Best Crypto Exchanges in Hungary

.webp)

Summary: Hungary is experiencing a steady rise in crypto adoption and aligns with the EU’s Markets in Crypto-Assets Regulation (MiCA). While the Hungarian National Bank is cautious, the country offers several reputable crypto exchanges for residents to buy, sell, and trade digital currencies.

Here are the five best platforms accepting Hungarian Forint (HUF) deposits:

Kraken is the recommended platform for Hungarian investors as it facilitates HUF deposits, provides low fees and access to a wide range of cryptocurrencies.

Licenses

Holds MiCA license across Europe

Available Assets

370+ Cryptocurrencies

HUF Deposit Methods

IBAN, SEPA, Cards & Bank Transfers

Top Crypto Trading Platforms in Hungary

Hungary's cryptocurrency market continues to grow, driven by increasing interest among local investors seeking reliable platforms. For those investing in crypto with Hungarian Forints (HUF), choosing a secure and trustworthy exchange regulated by the Hungarian National Bank (MNB) is essential. Below, we've compared the five most reputable platforms currently serving users in Hungary.

1. Kraken

Kraken is a top crypto exchange known for its industry-leading security, global regulatory compliance, transparent proof-of-reserves, deep liquidity, and extensive asset selection. Since its launch in 2011, it has expanded to over 190 countries, including Hungary, and serves more than 10 million clients globally.

The platform provides access to 370 digital assets for spot trading, margin trading with up to 5x leverage, and over 100 futures contracts, catering to different trading strategies. Kraken Pro offers a high-performance interface with low latency execution, while the Kraken Wallet allows users to manage their digital assets securely.

Additionally, the Earn Rewards feature lets users stake cryptocurrencies with up to 10% APR returns. The platform is also transparent, publishing Proof-of-Reserves reports to verify user funds are backed 1:1 at all times. Kraken supports HUF deposits and withdrawals, making it convenient for local investors.

- Fees: Maker fees start at 0.16%, and taker fees are at 0.26%.

- Supported Assets: Over 370 cryptocurrencies.

- Regulation & Licensing: Holds a MiCA license across Europe.

- HUF Deposit Methods: Bank transfers, PayPal, SEPA transfers, and credit/debit cards.

.webp)

2. Uphold

Uphold is a multi-asset trading platform that offers Hungarian investors a seamless way to trade over 300 cryptocurrencies, 27 fiat currencies, and 4 precious metals. Its unique one-step trading feature allows users to instantly swap between any supported asset without the need for multiple conversions.

Users enjoy the staking program, which offers rewards of up to 17.6% APY and can instantly stake and unstake 19 cryptocurrencies, providing flexibility not commonly found on other exchanges. The platform also provides a secure custody solution through the Uphold Vault, allowing investors to store digital assets safely.

It is known for its commitment to radical transparency. Unlike traditional platforms, it never lends out customer funds and publishes its real-time proof-of-reserves every 30 seconds. This level of openness ensures Hungarian investors have full visibility into Uphold’s liquidity at all times, giving them peace of mind.

- Fees: 0% trading fees, but spreads range from 0.2% to 1.9%.

- Supported Assets: Over 300 cryptocurrencies, 27 fiat currencies and 4 precious metals.

- Regulation & Licensing: Regulated by the Financial Conduct Authority (FCA) and available in Hungary.

- HUF Deposit Methods: Bank transfer, SEPA, credit cards, debit cards, Google Pay and Apple Pay.

3. Binance

Binance is the world’s largest exchange, serving over 260 million users in 180 countries and providing a multilingual interface in Hungarian. Since its launch in 2017, it has become the go-to platform for traders seeking low fees, high liquidity, and access to 350+ cryptocurrencies for spot trading.

Hungarian traders can trade spot, margin, and futures markets with deep liquidity and competitive fees. Binance Earn provides multiple passive income options, including staking, savings accounts, and liquidity farming. The platform also features Binance P2P, allowing clients to buy and sell crypto directly using HUF.

Security is a priority, with two-factor authentication (2FA), withdrawal whitelisting, and a Secure Asset Fund for Users (SAFU) that protects funds against potential losses. Its Proof-of-Reserves system ensures full transparency by verifying that user assets are backed 1:1 at all times and always accessible.

