Best Crypto Exchanges in Brazil

.webp)

Summary: Brazil’s cryptocurrency industry is regulated under the Central Bank of Brazil and the Securities and Exchange Commission (CVM). Exchanges must comply with strict AML and KYC requirements and register as Virtual Asset Service Providers (VASPs) under the country’s regulatory framework.

In 2025, both domestic and international platforms support Brazilian real (BRL) deposits through PIX, bank transfers, and cards. Below are the leading exchanges available to Brazilian investors, known for their compliance, reliability, and support for local payment methods.

Bybit is the best exchange in Brazil because you can fund BRL with Pix, trade a large selection at low fees, and verify reserves through its published proof of reserves reports.

Supported Cryptocurrencies

2,300

Deposit Methods

Pix, Bank Transfers, Cards & More

Trading Fees

0.1% Per Trade

Top Crypto Trading Platforms in Brazil

For Brazilian investors, selecting a crypto exchange depends on compliance with the Central Bank of Brazil and the Securities and Exchange Commission (CVM). Platforms registered under the country’s Virtual Asset Service Provider (VASP) framework provide transparency, security, and investor protection aligned with global standards.

Exchanges offering low trading fees, a broad selection of cryptocurrencies, and fast BRL deposits through PIX or bank transfer are preferred by both retail and institutional users. Portuguese-language support and responsive customer service further enhance accessibility for local traders.

The table below highlights the best crypto exchanges in Brazil, comparing their fees, deposit methods, available assets, and standout features.

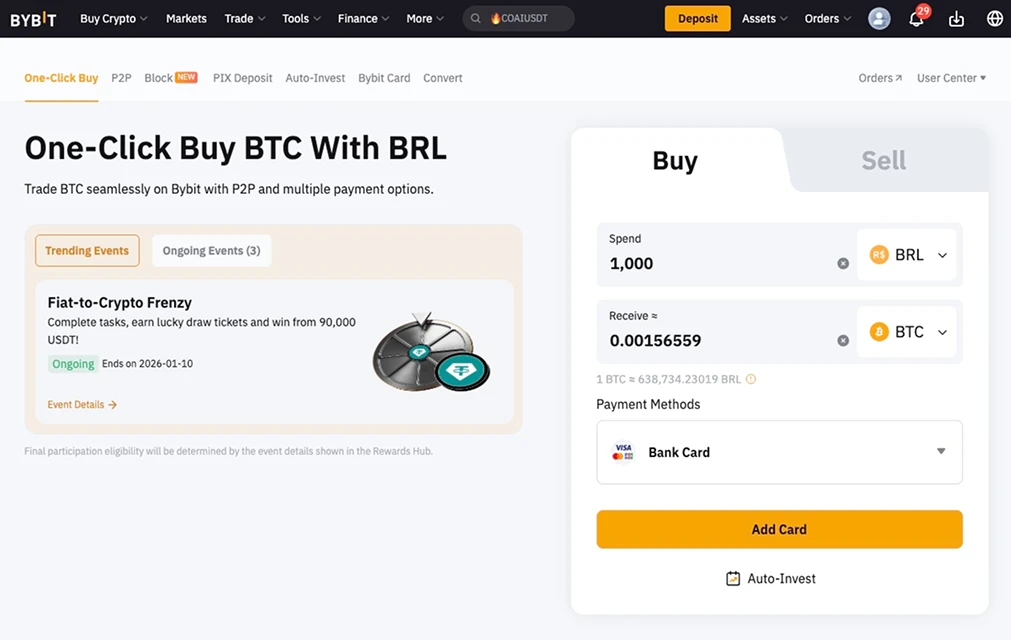

1. Bybit - Best Crypto Exchange in Brazil

Bybit is the best crypto exchange in Brazil, serving over 70 million users. It’s quickly become the preferred platform for traders seeking deep liquidity, diverse assets, and an intuitive interface. The exchange processes more than $51 billion in daily trading volume and lists over 2,300 cryptocurrencies.

Brazilian traders can access a full ecosystem of services that go beyond trading. Bybit’s Spot, Margin, and Futures markets deliver powerful tools and leverage options up to 200x, while Bybit Earn provides flexible and fixed-term savings products with returns reaching up to 555% APR for new users.

