How to Buy Tether (USDT) in the Philippines

%20Philippines.webp)

Summary: Filipinos can legally buy Tether (USDT) using PHP through GCash, Maya, InstaPay, PESONet, or P2P transfers on BSP-accredited or global platforms.

Ownership is legal, but USDT cannot replace the peso for payments. Investors should use licensed exchanges, pick low-cost funding methods, and track taxes as BIR treats gains as income.

Bybit is the best place to buy USDT in the Philippines because it supports PHP funding through GCash, Maya, InstaPay, and PESONet, offers deep USDT liquidity, and keeps trading fees low and transparent.

Available Markets

2,000+ Cryptocurrencies (Including USDT)

Trading Fees

0.1% Spot Trading Fees

PHP Deposit Methods

GCash, Bank Transfer, Cards, Maya & More

Is Buying Tether (USDT) Legal in the Philippines?

Yes, Filipinos can legally buy, trade, and hold Tether (USDT). However, cryptocurrencies are not legal tender under BSP rules, so USDT cannot be used directly for payments.

The framework is clear: ownership and trading are allowed, but replacing the peso in transactions is restricted. BSP Circular No. 1108 requires all exchanges in the Philippines to register as Virtual Asset Service Providers (VASPs) and comply with AML/KYC standards.

Investors should use BSP-accredited exchanges or global platforms with strong compliance. Funding is typically done through InstaPay, PESONet, GCash, or Maya. Using unlicensed offshore services risks frozen accounts, blocked transfers, and potential legal issues.

How to Buy Tether (USDT) in the Philippines

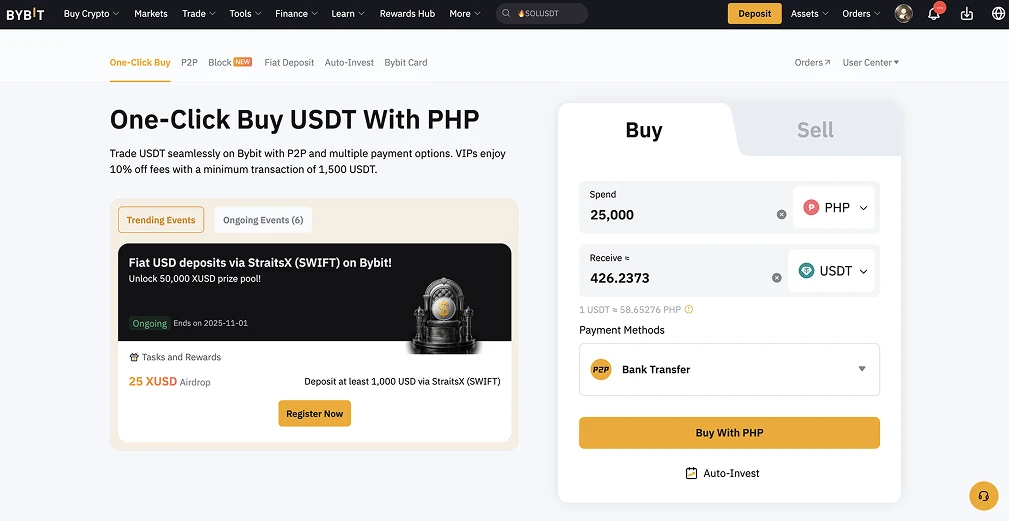

For Filipino investors, one of the easiest ways to buy USDT is through Bybit, a global exchange trusted in over 160 countries. Bybit allows funding in Philippine pesos (PHP) through GCash, Maya, and bank transfers using InstaPay or PESONet via its P2P marketplace.

The platform lists more than 2,000 digital assets with strong liquidity on USDT pairs. After purchasing, users can also allocate their USDT to savings products to earn a yield on their stablecoin holdings.

Step-by-step guide to buying USDT on Bybit with PHP:

- Open an Account: Sign up on Bybit and complete identity verification to enable PHP deposits and trading.

