6 Best Crypto Exchanges in Asia

.webp)

Summary: Asia’s cryptocurrency market is growing rapidly, with regulations varying across regions. Major hubs like Singapore, Hong Kong, and Japan have established clear licensing rules for exchanges, while countries such as Vietnam and Indonesia are experiencing strong retail participation.

Most platforms support local fiat deposits through bank transfers, cards, and regional payment networks. Below are the top exchanges in Asia known for security, transparency, and adherence to local compliance standards.

Bybit is the best cryptocurrency exchange in Asia as it can be accessed from almost every Asian countries and provides a multilingual platform accessible in 18 languages.

Available Markets

2,300+ Cryptocurrencies

Trading Fees

0.1% Spot Trading Fees

Deposit Currencies

JPY, THB, SGD, MYR, IDR, PHP

Top Crypto Trading Platforms in Asia

For investors across Asia, selecting a reliable cryptocurrency exchange depends on the platform’s adherence to local financial regulations and global compliance standards such as AML and KYC.

The best exchanges in the region offer access to a vast selection of digital assets, competitive trading fees, and support for multiple fiat currencies, including the Japanese yen (JPY), Singapore dollar (SGD), Indian rupee (INR), and Thai baht (THB). Most platforms also provide multilingual interfaces and regional payment options.

The table below compares Asia’s leading crypto exchanges, detailing their trading fees, supported currencies, available assets, and standout features.

Exchange |

Cryptocurrencies |

Trading Fees |

Deposit Currencies |

Key Features |

|---|---|---|---|---|

| Bybit | 2,300+ |

0.1% |

JPY, SGD, MYR +17 more |

Spot X, Futures, Launchpool, Copy Trading, Staking, Trading Bots |

| MEXC | 2,600+ |

0% Maker / 0.05% Taker |

USD, SGD, INR +14 more |

Spot, Futures, 500x Futures, Launchpool, Airdrops, Staking |

| Binance | 350+ |

0.1% |

JPY, SGD, INR +18 more |

Spot, Futures, Earn, Staking, Copy Trading, Launchpool, NFTs |

| Gate.io | 3,400+ |

0.2% |

JPY, SGD, MYR +15 more |

Spot, Futures, Simple Earn, Liquidity Mining, GT Token, Gate Card |

| KuCoin | 1,000+ |

0.1% |

JPY, HKD, SGD +12 more |

Spot, Futures, Staking, LaunchHub, KuCard, Web3 Wallet |

| OKX | 350+ |

0.08% Maker / 0.1% Taker |

JPY, IDR, SGD +10 more |

Spot, Futures, DeFi Apps, OKX Wallet, Staking, Crypto Loans |

1. Bybit - Best Crypto Exchange in Asia

Bybit is Asia’s most trusted crypto exchange, built for traders who value reliability, liquidity, and choice. Its trading engine delivers unmatched execution speed, offering spot, margin, and futures markets with leverage up to 200x, along with perpetual and options contracts settled in USDT or USDC.

Beyond trading, Bybit has built a full digital finance ecosystem. Bybit Earn offers flexible and fixed savings options, with up to 555% APR on select products. Features like Spot X, Launchpool, and Token Splash allow users to participate in new project launches and token reward events.

Bybit operates with strong transparency and regulatory alignment, holding multiple global licenses while adhering to international AML/KYC standards. The platform supports fiat deposits in JPY, SGD, MYR, THB, IDR, and PHP, plus provides a multilingual user interface accessible in 15 languages.

Platform Highlights:

- Fees: 0.1% spot, 0.01% maker / 0.06% taker on derivatives.

- Supported Assets: 2,300+ cryptocurrencies.

- Regulation & Licensing: Licensed in Malaysia, Hong Kong, Kazakhstan – compliant with global AML/KYC standards.

- Deposit Currencies: JPY, TWD, HKD, MOP, IDR, MYR, PHP, SGD, VND, MMK, BND, INR, PKR, BDT, LKR, NPR, BTN, MVR, KZT, TMT, KGS, TJS.