- Fees: Maker and taker fees start at 0.1%.

- Supported Assets: Over 350 cryptocurrencies.

- Regulation & Licensing: Holds a MiCA license to operate across Europe.

- HUF Deposit Methods: Bank transfers, SEPA payments, credit cards and debit cards.

4. Bitpanda

Bitpanda is a European-regulated multi-asset investment platform that allows Hungarian investors to trade cryptocurrencies, stocks, ETFs, precious metals, and commodities all in one place. Established in 2014 and headquartered in Austria, it has grown to serve over 6 million registered customers.

A major advantage of Bitpanda is its fractional investing, enabling users to buy small portions of stocks and ETFs without needing to purchase full shares. For crypto investors, Bitpanda Crypto Indices provides a convenient way to gain exposure to multiple digital assets with a single investment.

The platform also offers staking services, allowing Hungarian traders to earn passive income on select cryptocurrencies, and Bitpanda Spotlight, which introduces early-stage crypto projects. The platform supports Hungarian Forint (HUF) deposits and offers zero deposit and withdrawal fees for fiat transactions.

- Fees: Trading fees start at 1.49%, with no deposit or withdrawal fees for fiat currencies.

- Supported Assets: Over 3,000 cryptocurrencies, stocks, ETFs, and metals.

- Regulation & Licensing: Compliant with MiCA standards and available in Hungary.

- HUF Deposit Methods: Bank transfers, credit cards, debit cards, and e-wallets like Skrill and Neteller.

5. Gate.io

Gate.io is a high-liquidity crypto exchange offering the largest selection of digital assets in Hungary. Founded in 2013, the platform has grown to support over 3,700 cryptocurrencies and has 21 million users worldwide. It provides diverse trading options, from spot and margin trading to perpetual futures and leveraged ETFs.

Hungarian traders can access copy trading, allowing them to replicate the strategies of top-performing investors for passive income. The Gate.io Earn section offers multiple ways to earn on idle assets, including staking, DeFi yield farming, lending, borrowing, and interest-bearing crypto products.

The exchange offers multi-layered encryption, cold storage for funds, and real-time risk monitoring to protect clients. Additionally, Gate Pay allows Hungarian users to send and receive crypto payments effortlessly. With a user-friendly mobile app, Web3 integration, and AI-driven market insights, Gate.io is a great choice.

- Fees: Maker and taker fees start at 0.2%.

- Supported Assets: Over 3,700 cryptocurrencies.

- Regulation & Licensing: Not regulated in Europe but is available in Hungary.

- HUF Deposit Methods: SEPA, bank transfers, and credit/debit cards.

Is Crypto Regulated in Hungary?

Hungary has recently established a comprehensive regulatory framework for cryptocurrencies. In April 2024, the Hungarian Parliament adopted Act VII of 2024 on Markets in Crypto-Assets, aligning national regulations with the European Union's Markets in Crypto-Assets Regulation (MiCA).

This legislation, effective from June 30, 2024, designates the National Bank of Hungary (MNB) as the supervisory authority overseeing crypto-asset service providers. The Act categorizes crypto-assets into electronic money tokens and asset-referenced tokens with specific requirements for each category.

Crypto-asset service providers must comply with these regulations and are subject to supervisory fees to cover regulatory costs. Additionally, the MNB has implemented provisions to enhance consumer protection, including detailed procedures for handling customer complaints.

How is Crypto Taxed in Hungary?

In Hungary, the taxation of cryptocurrency transactions is governed by the Hungarian National Tax and Customs Administration (NAV). Here's an overview of how crypto activities are taxed:

- Personal Income Tax: Since 2022, income derived from cryptocurrency transactions, including trading and mining, is subject to a flat 15% personal income tax.

- Corporate Income Tax: Businesses involved in crypto-related activities, including trading, mining, or providing exchange services, are subject to Hungary’s corporate income tax at a flat rate of 9%.

It's important to note that tax regulations can change, and individual circumstances may vary. Therefore, consulting with a tax professional or the relevant authorities is advisable to obtain the most current and personalized information regarding cryptocurrency taxation in Hungary.

