How to Buy Crypto with Questrade

Summary: Questrade does not support direct crypto trading, but investors can gain indirect exposure through crypto ETFs, publicly traded crypto trusts, and crypto-related stocks.

To buy cryptocurrencies in Canada, regulated exchanges such as Kraken or Bitbuy offer secure platforms, fast CAD funding methods, staking rewards, and transparent fees.

Can I Buy Crypto with Questrade?

You cannot directly buy cryptocurrencies like Bitcoin or Ethereum through Questrade. Instead, investors can access indirect crypto exposure by trading crypto-related financial instruments, such as crypto ETFs, trusts, and publicly traded crypto funds listed on the platform.

Examples of crypto-focused investments accessible via Questrade include Purpose Bitcoin ETF (BTCC), 3iQ CoinShares Bitcoin ETF (BTCQ), and Purpose Ether ETF (ETHH).

These investment products offer a convenient way to trade cryptocurrencies without needing personal wallets or private keys. However, they also involve management fees, potential tracking discrepancies, and additional risks compared to real crypto ownership.

How to Buy Bitcoin & Crypto with Questrade Alternatives

The best alternative to Questrade for real crypto purchases is using a FINTRAC-registered exchange in Canada such as Kraken.

Kraken supports 350+ cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), and Solana (SOL). Users benefit from staking rewards and simple CAD deposits through Interac e-Transfer, cards, PayPal or wire transfer.

Follow these steps to buy cryptocurrency on Kraken:

- Open an Account: Sign up with Kraken and complete the KYC identity verification.

- Fund with CAD: Deposit Canadian dollars via Interac e-Transfer or wire transfer.

- Choose Cryptocurrency: Select your crypto asset from Kraken’s extensive options.

- Finalise Your Purchase: Enter your investment amount, review details carefully, and confirm your transaction.

Questrade Crypto Product Fees

Questrade does not charge fees for trading crypto-linked ETFs or publicly listed crypto trusts, aside from its standard brokerage commissions. However, these products have built-in costs investors should consider:

- Crypto ETFs: No additional trading fees beyond regular Questrade commissions, but annual management expense ratios (MERs) ranging from approximately 0.4% to 1.5% apply, depending on the fund provider and asset exposure.

- Crypto Trusts (Publicly Listed): Regular brokerage trading commissions apply. Additionally, these trusts typically include management fees and may trade at premiums or discounts relative to their underlying crypto assets, affecting overall returns.

Questrade does not currently offer crypto futures contracts or other leveraged crypto derivatives.

Alternative Crypto Exchanges to Questrade

If you're looking for more alternatives to Kraken outside of Questrade, there are several trusted, FINTRAC-regulated Canadian exchanges provide reliable options:

- Bitbuy: A Canadian crypto exchange regulated by FINTRAC and OSC, Bitbuy provides secure access to 25+ cryptocurrencies, including BTC and ETH, with straightforward trading. Trading fees average around 0.6%.

- Coinbase: Available to Canadians and registered with FINTRAC, Coinbase offers a user-friendly platform with access to 250+ digital assets and advanced trading features. Standard trades incur fees of approximately 1.49%.

- Shakepay: A popular Canadian FINTRAC-regulated exchange known for simplicity, Shakepay supports Bitcoin and Ethereum purchases. While it doesn't charge direct commissions, Shakepay applies a spread fee of roughly 1% per transaction.

Can I Invest in Crypto Stocks on Questrade?

Yes, Questrade supports trading various crypto-related stocks. Popular examples include Coinbase (COIN), a leading cryptocurrency exchange; MicroStrategy (MSTR), the largest publicly traded Bitcoin treasury holder; Circle Internet Group Inc. (CRCL), the company behind the USDC stablecoin; and prominent crypto miners like Riot Platforms (RIOT).

These stocks offer investors indirect exposure to crypto markets without owning the underlying digital currencies.

