6 Best Crypto Exchanges in Malta

.webp)

Malta’s status as a global leader in digital finance remains strong in 2026, making it important for every investor to choose a compliant cryptocurrency exchange.

The top-rated platforms currently serving the Maltese market distinguish themselves by offering deep liquidity, rigorous security protocols, and full adherence to the European Union’s Markets in Crypto-Assets (MiCA) regulation.

This overview identifies the premier exchanges based on their reliability and features, ensuring that traders can find a secure home for their digital assets on the Mediterranean's Blockchain Island.

Top Picks: Best Platforms for 2026

eToro is the best crypto exchange in Malta as it provides multiple asset classes, diverse Euro deposit methods and multilingual customer support.

Licenses

MFSA & MiCA Licensed in Malta

Available Assets

6,000 Cryptocurrencies, Stocks, ETFs & More

EUR Deposit Methods

Bank Transfer, SEPA, Cards & More

Compare Top Maltese Crypto Exchanges

Exchange |

Trust Score |

Cryptos |

Trading Fees |

EUR Deposit Methods |

Key Features |

|---|---|---|---|---|---|

| eToro |

4.9/5

|

6,000+ |

1% (Spread) |

SEPA, PayPal, Cards, Neteller |

Copy Trading, MTCA Tax Tools, Multi-Asset |

| Kraken |

4.8/5

|

250+ |

0.16% Maker |

SEPA Instant, Cards, Wire |

OTC Desk, Kraken Pro, Staking, 1:1 Reserves |

| Bybit |

4.8/5

|

2,400+ |

0.1% |

SEPA, Zen, Advcash, Apple/Google Pay |

Spot, Margin, Bybit Card, Copy Trading |

| Binance |

4.8/5

|

350+ |

0.1% |

SEPA, SEPA Instant, Cards, P2P |

Spot, Futures, Copy Trading, BNB Discounts |

| Uphold |

4.6/5

|

300+ |

Variable Spread |

SEPA (Free), Cards, Google/Apple Pay |

Anything-to-Anything, Precious Metals, AutoPilot |

| Gate |

4.5/5

|

4,200+ |

0.1% |

SEPA, Cards, Apple Pay |

Startup Launchpad, Altcoin Selection, Gate Card |

1. eToro

eToro is the premier choice for cryptocurrency investors in Malta. Managed locally through its MiCA-authorized subsidiary, eToro (Europe) Ltd, the platform allows Maltese residents to manage Bitcoin and other cryptocurrencies alongside stocks and ETFs within a single platform.

The primary reason for eToro's dominance in Malta is its CopyTrader technology. In a market where many investors are transitioning from traditional savings to digital assets, eToro allows users to automatically replicate the trades of top-performing crypto investors in real-time.

Furthermore, eToro’s localized compliance with the MTCA makes it highly practical. Following the 2026 implementation of DAC8 and CARF, eToro provides automated tax reporting tools specifically designed for the Maltese fiscal year, ensuring that residents remain fully compliant.

Pros

- eToro is fully MiCA-compliant and operates under a license passported into Malta, ensuring the highest EU standards for fraud prevention to protect your assets.

- Maltese users can deposit Euros via SEPA, SEPA Instant, PayPal, credit card, debit card, and Neteller.

- Unlike "crypto-only" exchanges, eToro allows you to diversify your portfolio by holding Bitcoin, Ethereum, and over 100 other tokens, plus international stocks and ETFs.

Cons

- Since eToro operates primarily in USD, Maltese investors depositing in Euros (EUR) will encounter a conversion fee unless they use a specialized multi-currency account.

- There is a flat $5 (approx. €4.60) fee for every cash withdrawal, which can be disproportionately high for smaller retail investors making frequent transfers.

- eToro charges a transparent 1% spread on crypto buys and sells. While simple, this can be more expensive than the "maker/taker" fees found on high-volume professional exchanges like Binance.

2. Kraken

Kraken has distinguished itself not just as a retail exchange, but as the premier institutional trading platform for Maltese companies. By leveraging the full activation of the MiCA regulation, it provides a secure, compliant bridge for local hedge funds, family offices, and corporate treasuries.

