OKX Review: Features, Fees, Regulation & More

Summary: OKX ranks among the world’s largest crypto exchanges, regularly exceeding a trillion dollars in monthly trading volume across spot, futures, and options markets.

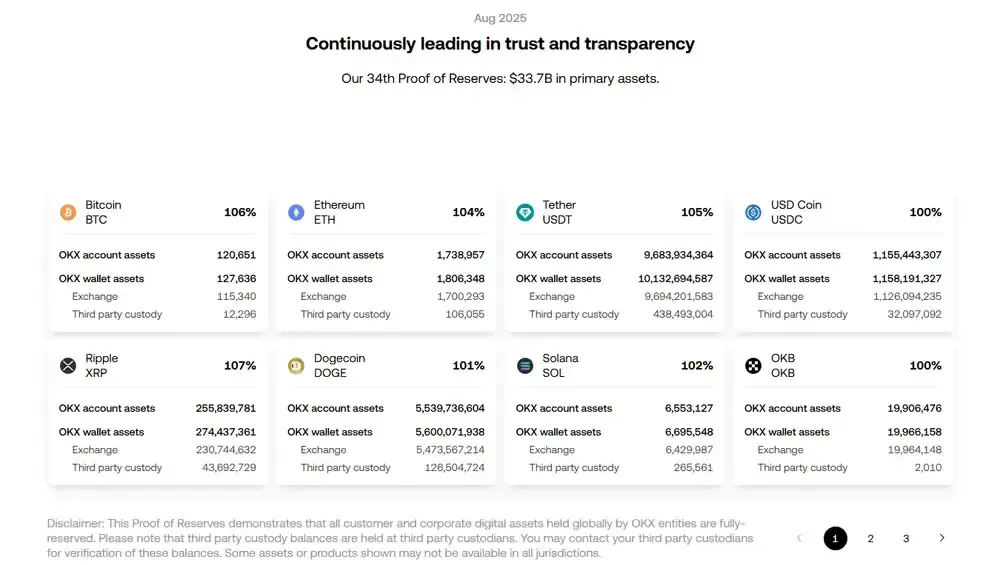

The platform supports over 350 assets, offers institutional-grade features, maintains $33.7 billion in reserves, and holds licenses spanning the US, EU, Singapore, Australia, and other jurisdictions.

OKX is a global cryptocurrency exchange serving over 50 million users in 160+ jurisdictions, with products spanning derivatives, spot markets, staking, lending, NFTs, and broader blockchain services.

Accepted Fiat Currencies

USD, EUR, AUD, CAD, GBP, AED, JPY, and 80+ more

Supported Cryptocurrencies

350+ cryptocurrencies across 320+ pairs, plus 1,000+ NFTs

Security

Audited Proof-of-Reserves, showing $33.7B+ in assets

What is OKX?

OKX is a derivatives-dominant cryptocurrency exchange and blockchain services provider, founded in 2013 by Star Xu as Okcoin. It rebranded as OKEx in 2017 to expand internationally, then in 2022 became OKX as we know it today, reflecting its expansion into perpetuals trading, DeFi, and Web3 services.

The platform consistently ranks among the world’s largest centralized exchanges by trading activity, often surpassing $40 billion in daily transaction volume. According to CryptoQuant, OKX also maintains one of the industry’s highest proof-of-reserves transparency scores among major exchanges.

Notorious for its regulatory strength, OKX holds licenses in the United States, the European Union, Singapore, and Australia, among other regions. With more than 5,000 employees worldwide, it serves millions of users while partnering with leading global sports and technology brands.

OKX Features

All of OKX's features provide complete access to digital assets, with distinct products for investing, trading, and managing capital. The platform organizes its core functions into access, trading, yield generation, and borrowing categories:

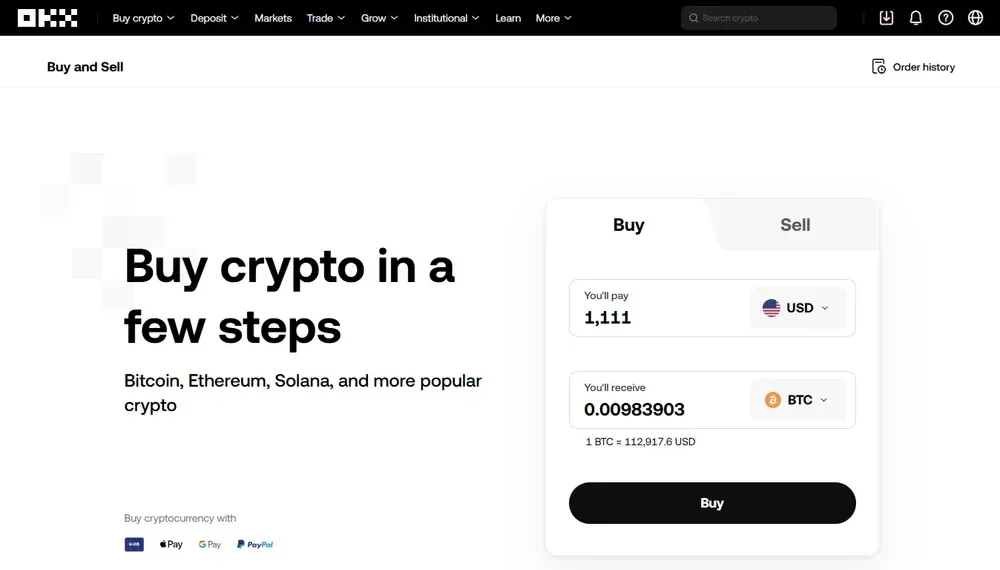

Buy and Sell Crypto

OKX enables direct fiat-to-crypto transactions through multiple gateways and settlement options:

- Debit and credit cards: Supports instant crypto purchases via Visa, Mastercard, Apple Pay, or Google Pay across more than 160 countries worldwide.

- Third-party payment providers: Connects users to over 20 licensed fiat gateways offering region-specific KYC, transaction limits, and settlement speeds.

- Bank transfers and e-wallets: Enable deposits and withdrawals in EUR, USD, SGD, BRL, and AED through instant or near-instant clearing networks.

Trading

The platform delivers institutional-grade liquidity and a broad suite of execution models for digital asset trading:

- Spot trading: Provides access to over 350 cryptocurrencies with advanced order types, competitive fees, and deep liquidity across trading pairs.

- Automated trading bots: Offers grid, arbitrage, and DCA bots operating continuously with customizable strategies and performance tracking dashboards.

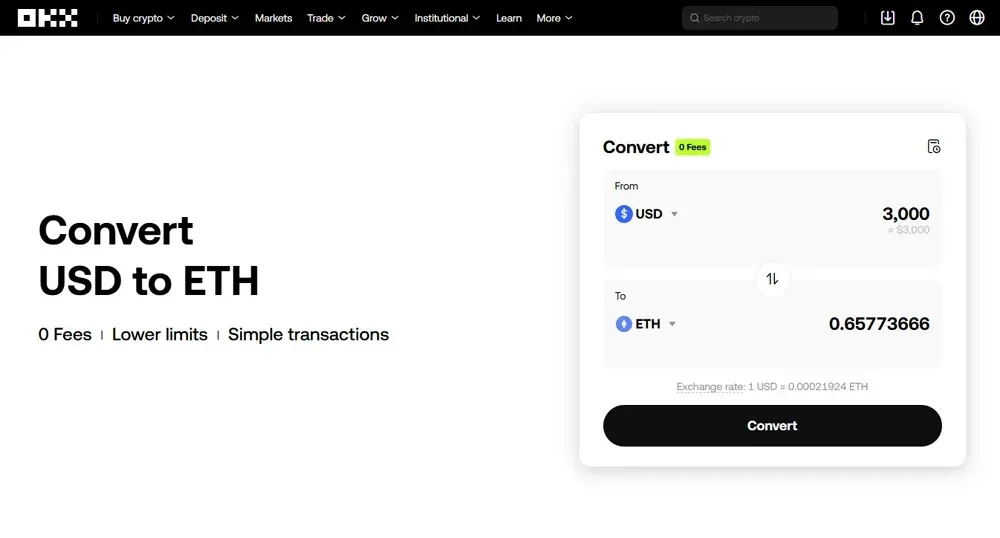

- Convert function: Enables one-click swaps between most supported assets with zero slippage or fees using a proprietary quoting model.

- OTC and block trading: Allows transactions above $100,000 through institutional liquidity pools, request-for-quote boards, and minimized counterparty exposure.