2. MEXC - Trade Futures with 500x Leverage

MEXC has earned a reputation across Asia for delivering institutional-level trading performance and offering up to 500x leverage. Founded in 2018, the exchange now serves over 10 million users worldwide, offering a deep liquidity pool and advanced order execution across 2,697 spot pairs and 831 futures pairs.

Beyond trading, MEXC provides a full ecosystem of earning and event-driven opportunities. Users can participate in Launchpools, Kickstarter airdrops, and Blue Chip Blitz events with rewards reaching up to 1,000% APR. Its native token, MX Token, unlocks fee discounts and exclusive airdrop access.

The exchange also backs all user assets 1:1 through publicly verifiable proof-of-reserves, reinforcing its commitment to security and transparency. MEXC supports fiat deposits in USD, SGD, INR, KRW, THB, and PHP through direct bank transfers, cards, local payment methods, and P2P payments.

Platform Highlights:

- Fees: 0% maker / 0.02% taker on futures; 0% maker / 0.05% taker on spot.

- Supported Assets: 2,600+ cryptocurrencies.

- Regulation & Licensing: Holds a license in Japan and other Tier-1 countries, complies with global AML standards.

- Deposit Currencies: JPY, TWD, HKD, MOP, IDR, MYR, PHP, VND, BND, INR, PKR, BDT, LKR, NPR, MVR, KZT, TMT, KGS, TJS.

3. Binance - Largest Crypto Exchange Globally

Binance remains the world’s largest exchange, with over 296 million verified users and more than $181 billion in customer assets under management. Established in 2017, it processes a staggering $99 billion in daily trading volume, giving it unmatched liquidity across spot, margin, and futures markets.

The platform provides a full suite of digital asset products. Binance Earn allows users to generate passive income through flexible savings, staking, and auto-invest features. Binance Launchpool, Megadrop, and Alpha Airdrops give investors early access to new token launches and exclusive listings.

Its global reach extends across Asia, with regional support in countries like Japan, Singapore, South Korea, and India. It holds multiple international licenses and aligns with FATF and local regulatory standards. The platform supports deposits in JPY, SGD, INR, KRW, THB, PHP, and IDR.

Platform Highlights:

- Fees: From 0.1% on spot; 0.02% maker / 0.04% taker on futures.

- Supported Assets: 350+ cryptocurrencies.

- Regulation & Licensing: Licensed in multiple Asian jurisdictions; adheres to global AML and KYC standards.

- Deposit Currencies: CNY, JPY, TWD, HKD, MOP, IDR, MYR, PHP, SGD, THB, VND, KHR, LAK, MMK, BND, INR, PKR, BDT, LKR, NPR, BTN, MVR, KZT, TMT, KGS, TJS.