About Questrade

Questrade is Canada's leading independent online brokerage, with over 250,000 customers nationwide and around $50 billion under management. Founded in 1999, it lets investors trade stocks, ETFs, options, bonds, precious metals, and FX through its Questrade Trading platform.

The brokerage is known for commission-free ETF purchases and competitively priced stock trades (starting at $4.95). It also provides automated portfolio management with Questwealth Portfolios, using low-cost ETFs tailored to individual risk profiles.

Advanced traders get access to sophisticated tools like Questrade Edge and real-time market data subscriptions.

Final Thoughts

Questrade doesn't support direct crypto trading but remains a solid choice for accessing crypto through ETFs, trusts, or crypto-related stocks.

Investors who prefer owning real crypto assets can choose FINTRAC-regulated exchanges like Kraken, Bitbuy, or Shakepay.

Ultimately, indirect options are hands-off but come with hidden fees, while direct crypto ownership requires active oversight but offers greater control. Choose what fits your investing style best.

Frequently asked questions

Can I hold crypto ETFs in a TFSA or RRSP with Questrade?

Yes. Questrade supports crypto ETFs such as BTCC or ETHH within TFSA and RRSP accounts, giving Canadian investors tax-efficient exposure to Bitcoin or Ethereum.

What are the tax implications of crypto ETFs vs. direct crypto?

Crypto ETFs held in taxable accounts trigger capital gains or distributions but simplify tax reporting. Direct crypto investments involve tracking cost basis for each trade, with every sale potentially causing taxable events.

Is there a risk of tracking error with crypto ETFs on Questrade?

Yes, tracking errors can happen due to management fees, custody expenses, and price volatility. These factors might cause ETF performance to lag behind directly owning Bitcoin or Ethereum.

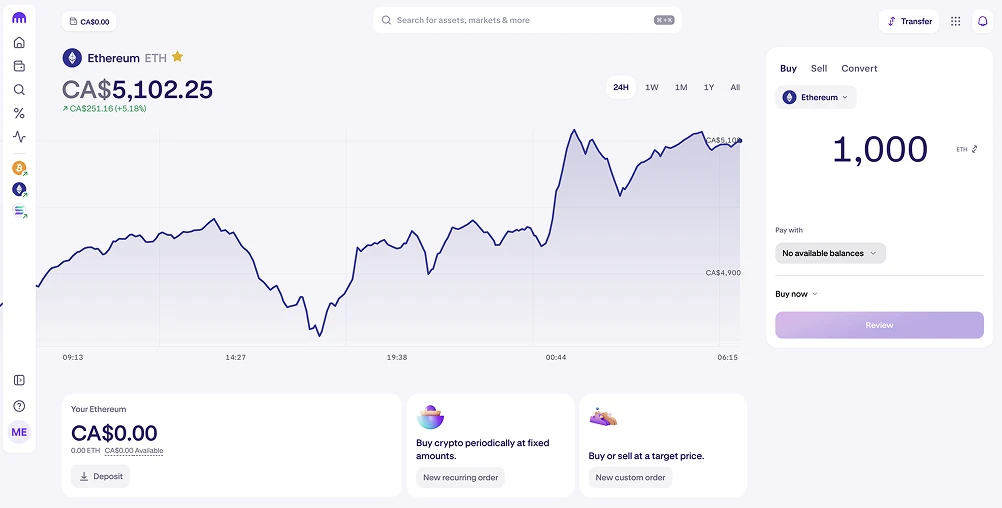

How does Questrade compare to Wealthsimple for crypto investing?

Questrade provides indirect crypto exposure through ETFs and related stocks. Wealthsimple Crypto allows direct buying and selling of cryptocurrencies but comes with excessive spreads and no wallet withdrawals, making it less attractive compared to specialized crypto exchanges.

.webp)

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.

%2520(1).webp)

.webp)

%25201%2520(1).webp)

%2520(1).webp)