Security and compliance remain core pillars of Bybit’s success. The company is licensed in multiple jurisdictions, operates under strict AML and KYC frameworks, and provides 1:1 Proof-of-Reserves verification. The platform supports Portuguese and English, and provides 24/7 live support.

Platform Highlights:

- Fees: 0.1% for spot trades.

- Supported Assets: 2,300+ cryptocurrencies.

- Regulation & Licensing: Licensed globally and accessible from Brazil.

- BRL Deposit Methods: PIX, local bank transfer, debit/credit card, Google Pay, Apple Pay, Samsung Pay.

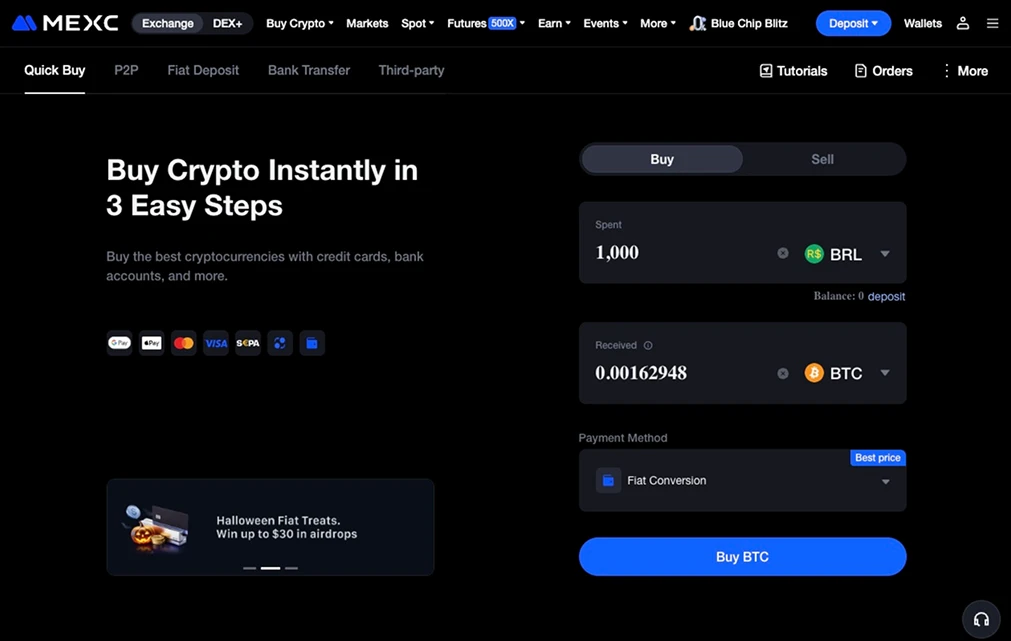

2. MEXC - Trade Futures with High Leverage

MEXC has earned a reputation as one of the most advanced and liquid global trading platforms, now trusted by more than 40 million users worldwide. It’s a preferred choice for experienced traders seeking high-leverage derivatives, low fees, and deep liquidity across thousands of trading pairs.

The exchange lists over 1,800 spot and more than 2,000 futures markets, processing billions in daily volume, and offers up to 500x leverage on select perpetual contracts. The Futures and Spot markets stand out for their 0% maker fees and ultra-competitive taker fees starting from 0.02%.

MEXC also maintains a $100 million Guardian Fund to compensate users for potential losses related to system issues, while its Futures Insurance Fund shields traders during extreme market conditions. All reserves are backed 1:1 and audited continuously, reinforcing user confidence.

Platform Highlights:

- Fees: 0% maker and 0.05% taker on spot.

- Supported Assets: 1,800+ cryptocurrencies.

- Regulation & Licensing: Operates under international compliance; aligns with Brazil’s Virtual Asset Provider guidelines.

- BRL Deposit Methods: PIX, bank transfer, debit/credit cards.