- Select Buy Option: On the P2P or One-Click Buy page, choose PHP and enter the amount you want to spend.

- Choose a Payment Method: Pay with GCash, Maya, or a bank transfer through InstaPay or PESONet.

- Confirm and Receive: Finalize the transaction, and once payment is verified, USDT will be credited instantly to your Bybit wallet.

PHP to USDT Fees

Filipino investors converting pesos (PHP) into Tether (USDT) should understand the key costs involved:

- Deposit Fees: Funding via GCash, Maya, or bank transfers through InstaPay and PESONet on P2P platforms often comes with zero or very low fees. Some third-party providers or card payments may charge around 1% to 2%.

- Withdrawal Fees: Moving USDT back into PHP through P2P trades is usually free or low cost. Sending USDT to an external wallet incurs blockchain network fees, which depend on whether you use TRC20, ERC20, or other networks.

- Trading Fees: Exchanges such as Bybit or Binance charge about 0.1% per trade. On maker-taker models, expect maker fees near 0.1% and taker fees closer to 0.2%.

Tip: To keep costs down, use bank transfer or P2P deposits in PHP and trade on platforms with clear, transparent fee structurest.

Best Exchanges for Buying USDT in the Philippines

While Bybit is the most popular choice, several other global exchanges support PHP funding through P2P transfers and local e-wallets, giving Filipino investors multiple options to access USDT markets. Here’s a comparison of leading platforms:

Tax Implications for Tether (USDT) in the Philippines

The Bureau of Internal Revenue (BIR) classifies cryptocurrencies like Tether (USDT) as taxable assets under existing laws. There are no separate crypto tax rules, but profits from trading or related activities fall under standard income and business taxes.

- Individual Taxation: Gains from trading, staking rewards, play-to-earn, or NFT sales are treated as ordinary income and taxed at progressive rates up to 35%. Long-term holdings over 12 months get partial relief, with only half the net gain taxed.

- Corporate Taxation: Companies involved in crypto activities pay the standard 25% corporate income tax on net profits.

- Value-Added Tax (VAT): Annual crypto revenue above ₱3 million may trigger a 12% VAT, especially when transactions are part of business operations.

- Taxable Events: Taxes apply when USDT is sold for pesos, exchanged into other crypto as business activity, or earned as income.

Detailed records of trades, conversions, and income are required. These must be reported in annual tax returns (BIR Form 1700, 1701, or 1702) by April 15. Non-disclosure can lead to penalties, surcharges, and possible legal action.

Final Thoughts

Buying Tether (USDT) in the Philippines is legal and accessible, but it requires using BSP-accredited or globally compliant exchanges to avoid regulatory or banking issues.

The key is to stick with licensed platforms, keep detailed tax records, and choose low-cost funding methods like bank transfers or P2P to protect both your capital and compliance standing.

Frequently asked questions

Can Overseas Filipinos Send USDT to the Philippines?

Yes. Overseas workers can transfer USDT to family in the Philippines using global exchanges or wallets that support TRC20 or ERC20 networks. The recipient can then convert USDT into pesos through BSP-accredited platforms or P2P marketplaces.

What Network Should I Use to Transfer USDT?

Most Filipinos prefer TRC20 transfers because they are faster and cheaper than ERC20. However, ERC20 may be required for platforms with broader DeFi support. Always check the deposit address format before sending.

Can USDT Be Used for Remittances in the Philippines?

While not a substitute for legal tender, USDT is increasingly used as an informal remittance channel. Families receive stablecoins instantly and can cash out to PHP through P2P trades, often at lower costs than traditional remittance services.

Written by

Emily Shin

Research Analyst

Emily is passionate about Web 3 and has dedicated her writing to exploring decentralized finance, NFTs, GameFi, and the broader crypto culture. She excels at breaking down the complexities of these cutting-edge technologies, providing readers with clear and insightful explanations of their transformative power.

.webp)