Best Gold-Backed Cryptocurrencies in 2025 (Ranked)

Summary: Gold-backed cryptocurrencies remain a narrow corner of the digital asset market. Unlike stablecoins, they’re pegged to real, auditable gold reserves and serve as both hedging tools and long-term stores of value.

We ranked & reviewed the top projects based on regulatory compliance, market liquidity, transparency, and blockchain compatibility. The leading options for investors are:

- Pax Gold (PAXG) - Best Overall, Highly Regulated

- Tether Gold (XAUT) - Most Held, Deep Liquidity

- GoldPro Token (GPRO) - Utility-Driven, NFT Integration

- Comtech Gold (CGO) - Shariah-Compliant, XDC-Based

- VNX Gold (VNXAU) - EU Regulated, Multichain Access

Uphold, trusted by over 10 million investors and FCA-regulated, stands out as the premier platform for purchasing tokenized gold assets like Pax Gold (PAXG), also offering real gold options.

Available Assets

PAXG, XAUT + 250 more cryptocurrencies.

Deposit Methods

Bank Transfer, Credit Card, Apple Pay and more.

Licensing

Regulated by the FCA, CySEC and Tier-1 Authorities.

Top Gold-Backed Cryptocurrencies

Gold has surged back into the spotlight amid renewed global tariff conflicts, with investors seeking protection from inflation and currency risk. In April 2025, spot prices hit an all-time high of $3,385 per ounce, marking nearly 70% growth over the past three years as trade tensions and macro uncertainty drove demand.

This rising demand has boosted interest in tokenized gold, which offers direct exposure to physical bullion without the complications of traditional ownership. The market for gold-backed cryptocurrencies is small but focused, with only a select few projects standing out based on real liquidity, regulatory clarity, and utility.

Here is an overview of the most prominent gold crypto projects and their core fundamentals:

1. Pax Gold (PAXG)

Pax Gold (PAXG) is a digital asset issued by Paxos Trust Company, where each token represents one fine troy ounce of a London Good Delivery gold bar stored in secure vaults. This setup allows investors to own physical gold in a digital form, combining the stability of gold with the flexibility of cryptocurrency.

Technically, PAXG is an ERC-20 token on the Ethereum blockchain, enabling seamless integration with various wallets and decentralized applications. Each token is backed by allocated gold, meaning holders have ownership rights to specific gold bars, identifiable by serial numbers and other details. Paxos ensures transparency through regular audits and provides tools for users to verify their holdings.

For users, PAXG offers the convenience of trading gold without the challenges of physical storage or transportation. It can be easily bought, sold, or transferred like any other cryptocurrency, and holders have the option to redeem their tokens for physical gold, fiat currency, or other digital assets, providing flexibility in managing their investments.

Platform Highlights:

- Issuer: Paxos Trust Company.

- License: Regulated by the New York State Department of Financial Services.

- Market Capitalization: Approximately $784 million.

- Available Chains: Ethereum, Solana, BNB Smart Chain.

2. Tether Gold (XAUT)

Tether Gold (XAUT) gives crypto investors access to physical gold ownership via tokens pegged 1:1 to one troy ounce of LBMA-certified gold, securely vaulted in Switzerland. The project blends Tether’s liquidity dominance with discreet Swiss storage and full asset backing, making it a favorite among gold-pegged assets.

Built on Ethereum as an ERC-20 token, XAUT supports precise fractional trades down to micro amounts. Each token is backed by specific gold bars, with details like serial numbers and weight accessible through Tether’s portal, offering traceability without compromising privacy.

What appeals to most users is the hybrid model, uncompromising gold reserves paired with the ability to transfer value globally, instantly, and without intermediaries. While redemptions for physical delivery are possible, most holders opt to trade or use XAUT as a long-term hedge within crypto portfolios.

Platform Highlights:

- Issuer: TG Commodities Limited.

- License: Registered under the laws of the British Virgin Islands.

- Market Capitalization: Roughly $833 million.

- Available Chains: Ethereum (ERC-20 only).

3. GoldPro Token (GPRO)

GoldPro Token (GPRO), launched by IPMB, is a gold-backed digital asset where each token represents one gram of 22-carat gold doré. Unlike traditional stablecoins, GPRO's value is influenced by market demand, offering both stability and growth potential.

GPRO operates on the Polygon blockchain, ensuring fast and cost-effective transactions. Its interoperability across multiple EVM-compatible chains, facilitated by the Axelar network, improves its accessibility within the decentralized ecosystem.

For users, GPRO offers the opportunity to stake tokens to receive up to an 11% discount on GEM NFTs, which are backed by LBMA-certified gold. Additionally, GPRO can be used for payments at select merchants through the IPMB Vantage program, providing real utility.

Platform Highlights:

- Issuer: IPMB.

- License: Operates under the jurisdiction of the British Virgin Islands.

- Market Capitalization: Approximately $122 million.

- Available Chains: Polygon.