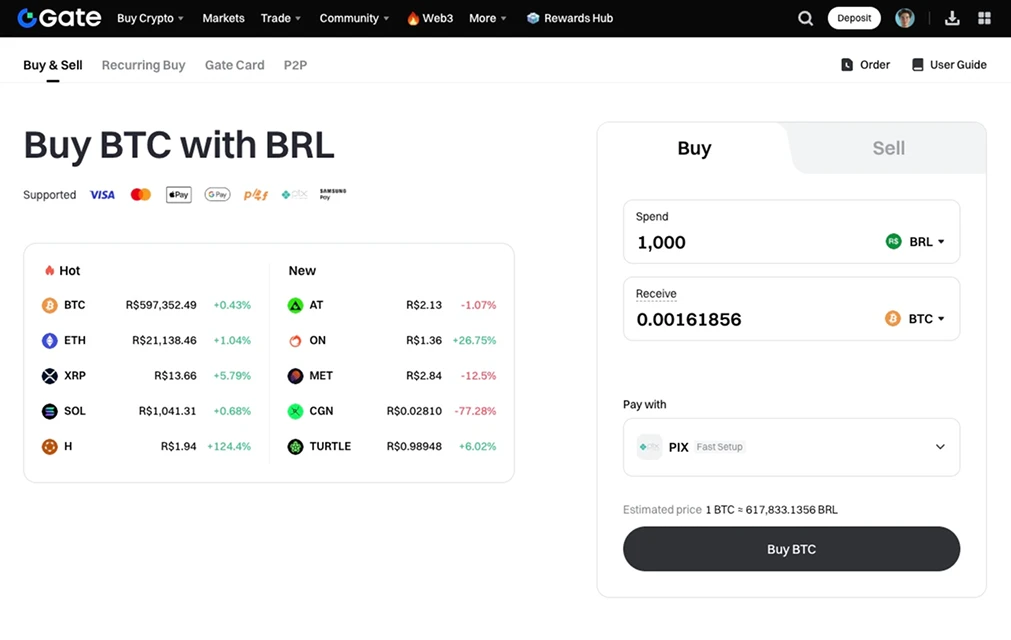

3. Gate - World’s Largest Crypto Selection

Gate is one of the most comprehensive exchanges, serving over 41 million users worldwide. In Brazil, it’s recognized for offering the largest selection of cryptocurrencies, more than 3,500 digital assets, along with advanced trading products designed for both retail and institutional investors.

The platform supports an extensive ecosystem, including Simple Earn, which offers flexible and fixed-term savings with returns up to 11.11% APR, and copy trading. Gate also operates an NFT marketplace, Startup Launchpad for early token investments, and robust trading bots that help automate strategies.

Gate’s compliance-first approach ensures secure operations in every supported jurisdiction, with multi-layered KYC verification, cold storage of funds, and continuous Proof-of-Reserves audits. Brazilian traders benefit from full Portuguese language support, instant BRL deposits via PIX, and a simple mobile app.

Platform Highlights:

- Fees: 0.1% spot trading fee.

- Supported Assets: 3,500+ cryptocurrencies.

- Regulation & Licensing: Operates in compliance with Brazil’s Virtual Asset Provider (VASP) requirements.

- BRL Deposit Methods: PIX, credit/debit card, and local bank transfers.

