP) under MiCA.

- United Arab Emirates: Securities and Commodities Authority (SCA) - Virtual Asset Platform Operator Licence.

- Kazakhstan (AIFC): Astana Financial Services Authority (AFSA) - licence AFSA-A-LA-2024-0027 covering regulated activities including Operating a Digital Asset Trading Facility and Providing Custody.

- Cyprus (EEA register): CySEC - UAB Onlychain Fintech Limited is listed on the EEA CASP Register with approved trade name Bybit, covering crypto-asset exchange and custody-style services as shown on the record.

Licensing is tied to the entity you contract with, not the brand name. For EU/EEA users, the key entity is Bybit EU GmbH under MiCA. Product access can change by country (spot, derivatives, lending/earn, cards, marketing permissions), even when the app looks the same.

For due diligence, confirm the regulated entity in the platform’s legal pages and ensure the services you plan to use are covered by that authorisation in your jurisdiction.

.webp)

Bybit Fee Schedule

Bybit’s costs break into two buckets: trading fees (maker/taker) and non-trading costs (withdrawal network fees, margin interest, and perpetual funding). The numbers below are the baseline VIP 0/non-VIP rates, with lower rates available at higher VIP tiers.

Spot Fees

- Spot (standard pairs): Bybit’s own fee explainer lists 0.10% maker and 0.10% taker for non-VIP users.

- Fiat-crypto spot pairs: These can be higher. Bybit’s fee structure shows VIP 0 fiat pair rates starting around 0.20% taker / 0.15% maker (then stepping down with higher VIP levels and volume thresholds).

Perpetuals and Futures Fees

- Perpetual & futures: Bybit’s fee overview lists 0.01% maker and 0.06% taker for non-VIP users.

- Funding payments: Perpetuals add funding, which is exchanged between longs and shorts at set timestamps. Bybit’s docs show the calculation and timing, and the funding fee is position value × funding rate.

Options Fees

- Options trading fee: Bybit lists a 0.03% taker fee for options for non-VIP users.

- Delivery fee when exercised: Bybit also charges a 0.015% delivery fee rate on exercised options, capped per contract (and it notes Daily Options don’t incur delivery fees).

Deposits, Withdrawals & P2P

- Crypto deposits: Bybit does not charge fees for on-chain crypto deposits or internal transfers.

- On-chain withdrawals: Bybit charges a fixed withdrawal fee per coin and network, shown in the withdrawal screen, plus minimum withdrawal amounts. Internal transfers to other Bybit users are fee-free.

- Fiat deposits: Bybit charges variable fees when depositing fiat currencies like USD or EUR, with rates ranging from 0.2% - 3.99% depending on the payment method.

- P2P fees: Bybit’s P2P fee page shows 0% for many trading pairs, but 0.25% fees apply in certain cases (including some fiat currencies/advertiser conditions), and fees only apply on completed orders.

Bybit’s official Trading Fee Structure shows fees stepping down across VIP tiers for spot, derivatives, and special zones, so frequent traders typically see lower maker/taker rates than the baseline figures above.

Compared to other popular exchanges like Kraken and eToro, whose fees start at 1%, Bybit has extremely low fees. This makes it an attractive platform for experienced traders wanting to avoid high trading costs.

.webp)

Bybit Learn & Customer Support

Bybit’s support is built around its Help Center and a ticketing workflow, with self-service tools for the problems that lock people out fastest (2FA resets, password resets, device changes, KYC fixes). The Help Center homepage surfaces common fixes and links to Submit a Case for anything that needs a human.

When you open a ticket through Submit Case, Bybit states its customer support is available 24/7, and the form is designed to route you to the right team based on the category you pick. This allows users to access the live chat feature, which offers live customer support in 15 languages.

Bybit Learn

Bybit’s education hub lives on Bybit Learn, which is structured more like a newsroom and handbook than a single “academy” page. The site is organised into topical streams (beginner through advanced content, analysis, and community), plus dedicated reference sections such as its crypto glossary (Ecopedia) for quick definitions.

The most useful part for new account holders is the Guides area, which frames itself as a practical manual covering actions users actually need to complete: depositing, withdrawing, and protecting an account.

Bybit Learn also publishes timely platform updates and explainers; for example, it hosted a detailed “timeline and FAQs” post about the February 2025 security incident, which is the kind of material readers use to judge how transparent an exchange is when something goes wrong.