Its dominance in the institutional sector is driven by its Kraken Institutional platform, a dedicated interface designed for professional fiduciaries that provides white-glove service. While many platforms focus on social features, Kraken prioritizes liquidity, security, and regulatory compliance.

Kraken’s OTC (Over-the-Counter) desk allows Maltese institutional clients to execute multi-million euro trades without causing slippage. Additional features include spot and futures trading, margin trading, xStocks trading, staking, and access to DeFi via the Ink platform.

Pros

- Kraken is one of the oldest exchanges globally and has never been hacked. Its commitment to Proof of Reserves allows Maltese users to verify their holdings on-chain at any time.

- For active traders in Malta, Kraken Pro offers some of the lowest maker/taker fees in the industry (starting as low as 0% for high-volume accounts).

- Kraken’s integration with the SEPA Instant network ensures that Maltese investors can move Euros from local banks to the platform in near real-time.

Cons

- To maintain its high regulatory status with the MFSA and MiCA, Kraken’s verification process for corporate accounts is exhaustive. Maltese firms should prepare for a rigorous documentation phase that can take several days.

- While Kraken Pro is powerful, it can be intimidating for casual investors. The "Instant Buy" alternative, while simpler, carries significantly higher fees (approx. 1%) compared to the Pro interface.

- Compared to some smaller exchanges, Kraken maintains relatively high withdrawal minimums and fixed network fees for certain assets, which may be a drawback for retail users looking to move small amounts to personal wallets.

3. Bybit

Bybit is a powerhouse for Maltese investors, particularly those who prioritize flexibility in funding their accounts. While the platform is globally recognized for its high-performance trading engine and deep liquidity, its primary appeal in Malta today lies in its diverse Euro deposit ecosystem.

The defining characteristic of Bybit is the diverse Euro funding methods. The platform offers Maltese users multiple ways to deposit EUR, including SEPA, Zen.com, Advcash, Apple Pay, Google Pay, Klarna, Samsung Pay, credit and debit cards, and P2P options like Revolut or Wise.

In addition, Bybit offers spot trading, staking, crypto loans, copy trading, trading bots, and provides the Bybit card, which allows users to spend crypto at any merchant that accepts Mastercard deposits. It is also highly secure, undergoing frequent third-party audits of its reserves.

Pros

- Bybit offers more ways to move Euros than almost any other exchange in Malta.

- For advanced Maltese traders, Bybit offers up to 10x leverage on spot margin, all within a MiCA-aligned environment featuring built-in risk management tools.

- Through the Bybit Card (EU) and Bybit Earn, Maltese users can earn passive income on their Euro balances or receive cashback in crypto for their daily spending at local merchants.

Cons

- While trading fees are very low (0.1% for spot), third-party deposit methods like Apple Pay or card payments may charge convenience fees of 1.5% to 3.5%.

- Bybit is a "feature-rich" platform designed for active traders. Absolute beginners may find the interface overwhelming compared to simpler "broker" apps.

- Due to its MiCA-compliant status, Bybit requires a very rigorous Level 2 KYC for Maltese residents. This includes not just an ID scan, but comprehensive proof of residence and occasionally a "Source of Wealth" declaration for high-volume traders.

4. Binance

Binance continues to dominate the Maltese market as the ultimate destination for active traders. While other platforms focus on social features or simple buy-and-hold strategies, it is built for high-performance execution. It stands out due to its unmatched liquidity and professional interface.

The exchange maintains the deepest order books in the industry, meaning slippage is virtually non-existent. Binance Futures is the global benchmark for crypto derivatives, providing access to perpetual and quarterly contracts settled in both USDT and USDC, along with options trading.

It provides a "one-stop" ecosystem that is technically superior to its competitors. Binance offers 350+ cryptocurrencies and hundreds of trading pairs for spot trading. In addition to trading, it provides bot and copy trading, crypto loans, staking and an NFT marketplace.