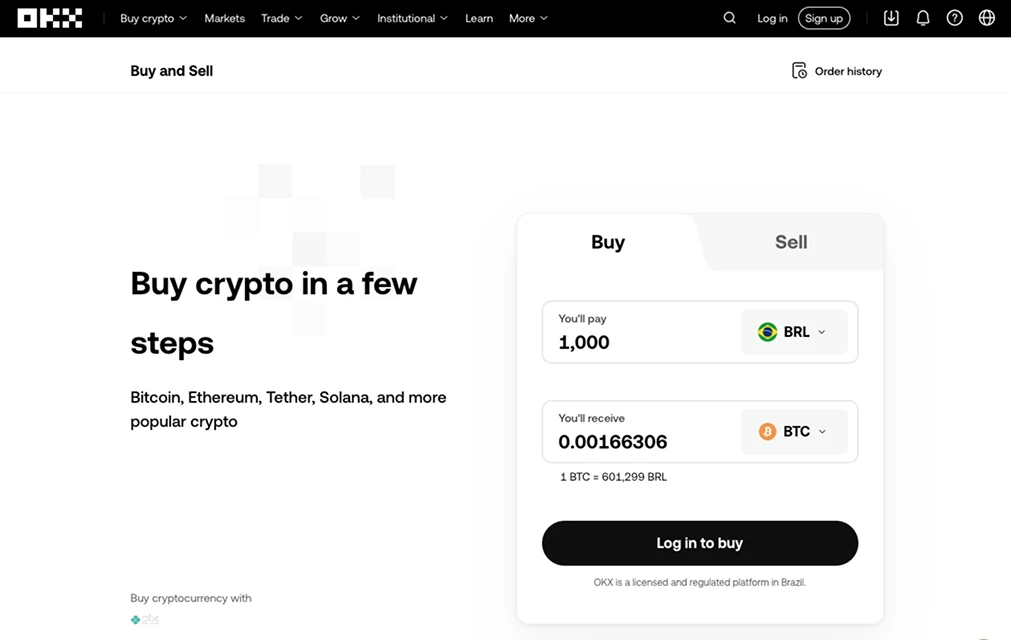

4. OKX - Access Web3 & DeFi Services

OKX has evolved into one of the most innovation-driven exchanges, now serving millions of users across 180+ countries. It’s known for combining deep trading liquidity with a robust Web3 ecosystem, giving users access to both traditional crypto markets and decentralized applications.

The exchange integrates directly with TradingView, offering high-performance charting and a streamlined trading experience. Beyond trading, OKX’s Earn products allow users to generate yield through savings, staking, and DeFi integrations, while its OKX Wallet connects users to NFTs and Web3 apps.

For institutions and retail traders alike, OKX offers OTC liquidity, API connectivity, and sub-account management tools for portfolio efficiency. The platform is globally regulated and emphasizes security through cold storage, Proof-of-Reserves verification, and transparent auditing.

Platform Highlights:

- Fees: From 0.08% maker / 0.10% taker on spot trades.

- Supported Assets: 350+ cryptocurrencies.

- Regulation & Licensing: Licensed in Brazil and operates under OKX Serviços Digitais Ltda.

- BRL Deposit Methods: PIX, bank transfer, debit/credit card, Apple Pay.

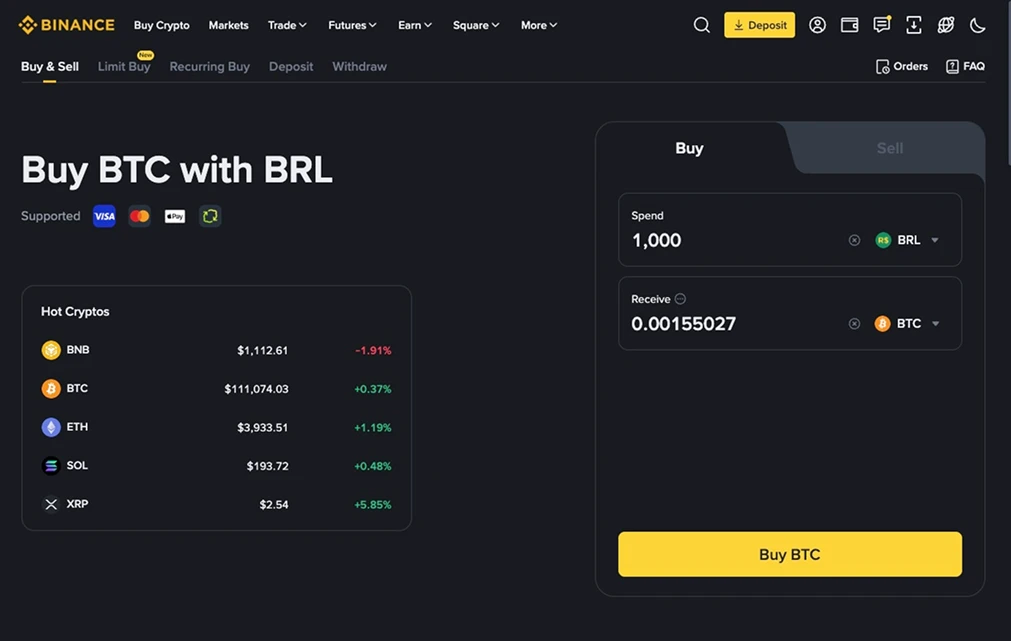

5. Binance - Good Option for Institutions

Binance remains the world’s largest cryptocurrency exchange, trusted by more than 290 million users worldwide and managing over $185 billion in customer assets. It leads both in user adoption and liquidity in Brazil and across South America, handling more than $134 billion in 24-hour trading volume.