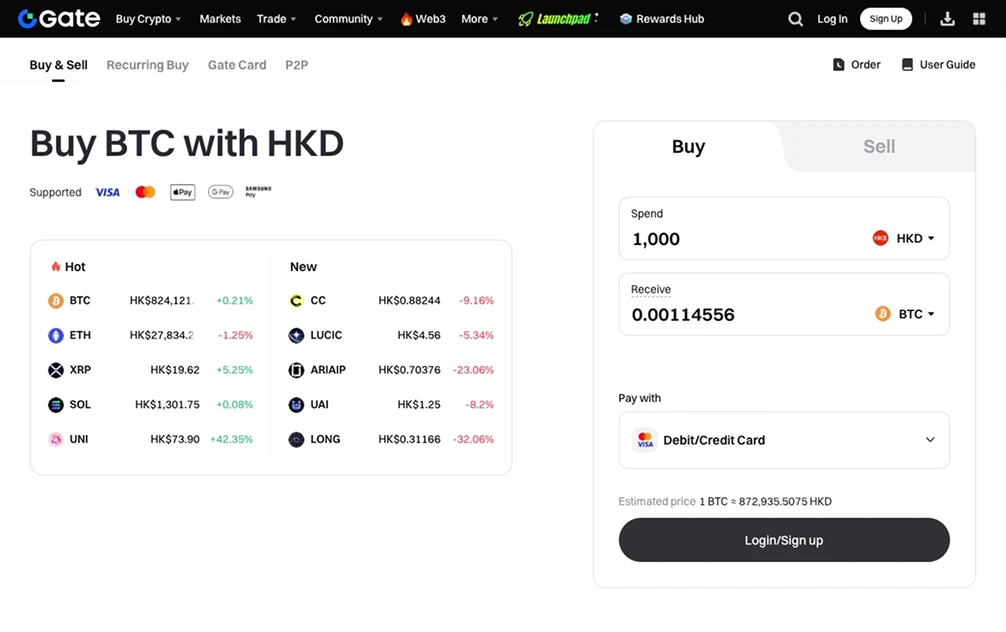

4. Gate - Trade Over 3,500 Cryptocurrencies

Gate has become one of Asia’s most versatile crypto exchanges, known for its massive token selection. Established in 2013, it now boasts over 43 million users worldwide and lists more than 3,400 cryptocurrencies, offering traders access to one of the broadest digital asset markets available.

The exchange extends beyond trading into a complete digital-asset ecosystem. Its Simple Earn program offers flexible staking with average annual returns of 11%, while liquidity mining, structured products, and the GateToken (GT) provide additional earning opportunities and fee reductions.

Gate maintains a 124% total reserve ratio, publicly verifiable through its real-time proof-of-reserves dashboard. It supports deposits in JPY, SGD, MYR, THB, KRW, and IDR, with multiple on-ramp options including local payment methods, bank transfer, cards, and P2P services.

Platform Highlights:

- Fees: 0.2% spot trading fee; reduced with GT token holdings.

- Supported Assets: 3,400+ cryptocurrencies.

- Regulation & Licensing: Licensed across Asia and fully compliant with AML and financial regulations.

- Deposit Currencies: JPY, TWD, HKD, MOP, IDR, MYR, PHP, VND, KHR, LAK, MMK, BND, INR, BDT, LKR, NPR, BTN, MVR, KZT, TMT, KGS, TJS.

5. KuCoin - Access High Crypto Staking Rewards

KuCoin offers access to over 1,000 digital assets and serves a community of 40 million users. Known for deep liquidity and ultra-low latency execution, KuCoin supports spot, margin, futures, and ETF trading, alongside zero-fee conversions for seamless swaps between major assets.

What sets KuCoin apart is its robust ecosystem that blends CeFi and Web3. Through KuCoin Earn, users can access high-yield savings, flexible staking, and lending products. The KuCard system bridges crypto and traditional finance, while LaunchHub introduces early access to promising projects.

The platform’s Proof of Reserves system guarantees all customer assets are backed 1:1, and its 24/7 multilingual support ensures accessibility for Asian traders. KuCoin also maintains a secure, non-custodial Web3 Wallet, giving users full control of their assets while connecting to dApps and NFTs.

Platform Highlights:

- Fees: 0.1% on spot; 0.02% maker / 0.06% taker on futures.

- Supported Assets: 1,000+ cryptocurrencies.

- Regulation & Licensing: ISO/IEC 27001, SOC 2 Type II, and PCI DSS certified; full Proof of Reserves transparency.

- Deposit Currencies: JPY, TWD, HKD, IDR, MYR, PHP, SGD, VND, LAK, INR, PKR, BDT, LKR, NPR, KZT, KGS, TJS.

6. OKX - Recommended for DeFi & Web3 Products

OKX is one of Asia’s most advanced digital-asset ecosystems, bridging traditional finance with the fast-moving world of decentralized technology. The exchange delivers a full suite of crypto services, from simple spot and futures trading to institutional-grade liquidity and Web3 integration.

What sets OKX apart is its expanding footprint in DeFi and Web3. The platform’s OKX Wallet connects users to decentralized applications, NFT marketplaces, and yield-earning products. Additionally, the Earn section enables flexible savings, dual investment products, and lending and borrowing services.

Institutional users benefit from an OTC liquidity network, sub-account management, and low-latency APIs. The company also maintains high-profile global partnerships with Manchester City, McLaren Formula 1, and the Tribeca Festival, reflecting its strong brand credibility and mainstream appeal.

Platform Highlights:

- Fees: 0.08% maker / 0.10% taker on spot; 0.02% maker / 0.05% taker on futures.

- Supported Assets: 350+ cryptocurrencies.