Pros

- Binance offers some of the lowest fees in Malta. Spot trading fees start at just 0.1%, and users can further reduce these by 25% if they pay using BNB (Binance Coin).

- The platform has successfully integrated the MiCA requirements, allowing it to offer regulated services to the European Economic Area with transparency.

- Thanks to full SEPA and SEPA Instant support, Maltese residents can deposit and withdraw Euros in near real-time, often for a flat fee as low as €1.

Cons

- Binance’s Pro interface is designed for experts. Beginners in Malta may find the density of charts, order types, and technical data overwhelming, though the "Binance Lite" mode provides a simplified alternative.

- It does not provide a Maltese user interface or customer support.

- The sheer volume of "Earn" products, Launchpads, and NFT marketplaces can lead to "feature fatigue," making it difficult for some users to navigate the platform without a clear strategy.

5. Uphold

Uphold is the most accessible entryway for cryptocurrency beginners in Malta. While pro traders often gravitate toward the complex interfaces of Binance or Kraken, Uphold caters specifically to the "first-time" investor by offering a streamlined, simple and intuitive user experience.

Most exchanges require beginners to execute multiple trades to move from one asset class to another (e.g., selling Gold to buy BTC). Its unique architecture allows for one-step conversions between over 300+ cryptocurrencies, fiat currencies (such as EUR), and commodities.

As Malta fully embraces the MiCA standards, Uphold operates with a level of transparency that resonates with risk-averse newcomers. Its commitment to a 100% Reserve Model, where every coin is backed 1:1, sets it apart in a post-regulation landscape where trust is important.

Pros

- Uphold is one of the few platforms that provides a real-time, public "Proof of Reserves." Maltese investors can verify at any moment that the exchange holds all customer assets 1:1.

- It is the only major platform in Malta where you can hedge your crypto holdings with physical assets like Gold, Silver, and Platinum within the same wallet.

- Maltese residents can fund their accounts using SEPA and SEPA Instant without any deposit fees, making it highly affordable for those starting with small amounts.

Cons

- Instead of a fixed commission, Uphold uses a "spread" model. While transparent, the cost for buying smaller, less-liquid altcoins can be higher (often 1.9% to 2.95%) compared to the maker/taker fees on pro exchanges.

- For users who grow beyond the beginner stage, Uphold’s charting tools are basic. It lacks the technical indicators and drawing tools required for sophisticated day trading.

- Using a card for "Instant Buys" in Malta carries a steep 3.99% fee. Beginners are strongly encouraged to use the free SEPA bank transfer method instead.

6. Gate

Gate is the top option for Maltese investors seeking the broadest possible exposure to the cryptocurrency market. While most exchanges offer a list of a few hundred tokens, Gate has surpassed this by providing access to over 4,200+ assets and thousands of trading pairs.

For the Maltese "gem hunter" or the sophisticated diversifier, the platform serves as a critical bridge. Its subsidiary, Gate Europe, secured a MiCA license from the MFSA in late 2025, ensuring that its massive catalog is available within a fully compliant, regulated framework.

The primary draw is its listing strategy. In 2026, it is often the first centralized exchange to list emerging projects from the DeFi, AI, and Gaming sectors long before they reach larger platforms. Additionally, the startup platform allows users to participate in initial offerings of new tokens.

Pros

- With 4,200+ assets, Gate offers more than double the selection of its nearest competitors in Malta.

- Unlike its early years, the 2026 version of Gate (Gate Europe) is a regulated entity. This gives Maltese residents legal recourse and the peace of mind that the platform adheres to strict EU consumer protection laws.

- Gate.io uses a tiered VIP system. By holding the native GateToken (GT), traders can lower their trading fees, with some high-volume tiers reaching near-zero costs.

Cons

- The sheer volume of features, including liquidity mining, dual investment, and slot auctions, creates a steep learning curve.

- While "Major" pairs (like BTC/EUR) have deep liquidity, many of the 4,000+ long-tail altcoins have thinner order books. Maltese investors trading large amounts of niche tokens may experience slippage if they use market orders.

- To comply with Maltese and EU regulations, Gate requires a very thorough KYC process.