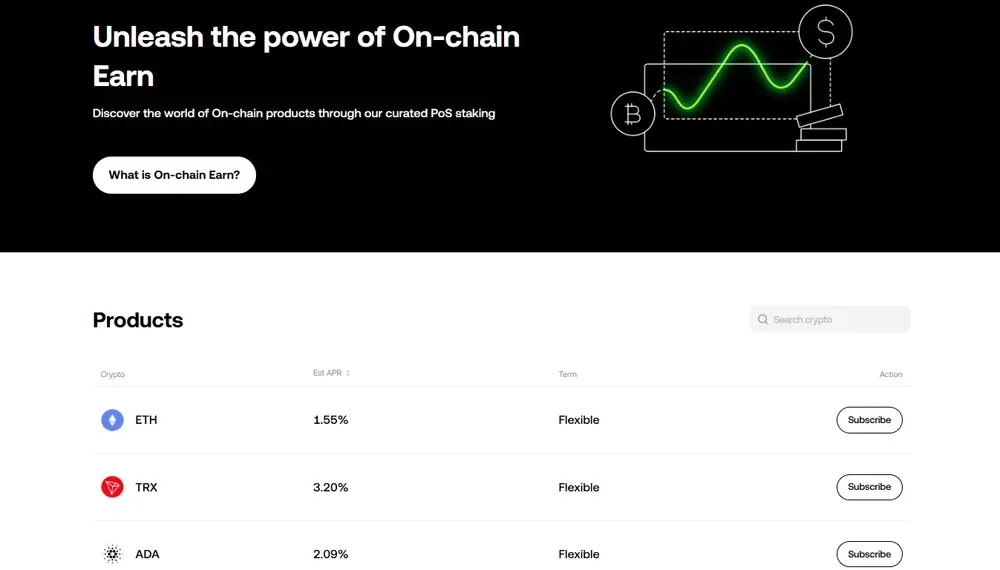

Earn and Grow

OKX provides yield through structured Grow products and curated blockchain protocol integrations:

- Simple Earn: Flexible allocation product paying hourly yields, historically averaging 1-8% APR, with anytime redemption and strong risk controls.

- Dual Investment: Non-principal-protected contract allowing buy-low or sell-high strategies while securing potential APRs exceeding 300% in volatile cycles.

- On-chain Earn: Aggregates vetted DeFi protocols and staking networks across Ethereum, Solana, and Avalanche with rewards distributed securely on-chain.

- BTC Yield+: Principal-protected Bitcoin strategy designed for stability, delivering consistent daily payouts with average historical returns around 1.5-2% annually.

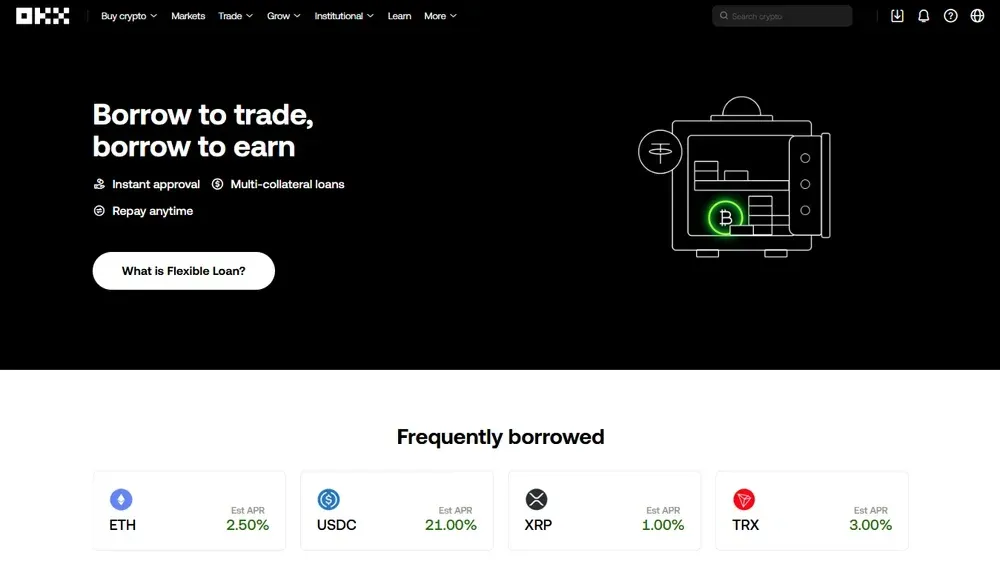

Loans and Borrowing

Users can access liquidity without selling assets through secured lending options with clear risk controls:

- Flexible Loan: Provides overcollateralized loans with dynamic interest rates, instant approval, and collateral support spanning more than 100 tokens.

- Multi-collateral borrowing: Allows users to combine multiple crypto assets as collateral, optimizing loan-to-value ratios and minimizing forced liquidation risks.

