How to Buy Crypto with Santander Bank

.webp)

Summary: Santander does not provide direct crypto trading, but customers can buy Bitcoin and other digital assets by funding regulated exchanges such as Kraken, Coinbase or Uphold.

Investors should use only platforms approved under local rules, whether MiCA-licensed CASPs in the EU, FCA-registered firms in the UK, or regulated providers in Latin America.

Kraken is the best choice for Santander customers because it is regulated in the UK, EU and abroad, offers low fees, 460+ cryptocurrencies and top-tier security.

Licenses

FCA (UK), MiCA (EU), FinCEN (USA) & More

Supported Assets

460+ Cryptocurrencies

Deposit Methods

Bank Transfers, Cards, PayPal & More

Can I Buy Bitcoin with Santander Bank?

Santander does not offer direct cryptocurrency trading, but customers can fund accounts on regulated exchanges. Payments can be made through bank transfers, SWIFT, or Santander debit and credit cards.

These exchanges support Santander deposits, enabling investors to buy Bitcoin and other digital assets while staying within regulatory frameworks in regions such as the UK, Europe and Latin America. Santander clients can securely move funds to licensed platforms before purchasing crypto.

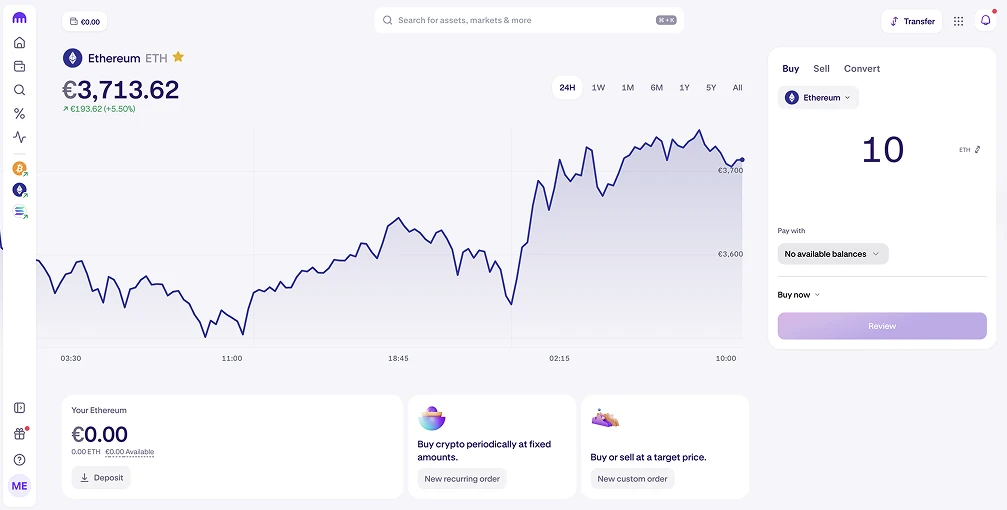

How to Buy Bitcoin & Crypto with Santander

Santander does not offer built-in cryptocurrency trading, but customers can still purchase Bitcoin and other digital assets by funding accounts on regulated exchanges. The most reliable choice is Kraken, a global platform available in the US, UK, Europe, Australia, and Asia.

Kraken supports more than 460 cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), and provides staking services for investors seeking passive rewards.

Step-by-Step Guide to Buying Crypto with Santander and Kraken:

- Create an Account: Register on Kraken’s official website and complete identity verification (KYC).

- Deposit Funds: Transfer money from your Santander account using bank transfer, SWIFT, or supported card payments. Kraken accepts USD, EUR, GBP, and other local currencies.

- Select a Cryptocurrency: Choose from hundreds of available assets, such as BTC, ETH, or SOL.

- Confirm Your Purchase: Enter the amount, review the order details, and execute the trade.

Santander Bank’s Cryptocurrency Policy

While Santander enables payments to licensed exchanges, it enforces strict rules to meet regulatory and security standards. These vary across regions and reflect local oversight.

Key Policy Points:

- European Union: Customers may only transfer funds to exchanges licensed as Crypto Asset Service Providers (CASPs) under the MiCA framework.

- Mexico: Oversight comes from the CNBV, Banxico, and UIF, requiring exchanges to comply with AML and reporting rules.

- United Kingdom: Santander follows FCA guidance by restricting payments to certain exchanges, including Binance. It also enforces limits of £1,000 per transaction and £3,000 in a 30-day period, while warning that UK crypto investments are not protected by compensation schemes.

- Regional Variations: Other jurisdictions apply their own frameworks, and Santander customers must use only exchanges approved under local regulations.

- Transaction Screening: Crypto-related payments are monitored more closely than standard transfers. Transactions linked to unlicensed or high-risk platforms may be delayed or blocked.

Alternative Crypto Exchanges for Santander Customers

For Santander investors seeking options beyond Kraken, three exchanges stand out for their global compliance, asset coverage, and ease of GBP deposits.

- Coinbase: A publicly listed exchange with over 240 cryptocurrencies. Regular trades start at 1.49%, with lower fees available on Advanced Trade. GBP deposits supported via bank transfers, Faster Payments, and cards. Known for strong security and transparency.

- Uphold: London-based and serving 10 million users worldwide. Offers over 300 cryptocurrencies plus fiat and metals. Publishes real-time proof-of-reserves every 30 seconds. GBP deposits available through bank transfers, SEPA, and cards. Spreads range from 0.2% to 2.95%.

- eToro: A multi-asset platform with over 35 million users. Supports 100+ cryptocurrencies along with stocks and ETFs. Features CopyTrader, allowing beginners to follow experienced investors. Charges a flat 1% fee on crypto trades, with GBP deposits via bank transfer and cards.

Santander customers should weigh fees, asset availability, and GBP funding methods when choosing between these exchanges.

About Santander

Santander is a Spanish multinational bank with over 160 million customers worldwide, ranking among the largest financial institutions. It offers retail and commercial services including the Santander 1|2|3 Current Account, Everyday Saver, credit cards, personal loans, mortgages, and a full suite of business banking and corporate finance products.

With strong operations in Spain, the UK, Brazil, Mexico, and the United States, Santander combines traditional banking with digital platforms to serve individuals and companies at scale.

Final Thoughts

Santander customers can buy Bitcoin and other cryptocurrencies through regulated exchanges, but access depends on regional compliance rules.

Investors in the EU must use MiCA-licensed CASPs, while those in the UK face FCA restrictions and payment limits. In markets like Mexico, oversight comes from CNBV, Banxico, and the UIF.

The best approach is to select a licensed platform such as Kraken, Coinbase, Uphold, or eToro, confirm it is approved in your jurisdiction, and compare fees and deposit options before investing.

Frequently asked questions

Can I use the Santander mobile app to send money to a crypto exchange?

Yes, Santander’s mobile and online banking apps support transfers to licensed exchanges, though transactions may be subject to enhanced security checks or regional limits.

Do I pay taxes on crypto bought with Santander?

Yes, crypto purchases made via Santander accounts are still subject to local tax laws. In the UK, this includes capital gains tax, while EU and Latin American investors must follow national reporting rules.

Does Santander charge extra fees for crypto transactions?

Santander does not apply its own crypto transaction fees, but standard charges may apply for international transfers, SWIFT payments, or card deposits. Exchange platforms then apply their own trading fees.

Written by

Antony Bianco

Head of Research

Antony Bianco, co-founder of Datawallet, is a DeFi expert and active member of the Ethereum community who assist in zero-knowledge proof research for layer 2's. With a Master’s in Computer Science, he has made significant contributions to the crypto ecosystem, working with various DAOs on-chain.

.webp)

.webp)