How to Choose a Crypto Exchange in Malta

The process for selecting a cryptocurrency exchange in Malta has evolved into a sophisticated exercise in regulatory verification. Following the full integration of the EU’s MiCA regulation, the country has replaced its transitional VFA regime with an institutional-grade framework.

To protect your capital and ensure long-term compliance, use this expert guide for vetting a Maltese exchange.

Step 1: Confirm MFSA Authorization and MiCA Status

As of July 1, 2026, the period for old VFA licenses has officially ended. Any platform operating in Malta must now hold a full Crypto-Asset Service Provider (CASP) license.

- The Financial Services Register: Never take an exchange's word for it. Visit the Malta Financial Services Authority (MFSA) website and use their public Financial Services Register to verify the entity’s name.

- Regulatory Substance: A valid license ensures the exchange maintains a physical presence in Malta with at least two resident executive directors, providing a "mind and management" layer that protects local users.

Step 2: Verify EUR Deposit Options

A primary advantage of using a European exchange is the ease of moving Euros. However, not all platforms have optimized their local banking relationships.

- SEPA Instant Integration: Prioritize exchanges that offer 24/7 SEPA Instant deposits. This allows for near-instant transfers from local institutions like Bank of Valletta (BOV) or HSBC Malta.

- Asset Segregation: Under MFSA rules, customer funds must be kept in segregated accounts at reputable credit institutions, separate from the exchange’s operational capital. Verify that the exchange uses "safeguarding accounts" with recognized EU banks.

Step 3: Assess Security and Reserve Status

Security in 2026 is governed by the Digital Operational Resilience Act (DORA). Licensed Maltese exchanges must prove they can withstand sophisticated cyber-threats.

- Proof of Reserves (PoR): High-quality exchanges now provide real-time, Merkle-tree-based Proof of Reserves. This allows you to verify on-chain that the exchange actually holds the Bitcoin or Ethereum it claims to have in its custody.

- Cold Storage Ratios: Ensure the platform maintains at least 95% of user assets in geographically distributed "cold" (offline) storage to mitigate the risk of hot-wallet hacks.

Step 4: Evaluate Transparent Pricing Structures

Avoid platforms that advertise "zero fees," as these often hide costs within wide "spreads" (the difference between the buy and sell price).

- Tiered Maker/Taker Fees: Look for a transparent schedule where "Makers" (those providing liquidity) pay lower fees than "Takers." In the competitive 2026 market, standard entry-level fees should hover around 0.1% to 1%.

- Withdrawal Fair-Play: Check if the exchange charges a flat fee for Euro withdrawals. Competitive platforms typically charge €1 or less for SEPA transfers.

Step 5: Ensure Compatibility with MTCA Reporting

The Malta Tax and Customs Administration (MTCA) has implemented the Crypto-Asset Reporting Framework (CARF) and DAC8. This means your exchange will automatically report your 2026 transaction data to the authorities.

- Automated Tax Exports: Choose an exchange that provides "MTCA-ready" tax reports. These should include aggregated data on your acquisition costs, disposal values, and any income from staking or "Learn & Earn" programs.

- Compliance Tools: Top-tier exchanges integrate with tax software like Koinly or Blockpit, allowing you to generate a localized Maltese tax return in minutes.

Crypto & Bitcoin Regulation in Malta

In 2026, Malta has become a premier European crypto hub by fully transitioning from its local Virtual Financial Assets Act to the EU’s Markets in Crypto-Assets (MiCA) regulation.

This shift ensures that all Maltese service providers benefit from "passporting" rights across the Eurozone, provided they meet rigorous operational standards.

As of July 1, 2026, the transitional "grandfathering" period for former VFA license holders has ended. All platforms must now hold a full Crypto-Asset Service Provider (CASP) license to operate legally.

Key Regulatory Authorities

Two main bodies oversee the integrity of the Maltese crypto market:

- Malta Financial Services Authority (MFSA): As the lead supervisor, the MFSA handles the licensing and ongoing monitoring of all CASPs. Their oversight focuses on capital adequacy, governance, and the protection of client assets.