Its diverse product lineup includes Spot, Margin, Futures, and Options trading, as well as Binance Earn, Auto-Invest, Launchpool, and the NFT marketplace. Institutions benefit from Binance Institutional, which provides access to OTC liquidity, advanced APIs, and sub-account management.

Binance’s security infrastructure sets the standard in the industry. The SAFU Fund holds over $1 billion USDC to protect customers in rare emergencies. The exchange has been recognized as one of the world’s most trusted crypto platforms, emphasizing transparency through regular Proof-of-Reserves audits.

Platform Highlights:

- Fees: From 0.1% on spot trades; reduced further when paying with BNB.

- Supported Assets: 500+ cryptocurrencies.

- Regulation & Licensing: Binance obtained approval from the Brazilian Central Bank and operates under Simpaul Corretora de Cambio e Valores Mobiliários S.A.

- BRL Deposit Methods: PIX, bank transfer, debit/credit cards, Apple Pay, Google Pay.

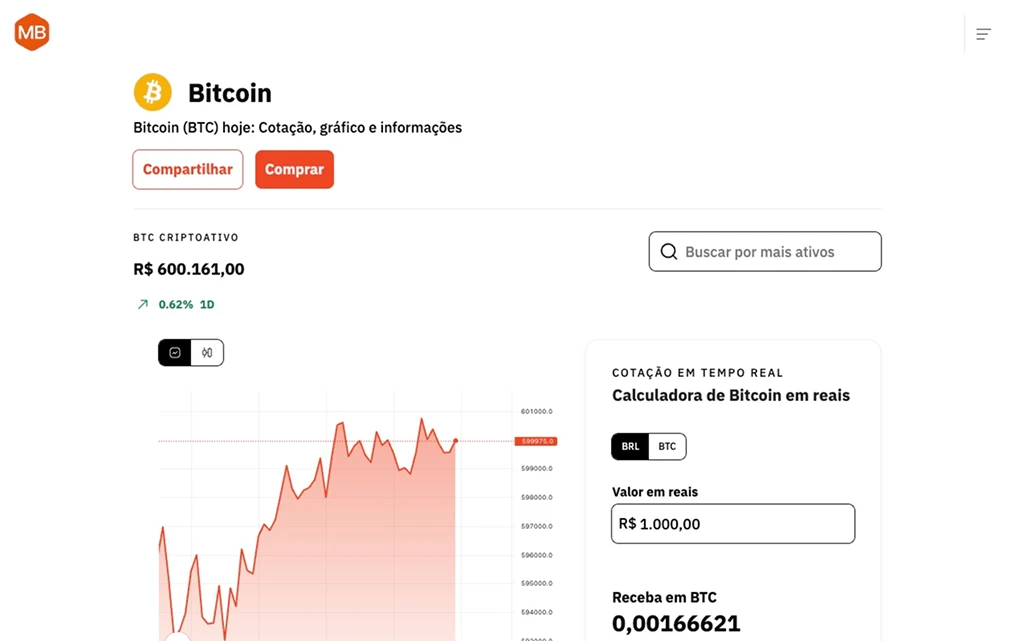

6. Mercado Bitcoin - Top Brazilian Platform

Mercado Bitcoin is Brazil’s largest digital asset exchange, trusted by more than 4 million users since its launch in 2013. Headquartered in São Paulo, it is recognized as Latin America’s leading crypto platform and supports over 650 digital assets for spot trading and staking.

The platform offers far more than cryptocurrency trading. Mercado Bitcoin provides a diversified suite of investment products, including Renda Fixa Digital (tokenized fixed-income securities), Renda Variável Digital (equity-linked digital assets), and Renda Passiva, which allows users to earn yield.

Regulated under Brazil’s Virtual Asset Providers Law (Law No. 14.478/2022), Mercado Bitcoin operates with full AML/KYC compliance and holds an outstanding reputation for safety and transparency—it’s ranked as the highest-rated crypto company on Reclame Aqui for customer satisfaction.

Platform Highlights:

- Fees: Starting from 0.3% per trade.

- Supported Assets: 650+ cryptocurrencies.

- Regulation & Licensing: Registered under the Central Bank of Brazil and CVM frameworks.

- BRL Deposit Methods: PIX, local bank transfers, MB Pay balance, debit/credit cards.

Is Crypto Regulated in Brazil?