- Institutional lending: Extends custom credit lines above $10 million with API integration, bespoke repayment terms, and high-capacity settlement infrastructure.

Is OKX Safe?

OKX is considered one of the most secure global exchanges due to its regulatory compliance and transparent reserve policies. The platform operates under strict licensing frameworks in multiple jurisdictions, ensuring user protection and adherence to financial regulations.

To demonstrate compliance, OKX holds licenses across major global markets:

- European Union (MiCA License, 2025): Grants full passporting rights to 30 EEA member states, enabling regulated services for over 400 million residents.

- United States (MSB Registration, State Licenses): Operates via OKCoin USA Inc., regulated by FinCEN and licensed across more than 40 U.S. jurisdictions.

- Singapore (MAS MPI License): Approved as a Major Payment Institution, authorizing digital payment token services and cross-border money transfers under MAS oversight.

- Australia (AUSTRAC Registration): Complies with AML/CTF obligations, allowing provision of digital asset exchange and custody services across the Australian market.

- United Arab Emirates (VARA License, Dubai): Permitted to provide spot trading and virtual asset services within Dubai’s regulated digital asset framework.

- Brazil (OKX Serviços Digitais Ltda.): Operates locally in line with Brazilian financial regulation, ensuring adherence to national crypto legislation and tax compliance standards.

- Seychelles (Aux Cayes FinTech Co. Ltd.): Manages global operations through its offshore entity, enabling flexibility for international service provision and legal structuring.

In addition to licensing, OKX maintains rigorous proof-of-reserves (PoR) reporting. Its August 2025 attestation confirmed $33.7 billion in verifiable assets, with reserve ratios of 106% for Bitcoin, 104% for Ethereum, 105% for Tether, and 100% for USD Coin.

OKX Fees Schedule

OKX applies a tiered fee system where rates depend on 30-day trading volume, verified asset balance, and account activity. Tiers are recalculated daily at 16:00 UTC, combining main and sub-accounts into a unified status, while specific rates may differ slightly across regions.

The following schedule outlines how fees apply across spot, futures, and options:

Fee type |

Standard tier (VIP 0) |

Notes |

|---|---|---|

Spot trading |

Maker 0.080%, Taker 0.100% |

Fees decrease with higher 30-day volume or OKB holdings; VIP discounts up to 40%. |

Futures trading |

Maker 0.020%, Taker 0.050% |

VIP tiers include rebates; makers can receive negative fees as low as -0.010%. |

Options trading |

Maker 0.030%, Taker 0.030% |

Tiered discounts apply; advanced RFQ combo trades may qualify for up to 50% fee reduction. |

Copy trading & bots |

Included in spot/futures fees |

Copy trading and bot strategies follow normal schedules; lead traders may receive rebates. |

Deposit fees |

Free for crypto deposits |

Fiat purchases via cards or third-party gateways may incur processor fees. |

Withdrawal fees |

Network-based; dynamic |

On-chain fees vary by asset and congestion (e.g., BTC 0.00035, ETH 0.003); internal transfers are free. |

Margin interest |

≈1% per year for BTC/ETH |

Rates vary by asset, collateral, and VIP level; institutional clients may access bespoke terms. |

Spot Trading Fees

Spot markets use maker-taker pricing, with discounts scaling for high-volume traders and VIP accounts:

- Regular tier (USDT pairs): Maker 0.080% and taker 0.100%, with $10,000,000 daily withdrawal ceiling.

- VIP 1-4: Maker 0.045%-0.020%, taker 0.050%-0.035%, progressively lowering costs for active traders.

- VIP 5-8: Maker 0.000% to -0.005%, taker 0.030%-0.015%, with limits rising to $80,000,000.

Perpetuals & Futures Fees

Futures markets mirror spot fee scaling but offer deeper rebates for institutional-level participants:

- Regular tier: Maker 0.020% and taker 0.050%, capped at $10,000,000 daily withdrawals.

- VIP 1-4: Maker 0.010%-0.002%, taker 0.030%-0.020%, rewarding higher liquidity provision.

- VIP 5-8: Maker 0.000% to -0.010%, taker 0.020%-0.015%, with $80,000,000 daily limit.

Funding Rates (Perpetuals)

Funding rates align perpetual contracts with spot markets, varying across asset classes and liquidity depth:

- BTCUSDT perpetuals: Typically range from -0.010% to +0.030% per 8-hour cycle.

- ETHUSDT perpetuals: Commonly fluctuate between -0.020% and +0.050%, reflecting volatility.

