How to Buy Crypto with ETRADE

Summary: ETRADE does not currently support direct crypto purchases, offering instead indirect crypto exposure via ETFs, coin trusts, and futures.

For direct crypto purchases, consider a regulated exchange like Kraken, which supports 350+ cryptocurrencies, staking rewards, secure USD deposits, and low fees for US investors.

Kraken is the best E*TRADE alternative, fully US-regulated, offering 360+ cryptos, low fees from 0.26%, staking rewards, and secure wallet withdrawals.

Licenses

FinCEN (USA), the FCA and More

Available Assets

360+ Cryptocurrencies

Trading Fees

Starts at 0.26% Maker Fees

Can I Buy Crypto with E*TRADE?

You cannot currently buy cryptocurrencies directly on E*TRADE. However, you can gain indirect crypto exposure through supported securities like spot crypto ETPs, ETFs, coin trusts, and futures contracts that track assets such as Bitcoin and Ethereum.

Popular examples available on ETRADE include the iShares Bitcoin Trust (IBIT), Fidelity Wise Origin Bitcoin Fund (FBTC) and iShares Ethereum ETF (ETHA).

These products allow crypto-linked trading without wallets or storage responsibilities, but they come with added management costs, leverage risks, and pricing differences compared to direct spot trading.

How to Buy Bitcoin & Crypto with ETRADE Alternatives

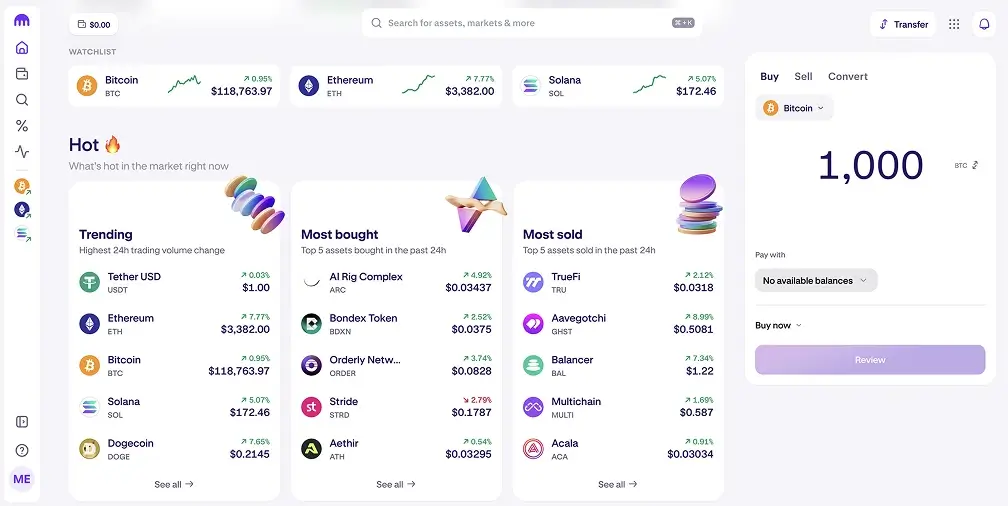

If you're an ETRADE customer looking to invest directly in crypto, consider using a cryptocurrency exchange in the USA registered with FinCEN, such as Kraken.

Kraken supports over 350 cryptocurrencies (e.g. BTC, ETH & SOL), offers attractive features like staking to earn yield, and accepts easy USD deposits directly from U.S. banks.

Follow these simple steps to buy crypto on Kraken:

- Create an Account: Sign up on Kraken's website and complete identity verification (KYC).

- Fund Your Account: Deposit USD via bank transfer.

- Select Your Crypto: Browse Kraken’s extensive selection of over 350 cryptocurrencies.

- Complete Your Purchase: Input your desired investment amount, review transaction details, and finalize your purchase.

ETRADE Crypto Product Fees

E*TRADE doesn’t charge any platform trading fees specifically for spot crypto ETPs, ETFs, or coin trusts beyond standard brokerage commissions, but there are indirect costs to consider. Futures contracts incur explicit fees. Here's how the fee structure breaks down:

- Spot crypto ETPs & ETFs: No direct commission, but expense ratios and fees embedded in the fund apply (typically around 0.2–1% annually, depending on the product).