Cryptocurrency is fully legal in Brazil and regulated under Law No. 14.478/2022, known as the Virtual Asset Providers Law. While crypto is not recognized as legal tender, individuals and institutions are free to buy, sell, and trade digital assets under a clear national framework.

Oversight is shared between the Central Bank of Brazil (BCB), which supervises Virtual Asset Service Providers (VASPs), and the Securities and Exchange Commission of Brazil (CVM), which regulates tokens classified as securities.

Since 2023, Brazil’s regulatory landscape has evolved to align with international standards on Anti-Money Laundering (AML), Know Your Customer (KYC), and consumer protection. VASPs must obtain authorization from the Central Bank, maintain transparent governance, and report suspicious transactions to the Council for Financial Activities Control (COAF).

💡 Regulation Timeline in Brazil

- 2019 – 2021: Initial legislative discussions on defining crypto assets and preventing financial crimes.

- 2022: Approval of the Virtual Asset Providers Law by Congress, establishing the foundation for national regulation.

- 2023: Law No. 14.478/2022 takes effect, formally recognizing digital assets and VASPs under federal oversight.

- 2024: The Central Bank assumes full supervisory authority over crypto service providers.

- 2025 – 2026: Implementation of new technical standards for stablecoins, custody, and risk management.

Brazil’s balanced approach offers clarity, investor protection, and innovation potential. With structured licensing and robust oversight, the country has positioned itself as Latin America’s regulatory leader in the digital asset economy.

How is Crypto Taxed in Brazil?

In Brazil, cryptocurrency taxation has undergone a significant transformation, especially as of June 2025, with the enactment of Provisional Measure No. 1303. Under the updated framework by the Federal Revenue Service (RFB), all capital gains from digital-asset transactions are subject to a flat 17.5% tax rate.

Previously, individual trades under BRL 35,000 per month were tax-exempt and gains above that were taxed progressively (15% up to ~BRL 5 million and up to 22.5% beyond). Losses can be carried forward to offset gains for up to five prior quarters, though this window is anticipated to be shortened in 2026.

This revised tax structure reflects the government’s priority on enhancing transparency, aligning digital-asset oversight with traditional finance, and closing offshore and self-custody loopholes. For investors in Brazil, maintaining comprehensive documentation of acquisition costs, disposal dates, and fair-market values is now essential to ensure compliance and accurate tax treatment.

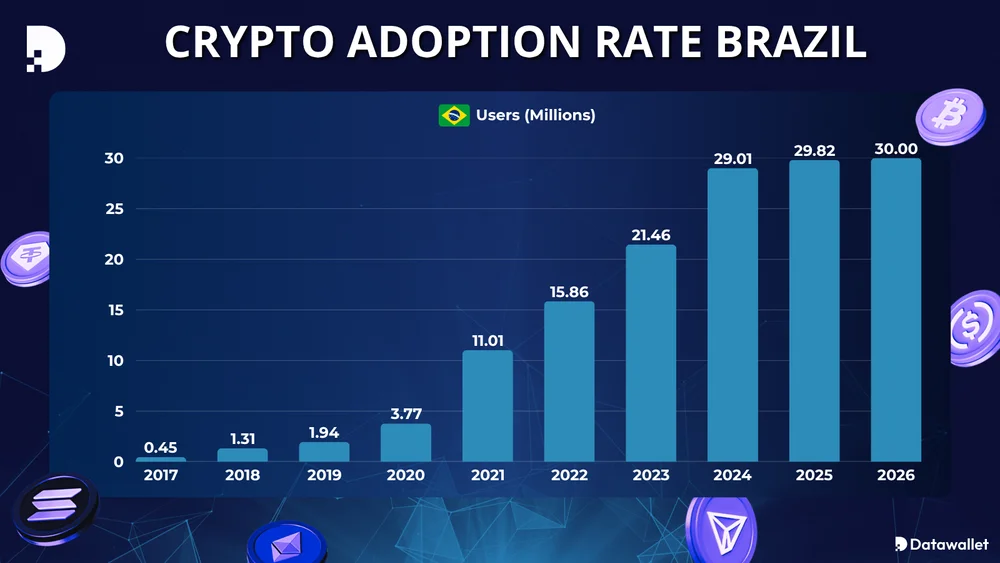

Cryptocurrency Adoption in Brazil

Brazil’s cryptocurrency market is experiencing rapid growth, underpinned by strong fintech integration, regulatory clarity, and rising investor participation. According to Statista Market Insights, Brazil’s crypto market is projected to generate US$2.8 billion in revenue by the end of 2025.