- Regulation & Licensing: Licensed under multiple international regulators, including in Hong Kong and Singapore.

- Deposit Currencies: JPY, TWD, HKD, IDR, MYR, PHP, SGD, VND, LAK, INR, PKR, BDT, LKR, NPR, KZT, KGS.

Is Crypto Regulated in Asia?

Cryptocurrency regulation in Asia varies widely, reflecting the region’s contrasting economic systems and policy priorities. Some countries have adopted comprehensive frameworks promoting innovation under supervision, while others maintain restrictive or uncertain environments.

Below is a regional breakdown highlighting where digital assets are fully regulated, partially regulated, or restricted.

Fully Regulated Markets

The following countries lead the region in clear, well-defined cryptocurrency regulation.

- Singapore operates under the Payment Services Act, requiring exchanges to register with the Monetary Authority of Singapore (MAS) and adhere to strict AML and KYC standards.

- Hong Kong introduced a comprehensive licensing regime under the Securities and Futures Commission (SFC), allowing both retail and institutional trading on approved platforms that meet capital and cybersecurity standards.

- Japan was among the first countries to legalize cryptocurrency trading through its Financial Services Agency (FSA), mandating registration, segregation of customer funds, and audits of exchange operations.

- South Korea also falls in this category, with mandatory registration through the Financial Intelligence Unit (FIU), real-name bank account verification, and transparent tax reporting for crypto gains.

Developing and Partially Regulated Markets

The following countries are in various stages of developing or refining crypto regulation.

- India has imposed a 30% capital gains tax and 1% transaction deduction (TDS) on crypto trades, but lacks a comprehensive legal framework. Exchanges operate under financial scrutiny but are not banned.

- Thailand regulates crypto under the SEC and central bank oversight, issuing exchange licenses but recently tightening rules around stablecoins and advertising.

- Vietnam and Indonesia allow trading under supervision, treating crypto as an investment asset rather than legal tender. Both are drafting frameworks to oversee taxation and exchange registration.

- The Philippines permits licensed exchanges under the Bangko Sentral ng Pilipinas (BSP) and supports pilot programs exploring blockchain-based remittances and tokenized assets.

Restrictive and Banned Markets

These countries maintain strict or prohibitive policies toward cryptocurrency.

- China enforces an outright ban on trading, mining, and ICOs, while promoting the state-controlled digital yuan as its alternative.

- Pakistan has announced intentions to regulate but continues to treat crypto trading as an unapproved activity, with frequent warnings from the State Bank.

- Bangladesh bans crypto transactions entirely under its Foreign Exchange Regulation Act, warning citizens against the use or promotion of digital assets.

How is Crypto Taxed in Asia?

Across Asia, taxation of cryptocurrency gains and transactions presents a patchwork of policies that vary significantly between jurisdictions. Countries such as Japan apply high marginal tax rates to crypto profits up to approximately 55%.

Here’s a breakdown of the main types of crypto taxes across the region and the countries that enforce them:

- Capital Gains Tax (CGT) - This tax applies when a person sells or trades cryptocurrency for profit. The gain is calculated as the difference between the purchase price and the selling price. It typically covers activities like converting crypto to fiat, exchanging one token for another, or using crypto to buy goods and services.

- Income Tax - Crypto income earned through mining, staking, airdrops, yield farming, or payment for goods and services is often treated as regular income. The taxable amount is usually based on the fair market value of the crypto at the time it is received.

- Transaction Tax or Value-Added Tax (VAT/GST) - Some jurisdictions apply a small percentage tax on each crypto transaction, similar to VAT or GST. This can apply to exchange service fees, crypto purchases, or the use of digital assets in commercial transactions.

- Withholding Tax (TDS or Final Deduction) - This is a tax automatically deducted at the source when a crypto transaction takes place. It ensures tax compliance by collecting a portion of the transaction value upfront, regardless of whether the trader made a profit or loss.

- Corporate Tax on Crypto Businesses - Companies involved in crypto trading, exchange operations, or blockchain services are subject to regular corporate income tax. Profits earned from fees, trading spreads, or staking services fall under this category.

As a result, any investor or firm operating in Asia should map local tax liabilities (capital gains, income tax, transaction tax), reporting rules, and potential future changes before entering the market.