4. Comtech Gold (CGO)

Comtech Gold (CGO) is a fully gold-backed token built on the XDC Network, with each CGO representing one gram of 999.9 purity gold held in accredited UAE vaults. Its standout feature is its Shariah compliance, positioning it uniquely for ethical investors and institutions seeking transparency and religious adherence.

Running as an XRC-20 token, CGO benefits from XDC’s energy-efficient, low-cost infrastructure; perfect for high-frequency traders or long-term holders. Every token is backed by specific, auditable gold bars, complete with serial numbers and verifiable storage data, with adequate compliance protocols in place.

Traders can easily access CGO via several exchanges and use the token as a gold substitute without needing to physically transport or insure bullion. With redemption options available and stable vaulting partnerships, it’s also ideal for investors looking to hedge against volatility while aligning with faith-based finance.

Platform Highlights:

- Issuer: ComTech FZCO.

- License: Authorized by Dubai Airport Free Zone Authority (DAFZA).

- Market Capitalization: Around $15 million.

- Available Chains: XDC Network (XRC-20).

5. VNX Gold (VNXAU)

VNX Gold (VNXAU) is a tokenized gold product issued by VNX Commodities AG, offering legal title to LBMA-certified gold stored in Liechtenstein. Each token corresponds to specific physical bars, making it one of the few offerings built from the ground up with EU regulatory compliance in mind.

Instead of staying tethered to one network, VNXAU is deployed across Ethereum, Polygon, Solana, Tezos, and Q, giving it rare cross-chain mobility for a commodity-backed asset. Full ownership records are maintained off- and on-chain, verified through government-licensed custodians and a strict audit trail.

Traders benefit from low-friction movement between networks, while investors can hold or redeem tokens with confidence in the underlying collateral. Access is straightforward via exchanges like LBank or directly through the VNX platform, with added perks for buyers in the European Union.

Platform Highlights:

- Issuer: VNX Commodities AG.

- License: Registered under Liechtenstein's TVTG (Blockchain Act), regulated by the FMA.

- Market Capitalization: Around $2.5 million.

- Available Chains: Ethereum, Polygon, Solana, Tezos, Q.

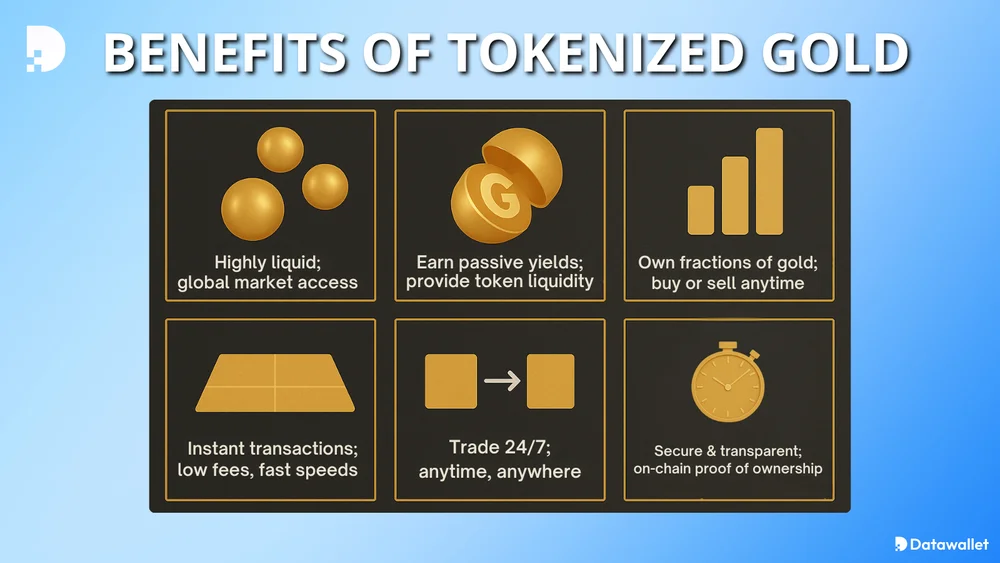

What is Tokenized Gold?

Tokenized gold is a digital representation of physical gold, issued as blockchain tokens that correspond to specific quantities of the underlying metal. Each token confers legal or economic ownership of a defined amount of gold, typically stored in audited, secure vaults by regulated custodians.

This format merges the intrinsic value of gold with the efficiencies of digital finance. By enabling fractional ownership, global transferability, and near-instant settlement, tokenized gold offers a more flexible and accessible way to hold gold compared to traditional methods.

In order to guarantee that these tokens are fully backed, decentralized oracles such as Chainlink offer critical verification services by verifying that the physical gold reserves exist and correspond to the digital claims. This integration guarantees the authenticity and stability of the asset for investors.

How Does Gold Tokenization Work?

Gold tokenization converts vaulted bullion into on-chain assets that can be traded, verified, and settled with unprecedented precision. Here’s a breakdown of the underlying structure:

- Institutional-Grade Custody: Allocated gold bars are stored with regulated entities, typically in offshore jurisdictions known for financial oversight and bullion handling like Switzerland and New Zealand.

- Smart Contract Minting: Each token is issued via programmable smart contracts, mapping directly to specific gold bars, often by serial number, weight, and purity.