The number of crypto users in Brazil is predicted to surge to 30 million by 2026, up from an estimated 13.82% penetration rate in 2025 to 14.05% in 2026, signaling broad public acceptance. This trend is fueled by a combination of inflation-driven demand, fintech-enabled access through apps like Nubank, and government oversight.

Brazil Adoption Snapshot (2025 – 2026)

- Users: 30 million projected by 2026

- Revenue: US $2.8 billion (2025) → US $3.0 billion (2026)

- Global Context: Brazil ranks among the top five countries for crypto adoption, outpacing most markets in user growth and engagement.

How to Buy Bitcoin in Brazil

The safest way to buy Bitcoin (BTC) in Brazil is through exchanges authorized by the Central Bank of Brazil (BCB) or regulated by global authorities. Here’s a clear step-by-step guide for Brazilian investors:

- Choose a Regulated Exchange: Select a licensed exchange that supports deposits in Brazilian real (BRL) and complies with national crypto regulations. Look for platforms that publish Proof-of-Reserves, offer robust security, and maintain competitive trading fees.

- Create and Verify Your Account: Register using your email or mobile number, then complete identity verification using a government-issued ID such as your CPF (Cadastro de Pessoas Físicas) or passport. This process is mandatory under Brazil’s AML laws.

- Deposit Funds: Add funds to your account through secure payment options like PIX, bank transfers, or credit and debit cards. PIX is the fastest and most popular method, offering instant deposits 24/7.

- Buy Bitcoin (BTC): Navigate to the BTC/BRL trading pair, enter the amount you wish to buy, and confirm your transaction. Your Bitcoin will appear in your exchange wallet within seconds.

- Secure Your Bitcoin: For long-term safety, transfer your BTC to a private wallet. Hardware wallets such as Ledger or Trezor offer offline protection, while trusted mobile wallets are ideal for everyday use.

Following these steps ensures compliance with Brazil’s crypto regulations while giving investors a reliable, efficient, and transparent way to buy and store Bitcoin.

Final Thoughts

Brazil offers a clear, regulated path for crypto investing, and your job is to match the exchange to your goal. Choose platforms registered under Brazil’s VASP rules that publish Proof-of-Reserves and support PIX for low-cost BRL funding.

Use Bybit or OKX for advanced trading tools, Gate for a diverse asset selection, Binance for deep liquidity and institutional features, MEXC for high-leverage futures, and Mercado Bitcoin for a local, BRL-first option. Enable two-factor authentication, consider self-custody for long-term holdings, and keep thorough records for tax reporting.

Frequently asked questions

Which crypto exchanges in Brazil support staking and passive income options?

Several regulated platforms in Brazil offer staking and yield services. Bybit, KuCoin, and OKX provide flexible and fixed-term staking products, while Mercado Bitcoin offers “Renda Passiva,” allowing users to earn returns on selected assets directly in BRL.

Are there any fees when depositing or withdrawing crypto in Brazil?

Most exchanges waive BRL deposit fees for PIX transfers but charge small network fees for crypto withdrawals. Binance, Bybit, and Gate generally offer free BRL deposits and variable withdrawal costs depending on network congestion.

What documents are required for KYC verification on Brazilian exchanges?

Brazilian users typically need a valid government-issued ID (such as CPF or passport) and proof of address. Exchanges regulated under the Central Bank’s VASP framework, including Bybit and Mercado Bitcoin, require identity verification to comply with AML laws.

Can foreigners trade crypto on Brazilian exchanges?

Yes, non-residents can open accounts on most global platforms operating in Brazil, such as Binance, OKX, and MEXC. However, they must complete international KYC verification and may face limits on BRL deposits unless they hold a local banking relationship.

Written by

Tony Kreng

Lead Editor

Tony Kreng, who holds an MBA in Business & Finance, brings over a decade of experience as a financial analyst. At Datawallet, he serves as the lead content editor and fact-checker, dedicated to maintaining the accuracy and trustworthiness of our insights.

.webp)

.webp)