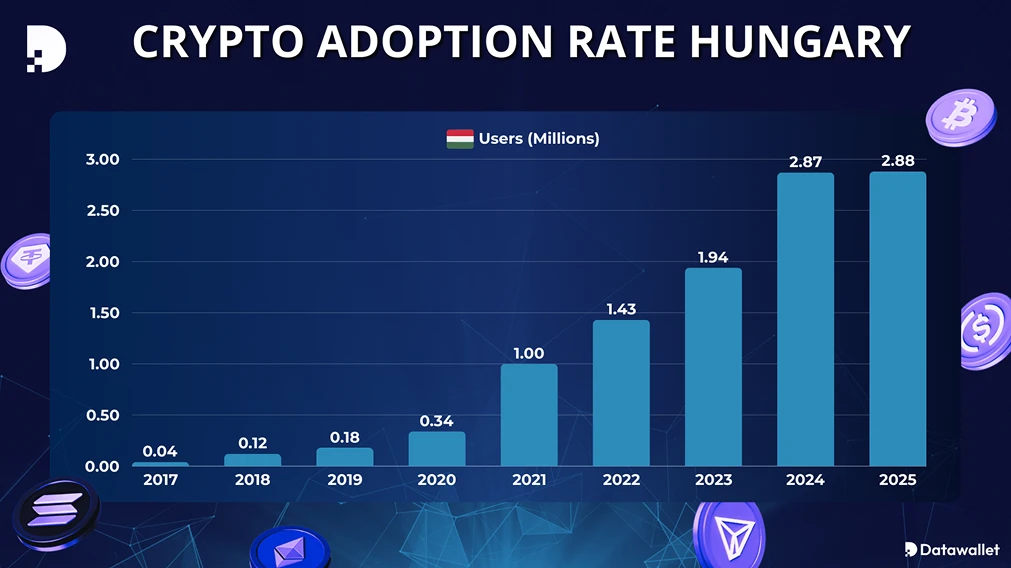

Cryptocurrency Adoption in Hungary

Hungary’s cryptocurrency market is showing promising signs of growth, with revenue projected to reach approximately US$186.4 million by the end of the year.

By that time, around 2.88 million Hungarians, representing nearly 29.16% of the population, are expected to participate actively in crypto trading and investment.

The expansion is partly driven by broader acceptance of cryptocurrencies among local businesses, clear regulatory oversight from the Hungarian National Bank (MNB), and growing public awareness about blockchain technology.

How to Buy Bitcoin in Hungary

Hungarian investors looking to enter the crypto market can easily buy digital currencies using Hungarian Forints (HUF). Here’s a simple guide to help you safely get started:

- Choose Exchange: Select a reputable crypto exchange that supports deposits in HUF. Trusted options in Hungary include Binance, Coinbase, and Kraken, which offer secure investment platforms.

- Create and Verify Your Account: Sign up on your chosen exchange and complete identity verification (KYC). You’ll typically need a valid Hungarian ID, passport, or driver’s license, along with proof of your residential address.

- Deposit Hungarian Forints (HUF): Fund your account through bank transfers, credit or debit cards, or other available local payment options. Confirm the deposit and ensure the correct amount appears in your account balance.

- Purchase Cryptocurrency: After funding your account, select your desired cryptocurrency, such as Bitcoin or Ethereum. Review exchange rates, enter the amount you want to buy, and confirm your transaction details carefully.

Following these straightforward steps on reliable platforms allows Hungarian investors to confidently trade cryptocurrencies while adhering to local regulatory requirements.

Final Thoughts

Hungary’s cryptocurrency market is expanding steadily, backed by clear regulations and multiple exchanges offering secure trading options. Selecting a platform that aligns with your investment needs, security preferences, and deposit methods is essential.

Kraken, Uphold, Binance, Bitpanda, and Gate.io each provide unique advantages, from high liquidity and advanced trading tools to passive income opportunities.

%25201%2520(1).webp)

Written by

Emily Shin

Research Analyst

Emily is passionate about Web 3 and has dedicated her writing to exploring decentralized finance, NFTs, GameFi, and the broader crypto culture. She excels at breaking down the complexities of these cutting-edge technologies, providing readers with clear and insightful explanations of their transformative power.

.webp)

%2520(1).webp)

.webp)

.webp)