- Financial Intelligence Analysis Unit (FIAU): This body enforces strict Anti-Money Laundering (AML) and Counter-Terrorist Financing (CTF) protocols. All exchanges and custodians must perform rigorous Know Your Customer (KYC) checks and report suspicious transactions.

This streamlined framework provides investors with world-class security while offering businesses a clear, compliant path for scaling within the Mediterranean's most advanced digital economy.

How Does MTCA Tax Crypto?

Malta’s cryptocurrency tax framework in 2026 has integrated new EU-wide transparency mandates. Taxation is primarily determined by the asset's classification and the investor's intent, distinguishing clearly between personal wealth management and professional trading activity.

Individual Tax

For individual residents, Malta remains a favorable jurisdiction for long-term holders:

- Capital Gains: Profits from selling "coins" (like Bitcoin or Ethereum) as a long-term store of value are generally exempt from capital gains tax.

- Trading Income: If your activity is frequent or high-volume, the Malta Tax and Customs Administration (MTCA) classifies it as "trading income." This is subject to progressive income tax rates for 2026, ranging from 0% to 35%.

Corporate Tax

Malta remains a top choice for crypto businesses due to its competitive corporate structure:

- Standard Rate: Companies are subject to a flat 35% tax on global income.

- Refund System: Under the full imputation system, shareholders can typically claim a 6/7ths refund upon dividend distribution, effectively reducing the tax burden on trading profits to 5%. Note that large multinationals (revenues >€750m) are now subject to the 15% minimum tax under Pillar Two rules.

This structured approach by the MTCA ensures that while Malta remains "The Blockchain Island," it fully aligns with the latest European standards for fiscal transparency and anti-evasion.

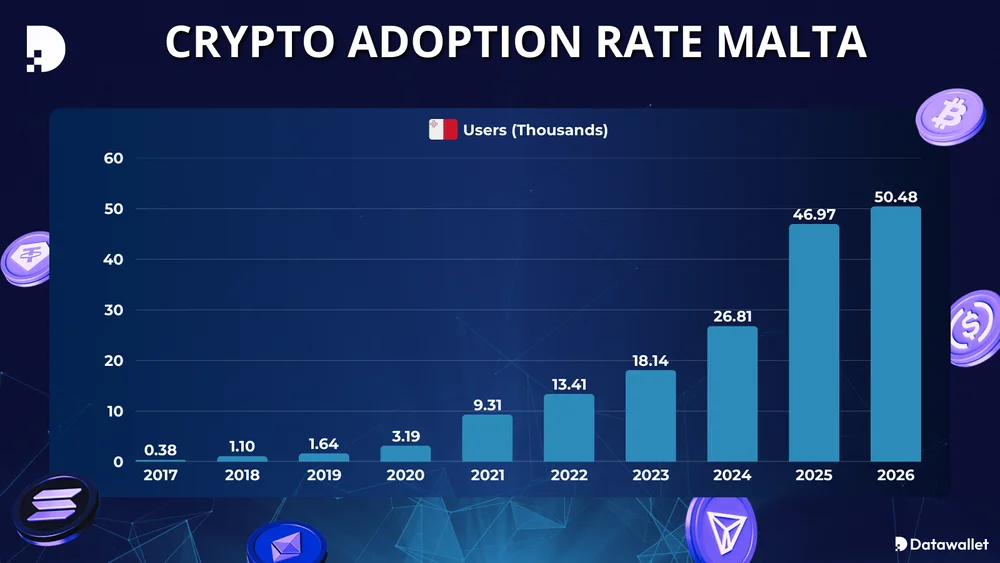

Cryptocurrency Adoption in Malta

Malta has built a reputation as a premier global hub for digital assets, with 2026 marking a period of steady growth. As the "Blockchain Island" moves deeper into the decade, the synergy between a supportive regulatory framework and increasing public interest has created a stable crypto market.

The financial trajectory of Malta's cryptocurrency sector remains positive. Following a strong performance in 2025, revenue reached US$638,000. This steady climb is expected to bring the total market revenue to US$659,700 by the end of 2026, according to Statista Market Insights.