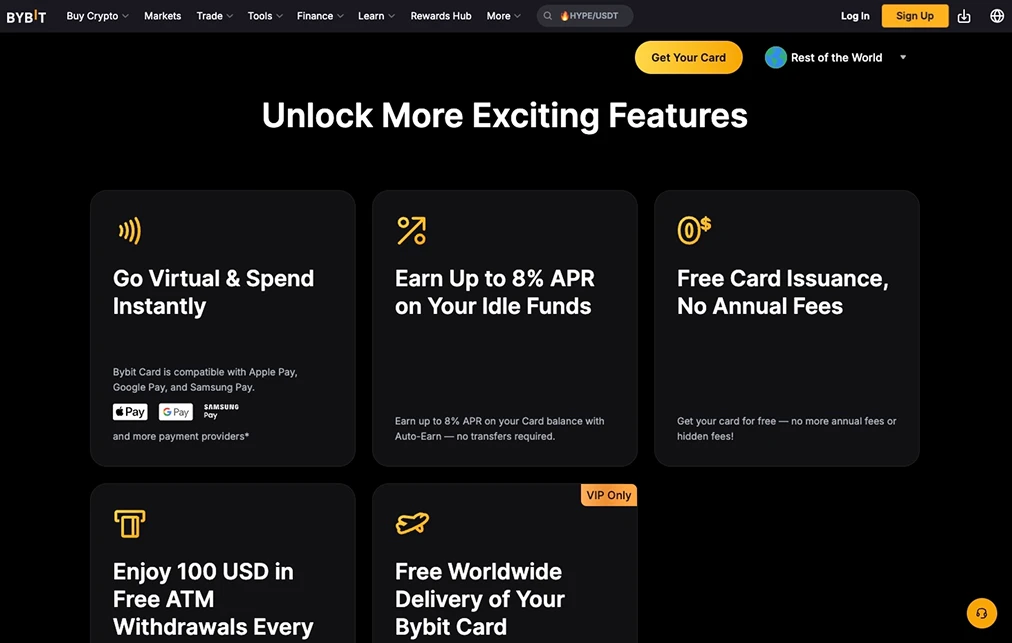

What is the Bybit Crypto Card?

Bybit Card is Bybit’s crypto-linked spending card that lets you pay at merchants using either fiat (USD) or supported cryptocurrencies from your Funding Account (there’s no separate card wallet balance).

Rewards are the main selling point with 2%-10% cashback depending on your Bybit VIP level, plus 100% rebates with selected partners (Netflix, Spotify, Prime, ChatGPT, and TradingView), and it also runs limited promos such as 10% cashback up to 150 USD for selected users.

Bybit Card Fees (as listed on the program page)

- Foreign exchange fee: 1% (on top of Mastercard’s exchange rate).

- Crypto conversion fee: 0.9% (on top of spot trading fees).

- Issuance/replacement: free for the virtual card; 5 USD/USDT for the physical card.

- ATM withdrawals: 100 USD/month free, then 2% after you hit the free monthly limit (availability can vary by region).

To apply, Bybit requires Identity Verification Level 2, including proof of address and identity, and may decline applications based on internal risk checks. The card network type can be Mastercard or Visa, depending on your country.

Final Thoughts

If you’re an active trader who values tight fees, deep derivatives, and a fast app, Bybit can be a strong option, but only if you treat it as a trading venue, not a vault.

Do three things before you scale up: finish KYC early so features and withdrawals aren’t blocked when you need them, lock down your account with passkeys/2FA plus withdrawal protections, and run a small deposit-and-withdrawal test to confirm your local rails and limits.

Frequently asked questions

Does Bybit have an insurance fund, and what happens during liquidations?

Yes, like most major derivatives venues, Bybit uses an insurance fund and an auto-deleveraging framework to manage bankrupt positions. For traders, the key is to watch your liquidation price, margin mode, and maintenance margin so you don’t get forced out during volatility.

Is Bybit available in the US and UK?

Bybit is not available to US residents, and UK access has been more restricted than many other markets due to local rules around crypto promotions and onboarding. Always check Bybit’s country eligibility notices in your account before depositing.

How do I check which Bybit features are available in my country?

Feature access can change by region and legal entity. The fastest check is inside your Bybit app/web account: open the relevant product page (Derivatives, Earn, Card, P2P) and see what’s visible and enabled after KYC, then confirm the entity and country rules in Bybit’s legal/region notices before funding a large balance.

What leverage does Bybit offer, and is leverage risky for beginners?

Bybit supports leveraged derivatives up to 200x, but maximum leverage varies by contract and risk tier. Leverage can wipe out a position fast, so beginners should start with low leverage (or none), use isolated margin, and set a stop-loss before scaling position size.

Written by

Emily Shin

Research Analyst

Emily is passionate about Web 3 and has dedicated her writing to exploring decentralized finance, NFTs, GameFi, and the broader crypto culture. She excels at breaking down the complexities of these cutting-edge technologies, providing readers with clear and insightful explanations of their transformative power.

.webp)