How to Buy Tether (USDT) in Oman

.webp)

Summary: Omani investors can buy Tether (USDT) through reputable crypto exchanges that support Omani Rial (OMR) funding and adhere to Financial Services Authority (FSA) regulations.

Because rules around digital assets can shift and enforcement is inconsistent across providers, it’s worth sticking to platforms that publish clear licensing details, strong identity checks, and transparent fee disclosures.

Bybit is our top pick for buying USDT in Oman because it supports OMR funding routes, offers deep liquidity with low fees, and enforces strict KYC for safer transactions.

OMR Deposit Methods

Bank Transfer, Debit Card, Credit Card & More

Supported Assets

1,700+ Cryptocurrencies (BTC, ETH, USDT & More).

Licensing & Regulation

ADGM's Financial Services Regulatory Authority (FSRA)

Can I Buy Tether (USDT) in Oman?

Yes, residents in Oman can buy Tether (USDT) through a reputable crypto platform that is transparent about where it is licensed, how it protects customer funds, and which checks it applies before allowing deposits and withdrawals.

Crypto rules and banking risk controls can change quickly, so don’t treat “available today” as a guarantee for tomorrow. Stick to providers that publish clear terms, disclose fees upfront, and explain their identity verification and anti-money laundering standards in Arabic.

How to Buy USDT in Oman

The best way to acquire Tether (USDT) is through reputable exchanges that accept Omani users and facilitate OMR deposits. One exchange that many in the region prefer is Bybit, which combines deep USDT liquidity with clear verification steps and reliable security practices.

Before placing any funds, make sure you review the platform’s terms, fee structure, and how deposits work for Omani Rial (OMR). This aligns with best practices for clarity and helps you make informed decisions.

Steps to Buy USDT from Oman

- Set up an account: Head to Bybit’s official site and sign up with your email or mobile number. Choose a strong, unique password and enable two-factor authentication to protect your login.

- Complete identity checks: To comply with regulatory requirements, upload a valid government-issued ID and any additional details requested. Wait until your account is fully verified before depositing funds.

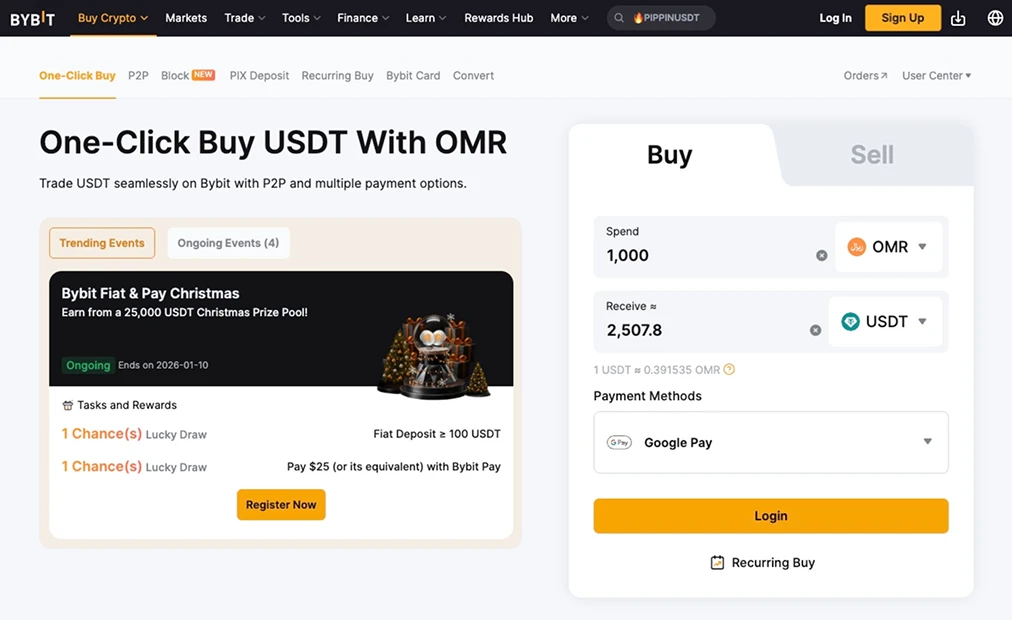

- Deposit funds: Navigate to the deposit page and select a supported payment method. Bybit facilitates OMR deposits via credit and debit cards, Google Pay, and Samsung Pay.