User Adoption

Crypto adoption in Malta is characterized by widespread accessibility and a growing participant base.

- Total User Count: By the close of 2026, the number of active cryptocurrency users in Malta is expected to reach 50,480.

- Penetration Growth: User penetration is on a clear upward trend. After reaching 8.56% in 2025, the percentage of the population engaging with digital assets is forecasted to hit 9.20% in 2026.

How to Buy Bitcoin in Malta

Malta has successfully modernized its digital asset framework by fully integrating the EU’s MiCA regulation. For those looking to enter the market in 2026, the process is governed by the MFSA, ensuring a high level of transparency and consumer protection.

Below is a detailed guide to acquiring Bitcoin (BTC) in Malta using compliant methods.

- Select an MFSA-Regulated Exchange: The first step is to choose a CASP that is authorized to operate within the Maltese jurisdiction. Reputable options for Maltese residents include global leaders like eToro, Bybit, OKX, and Kraken.

- Complete Identity Verification (KYC): To combat financial crime, the MFSA requires all service providers to implement rigorous Know Your Customer (KYC) procedures. This requires submitting a Maltese e-ID or passport when opening an exchange account.

- Fund Your Account with Euros (EUR): Residents can deposit Euros from Maltese banks, such as Bank of Valletta (BOV) or HSBC Malta, via SEPA, card payments, or mobile wallets like Apple Pay and Google Pay.

- Execute Your Bitcoin Trade: Once your Euro balance is confirmed by the exchange, you can proceed to the market interface. Most platforms offer instant buy or spot trading.

For long-term holdings, it is best practice to transfer your Bitcoin to a hardware wallet. By managing your own private keys, you remove the "third-party risk" associated with keeping funds on an exchange, ensuring that your digital assets remain entirely under your control.

Final Thoughts

Malta’s transition to a fully MiCA-compliant ecosystem in 2026 has transformed the Blockchain Island into a secure institutional-grade environment for digital assets.

Whether you prioritize eToro’s social features, Binance’s deep derivatives liquidity, or Uphold’s simplicity, your primary focus should remain on verified MFSA authorization and robust Proof of Reserves.

As a next step, cross-reference your preferred platform against the Financial Services Register and ensure your local bank supports SEPA Instant to take full advantage of Malta’s efficient financial infrastructure.

Frequently asked questions

Are crypto-to-crypto trades taxable under the MTCA in 2026?

The MTCA generally treats crypto-to-crypto swaps (e.g., trading BTC for ETH) as non-taxable events for casual investors, provided the assets are held as a long-term store of value. However, if you are classified as a professional trader, these trades may be viewed as business income and subject to income tax rates ranging from 0% to 35%.

What is the 100% Reserve Model, and why is it important for security?

Under 2026 regulations, top exchanges like Uphold and Kraken utilize a 1:1 Reserve Model. This means the exchange does not lend out your deposits to generate profit. Instead, they hold 100% of user assets in reserve, allowing you to withdraw your entire balance at any time, even during periods of extreme market volatility.

Is it legal to use cryptocurrency for everyday purchases in Maltese shops?

Yes, in 2026, cryptocurrency is legally recognized as a medium of exchange in Malta. While adoption is still growing, an increasing number of local merchants accept Bitcoin and stablecoins (USDC/USDT) via integrated point-of-sale systems.

What are the best wallet options for securing large holdings in Malta?

With the implementation of the Digital Operational Resilience Act (DORA), security awareness in Malta is at an all-time high. For long-term "HODLers," hardware wallets like the Ledger Nano Flex or Trezor Safe 5 remain the best options. These devices keep your private keys offline, protecting them from the hot-wallet vulnerabilities of an exchange.

Written by

Antony Bianco

Head of Research

Antony Bianco, co-founder of Datawallet, is a DeFi expert and active member of the Ethereum community who assist in zero-knowledge proof research for layer 2's. With a Master’s in Computer Science, he has made significant contributions to the crypto ecosystem, working with various DAOs on-chain.

.webp)