- Altcoin perpetuals: Often swing wider, from -0.050% to +0.200% in thinly traded markets.

Crypto Options Fees

Options markets maintain consistent pricing with discounts and combo incentives at advanced tiers:

- Regular tier: Maker 0.030% and taker 0.030%, applied to all contracts.

- VIP 1-4: Maker 0.025%-0.015%, taker 0.030%-0.020%, reducing execution costs.

- VIP 5-8: Maker -0.005% to -0.010%, taker 0.015%-0.013%, plus 50% RFQ combo discounts.

OKX Futures

OKX Futures is a derivatives platform offering 376 perpetual and expiry contracts across major cryptocurrencies with deep global liquidity. It supports both USDT-margined and coin-margined products, covering Bitcoin, Ethereum, Litecoin, and a wide range of altcoins.

Monthly trading volumes on OKX futures exceed $1.2 trillion, with average daily turnover consistently surpassing $40 billion in activity. Over 90% of transactions are settled in USDT, making OKX one of the largest and most active Tether exchanges globally.

The platform supports leverage up to 125x, with margin requirements dynamically adjusted by position tiers to manage systemic risk. Settlement under the Unified Account system further improves capital efficiency, enabling trading across perpetuals, expiry futures, and options.

How to Register on OKX

Opening an account on OKX involves several steps, from creating login credentials to completing verification and securing access. Follow the process below to register properly and prepare your account for use:

- Visit the OKX platform: Go to OKX or download the mobile app, then select the “Sign Up” option.

- Enter registration details: Provide an email address or phone number, set a strong password, and link an Apple, Google, or Telegram account if preferred.

- Apply an OKX referral code (optional): Enter a referral code during registration to activate potential bonuses, rewards, or discounted trading fees.

- Confirm account activation: Verify your email or mobile number by entering the one-time code sent to complete the initial registration process.

- Enable security features: Set up two-factor authentication (2FA), create a fund password, or register a FIDO passkey to protect login and withdrawals.

- Complete identity verification (KYC): Upload a government-issued ID and selfie; basic approval is often instant, while full KYC may take up to 24 hours.

- Provide additional details if required: Depending on your jurisdiction, submit proof of address, occupation, or source of funds for enhanced due diligence.

- Finalize setup: Once verification is approved, your account is fully activated and ready for deposits, trading, and product access.

Note: Check whether OKX is restricted in your country before starting registration. The platform is currently available in more than 160 jurisdictions, but there are exceptions like the USA, the UK, and Canada.

What is OKX Wallet?

OKX Wallet is a self-custodial multi-chain Web3 wallet supporting over 130 blockchains with advanced DeFi, NFT, and cross-chain tools. Originally launched within the OKX exchange, it evolved into a standalone application in 2025, processing nearly $1 billion in daily transactions.

The wallet brings together functions such as swaps, staking, bridging, and yield aggregation, while granting users complete private key control. Despite its global adoption, OKX Wallet and its DEX services remain unavailable across the European Economic Area due to compliance restrictions.

Final Thoughts

OKX doesn’t try to be everything for everyone, but it excels at derivatives, liquidity, and multi-chain tools. Fees are competitive, its proof-of-reserves regularly verifies more than $30 billion in assets, and licenses in the US, EU, and Asia-Pacific reinforce regulatory trust.

Frequently asked questions

Is OKX available in the United States?

OKX relaunched in the U.S. in 2025 through its regulated subsidiary, but availability varies by state. Residents in jurisdictions without active money transmitter licenses, such as New York and Texas, currently cannot access the platform.

What payment methods does OKX support for deposits and withdrawals?

Users can fund accounts with bank transfers, debit and credit cards, Apple Pay, Google Pay, and third-party fiat gateways. Availability depends on region, with support for SEPA in Europe, Pix in Brazil, and PayNow in Singapore.

Does OKX have an insurance fund for traders?

Yes, OKX maintains an insurance fund to cover unexpected losses in futures and perpetual markets. The fund helps absorb liquidation shortfalls, protecting counterparties from systemic risk during extreme volatility.

Can I use OKX Wallet without an OKX exchange account?

Yes, the standalone OKX Wallet app and browser extension function independently of the exchange. Users retain full self-custody of their assets, with no need for centralized account credentials.

Written by

Emily Shin

Research Analyst

Emily is passionate about Web 3 and has dedicated her writing to exploring decentralized finance, NFTs, GameFi, and the broader crypto culture. She excels at breaking down the complexities of these cutting-edge technologies, providing readers with clear and insightful explanations of their transformative power.

.webp)