- Third-Party Reconciliation: Frequent audits by independent firms verify the one-to-one parity between circulating tokens and gold reserves, often supplemented by public attestation reports.

- Multichain Deployment: Tokens are distributed across major blockchains such as Ethereum, Polygon, XDC, or Tezos, optimizing for liquidity, scalability, or compliance depending on the issuer’s strategy.

- Redemption Protocols: Token holders may initiate physical redemption, convert to fiat, or integrate tokens into DeFi environments, each pathway subject to issuer terms, fees, and KYC requirements.

Is Tokenized Gold Regulated?

In the EU, tokenized gold is regulated under the Markets in Crypto-Assets (MiCA) framework, which became law in 2023 and began full enforcement in late 2024. Issuers of gold tokens must provide proof of reserves, maintain legal custody of underlying gold, and publish whitepapers approved by national regulators.

In the United States, regulation is fragmented. The SEC considers some gold tokens potential securities under the Howey Test, though no formal tokenized gold project has been explicitly approved or exempted; issuers often operate under no-action letters or through offshore jurisdictions to avoid enforcement risk.

How to Buy Gold-Backed Cryptocurrencies

To invest in gold-backed cryptocurrencies like Pax Gold (PAXG), choosing a secure, regulated exchange is essential. Uphold stands out as a leading platform with global licensing, strong compliance standards, and support for over 250 cryptocurrencies, 20+ fiat currencies, and a range of precious metals.

Here’s how to get started:

- Create an Account: Visit Uphold and sign up. Complete the Know Your Customer (KYC) verification process to unlock full access.

- Link Your Bank or Card: Go to the “Funding Methods” section and securely connect your preferred bank account, debit card, or alternative payment method.

- Deposit Funds: Choose your funding currency (e.g., USD, EUR, GBP, JPY, CHF, SGD, NZD, AUD), and make a deposit to load your account balance.

- Buy PAXG or Other Assets: Use your funds to purchase Pax Gold (PAXG), or explore additional precious metals like Silver (XAG), Platinum (XPT), and traditional Gold (XAU).

- Store or Transfer: Keep your assets in Uphold’s secure wallet or transfer them (if it's a crypto token) to a private wallet for self-custody.

Can I Earn Yield with Gold Tokens?

Yes, tokenized gold like PAXG and XAUT can earn yield through DeFi platforms by providing liquidity or lending. Users connect a Web3 wallet to DEXs like Uniswap or Curve, deposit tokens into pools, and earn APY from trading fees or incentives.

For example, DefiLlama data show that Uniswap’s XAUT-USDT pool offers a 33.61% APY with just $1.06M in liquidity, while PAXG-USDC pools show 15–20% APY with over $5M combined TVL. Lower-yield options like PAXG-WETH (Polygon) offer around 2.8%, and lending via Wing Finance offers 1.5% APY.

Returns depend on pool activity and incentives, but risks include impermanent loss, volatility, and smart contract exploits. Always assess liquidity depth and 30-day APYs before committing assets.

Final Thoughts

Tokenized gold hasn’t broken into the mainstream, and most people in crypto still ignore it. The few serious projects are doing the basics well: vaulted backing, audits, and chain access. But actual usage remains low outside of holding and occasional DeFi yield.

Liquidity is fragmented across chains, real-world adoption is minimal, and pricing often trails physical markets during volatility. Until tokenized gold connects more meaningfully to credit, payments, or institutional workflows, it will stay functional but peripheral.

Frequently asked questions

Is tokenized gold a stablecoin or something else?

No, tokenized gold is not a traditional stablecoin. While both aim for price stability, gold tokens are backed by a tangible commodity (gold) rather than fiat currency, and their value fluctuates with the gold market and not a fixed peg.

Can tokenized gold be used for international payments?

Technically yes, but adoption is limited. Although gold tokens can move globally like any cryptocurrency, they aren't widely accepted as a payment medium due to low merchant adoption and regulatory friction.

How secure is the physical custody of gold tokens?

Top-tier issuers use insured vaults in jurisdictions like Switzerland, the UAE, and Liechtenstein, with third-party audits and bar-level tracking. However, custody models vary widely, and lack of transparency remains a risk for lesser-known projects.

Are gold-backed tokens better than physical gold for portfolio diversification?

They serve different purposes. Tokenized gold offers flexibility, fast settlement, and easier rebalancing, while physical gold remains superior for off-grid security and geopolitical hedge scenarios.

What are the tax implications of trading gold-backed crypto?

In many jurisdictions, gold tokens are treated like digital commodities. Gains may be subject to capital gains tax, but specific rules depend on whether the asset is classified as a security or a collectible under local law.

%2520(1).webp)

Written by

Antony Bianco

Head of Research

Antony Bianco, co-founder of Datawallet, is a DeFi expert and active member of the Ethereum community who assist in zero-knowledge proof research for layer 2's. With a Master’s in Computer Science, he has made significant contributions to the crypto ecosystem, working with various DAOs on-chain.

.webp)

%2520(1).webp)

.webp)