- Coin trusts (OTC securities): No trading commission beyond standard equity fees, but they often trade at premiums or discounts and carry management fees.

- Crypto futures on Power E*TRADE: $1.50 per contract per side (e.g., opening and closing a position costs $3 total per contract) plus margin costs and potential liquidity fees. Leverage amplifies both profit and loss.

Alternative Crypto Exchanges for E*TRADE

If you're looking beyond Kraken, several reliable, regulated exchanges in the U.S. offer direct crypto investing:

- Coinbase: Regulated by FinCEN and headquartered in San Francisco, Coinbase offers straightforward access to 250+ cryptocurrencies, staking options, and advanced trading through Coinbase Pro. Fees average around 0.6% per trade.

- Gemini: Supervised by the New York State Department of Financial Services (NYDFS), Gemini prioritizes robust security for investors, supporting over 100 digital assets. Typical trading fees are around 1.49%.

- Uphold: A FinCEN-registered exchange offering seamless access to over 250 cryptocurrencies alongside precious metals and fiat currencies. Uphold's fees typically range from 0.8% to 1.2%, depending on the asset traded.

Will ETRADE Offer Real Crypto Assets?

Morgan Stanley, ETRADE’s parent company, reportedly plans to launch direct cryptocurrency trading on the ETRADE platform by 2026.

Bloomberg reports indicate that preparations remain in the early stages, with Morgan Stanley actively exploring partnerships with established cryptocurrency providers to integrate services.

The firm's move follows positive regulatory changes under the Trump administration, creating a more favorable environment for crypto adoption by traditional brokerage platforms.

What is E*TRADE?

E*TRADE owned by Morgan Stanley, is an established brokerage offering individual investors tools to trade stocks, ETFs, mutual funds, bonds, futures, and options. Investors commonly use it to trade major ETFs like SPY and QQQ, blue-chip stocks such as Apple, Microsoft, or Amazon, and leading mutual funds from Fidelity or Vanguard.

Besides trading, E*TRADE provides retirement accounts like IRAs, managed portfolios, and banking services integrated into its desktop and mobile platforms. It currently serves over 5 million clients who collectively hold more than $360 billion in assets, making it one of America's top brokerage firms.

Final Thoughts

E*TRADE currently limits crypto investing to indirect products like ETFs, coin trusts, and futures. For direct crypto purchases, a FinCEN-registered exchange like Kraken or Coinbase are your best alternatives.

Monitor Morgan Stanley’s planned 2026 crypto rollout closely, and until then, carefully compare fees and risks when choosing between indirect exposure and direct ownership.

Frequently asked questions

What’s the difference between crypto ETFs and crypto futures on E*TRADE?

Crypto ETFs track underlying cryptocurrency prices passively, without leverage, and are suitable for long-term investors. Crypto futures involve leveraged trades on cryptocurrency price movements, offering potential for higher gains but increased short-term risk.

What popular Bitcoin and Ethereum ETFs can I buy on E*TRADE?

E*TRADE offers popular spot cryptocurrency ETFs like the iShares Bitcoin Trust (IBIT) and the iShares Ethereum Trust (ETHA), providing regulated, indirect exposure to BTC and ETH without needing wallets or private keys.

Does E*TRADE offer cryptocurrency investment in retirement accounts (IRAs)?

Yes, you can invest in crypto through supported ETFs, ETPs, and coin trusts within E*TRADE’s IRA accounts, offering tax-advantaged exposure.

Are crypto assets purchased through E*TRADE insured?

Crypto products like ETFs and futures on E*TRADE don't carry FDIC or SIPC protection specifically for cryptocurrency value fluctuations, although standard brokerage protections apply to account balances in case of brokerage failure.

%25201%2520(1).webp)

Written by

Emily Shin

Research Analyst

Emily is passionate about Web 3 and has dedicated her writing to exploring decentralized finance, NFTs, GameFi, and the broader crypto culture. She excels at breaking down the complexities of these cutting-edge technologies, providing readers with clear and insightful explanations of their transformative power.

%2520(1).webp)

.webp)

%2520(1).webp)

.webp)