- Purchase USDT: Once your account is funded, open a suitable trading pair that matches your deposited currency, or use Bybit’s Buy/Sell interface. Enter the amount of USDT you want, check the displayed price and any charges, then complete the trade.

OMR to USDT Fees

Knowing the full cost of converting Omani Rial (OMR) into USDT matters just as much as choosing the right platform. For traders in Oman, Bybit is often favoured because its pricing is published clearly and is usually more competitive than other platforms.

Deposits

- Bank transfers: Bybit generally does not add its own deposit charge. Any costs you see usually come from your bank or payment provider, such as currency conversion or processing fees.

- Credit and debit cards: Card purchases are processed by external payment processors, which may charge a processing fee of up to 3%, depending on the provider and card issuer.

Withdrawals

- Fiat withdrawals: Where fiat withdrawals are supported, a fixed fee typically applies. This reflects banking and payment-rail costs rather than an exchange mark-up.

- Crypto withdrawals: Withdrawing USDT to an external wallet includes a blockchain network fee that changes with network demand. Bybit passes this cost through directly, without adding hidden charges.

Trading

- Maker fees on USDT pairs: Standard spot maker fees start around 0.1% and can drop if your 30-day trading volume increases or you qualify for a higher account tier.

- Taker fees on USDT pairs: Taker fees are usually close to 0.1%, with lower rates available for more active traders based on volume and account status.

Thanks to tight spreads on liquid USDT markets and a fee structure that’s easy to verify, Bybit often works out cheaper for Omani traders than other exchanges like Coinbase, where total costs can quietly exceed 2.5% once margins and FX mark-up are taken into account.

Best Alternative USDT Exchanges in Oman

Omani investors can buy USDT through several global exchanges. Bybit is a common first pick for its liquidity and tools, but Binance, OKX, and KuCoin are also widely used options, depending on which deposit methods and features you value most.

The comparison table below highlights the platform’s supported OMR funding methods, total costs, features, and supported cryptocurrencies.

Regulatory Status of USDT in Oman

Buying Tether (USDT) in Oman is legally permitted for investment and personal use as of 2025, provided that traders utilize compliant platforms that adhere to the nation’s financial standards.

While the Central Bank of Oman (CBO) maintains that digital assets are not recognized as legal tender, the Financial Services Authority (FSA) has implemented a comprehensive Virtual Assets Regulatory Framework under Decision No. (E/35/2023) to formalize and oversee the sector.

This framework mandates that Virtual Asset Service Providers (VASPs) register with the FSA and uphold rigorous Anti-Money Laundering (AML) and Know Your Customer (KYC) protocols to safeguard the local financial ecosystem. Omani residents can legally acquire USDT through reputable regional exchanges or global platforms.

Tax Implications of Stablecoins in Oman

As of late 2025, individual investors in Oman enjoy a favorable tax climate for Tether (USDT), as the Sultanate does not currently impose personal income tax or capital gains tax on private digital asset holdings.

This tax-exempt status for individuals is scheduled to shift following the issuance of Royal Decree No. 56/2025, which introduces a 5% personal income tax effective January 1, 2028, though this will only apply to high-earners with annual incomes exceeding OMR 42,000.

Final Thoughts

Buying USDT in Oman can be straightforward, but treat it like any other financial decision and do your checks before you send OMR. Use a platform that clearly states its licensing and compliance under Oman’s rules, compare the real cost after card fees and spreads, and lock down your account with two-factor authentication.

After you buy, withdraw larger balances to a wallet you control, and keep a simple log of deposits, trades, and withdrawals so you can prove the source of funds and track gains if tax rules tighten later.

Written by

Antony Bianco

Head of Research

Antony Bianco, co-founder of Datawallet, is a DeFi expert and active member of the Ethereum community who assist in zero-knowledge proof research for layer 2's. With a Master’s in Computer Science, he has made significant contributions to the crypto ecosystem, working with various DAOs on-chain.

.webp)

%20(1).webp)