Cryptocurrency Adoption in Asia

Asia’s cryptocurrency market is expanding rapidly, supported by growing institutional participation, high mobile penetration, and a surge in fintech innovation across key economies.

According to Statista Market Insights, the region’s crypto market revenue is projected to reach US$28.8 billion in 2025, with an expected annual growth rate of 6.49%, bringing total revenue to US$30.7 billion by 2026. Asia’s user base is forecast to reach 322.82 million people by 2026, representing a penetration rate of 9.93% in 2025, increasing to 10.21% in 2026.

This steady climb is being driven by diverse national trends: financial hubs such as Singapore, Hong Kong, and Japan are setting the regional standard with clear licensing regimes, while India, Vietnam, Indonesia, and the Philippines are experiencing strong grassroots adoption supported by affordable trading access and digital payments integration.

Asia Adoption Snapshot (2025 – 2026)

- Revenue: US $28.8 billion (2025) → US $30.7 billion (2026)

- Users: 322.82 million projected by 2026

- Penetration Rate: 9.93% (2025) → 10.21% (2026)

How to Buy Bitcoin in Asia

The safest way to buy Bitcoin (BTC) in Asia is through cryptocurrency exchanges that are licensed and comply with local financial regulations in your country. Below is a step-by-step guide to purchasing Bitcoin securely and in full compliance with Asian regulatory standards:

- Choose a Regulated Exchange: Select a trusted platform that operates legally within your country. Look for exchanges that support local currencies such as JPY, SGD, INR, KRW, or IDR, and hold the required licenses or registrations from financial authorities.

- Create and Verify Your Account: Sign up using your email or mobile number and complete the Know Your Customer (KYC) process. Verification typically requires a valid government-issued ID or passport, along with proof of address in some cases.

- Deposit Funds: Add money to your account through supported payment options, including local bank transfers, debit or credit cards, and regional payment systems such as PayNow, UPI, or FPX.

- Buy Bitcoin (BTC): Go to the BTC/fiat trading pair (e.g., BTC/JPY or BTC/INR), enter the amount you want to purchase, and confirm your transaction. Once completed, your Bitcoin balance will appear in your exchange wallet.

By following these steps, investors across Asia can purchase Bitcoin safely on regulated exchanges that emphasize compliance, transparency, and robust consumer protection measures aligned with global standards.

Final Thoughts

Asia’s cryptocurrency market is entering a mature growth phase driven by clear regulation in key financial hubs and rapid adoption in developing economies. Investors should focus on exchanges that combine regulatory compliance with security, transparent operations, and access to local payment options.

Choosing a licensed platform such as Bybit, Binance, or OKX ensures safer trading and better protection in a market that continues to expand quickly. As policies evolve and participation rises, Asia is poised to remain a leading force in global digital asset innovation.

Frequently asked questions

Which Asian countries have the most crypto-friendly regulations?

Singapore, Hong Kong, and Japan currently lead in establishing transparent crypto frameworks. Their regulatory bodies, such as MAS and the FSA, require exchange licensing, strict AML/KYC standards, and proof-of-reserves systems to ensure investor protection and market stability.

What are the safest payment methods to buy crypto in Asia?

Most investors in Asia use local bank transfers, debit or credit cards, and regional payment networks like PayNow (Singapore), UPI (India), and FPX (Malaysia). Regulated exchanges often support these methods while maintaining compliance with national banking and anti-fraud policies.

How can new investors choose the right crypto exchange in Asia?

When selecting an exchange, prioritize those licensed under local or regional authorities, offering transparent fee structures, multilingual support, and fiat on-ramps in your national currency. Platforms like Bybit, KuCoin, and OKX provide these features while maintaining robust compliance standards.

How do I withdraw funds from a crypto exchange in Asia?

You can withdraw in local currencies such as JPY, SGD, INR, or THB through bank transfers, debit cards, or regional systems like PayNow and UPI. Ensure your chosen exchange supports fiat off-ramping and complies with local financial regulations.

Written by

Tony Kreng

Lead Editor

Tony Kreng, who holds an MBA in Business & Finance, brings over a decade of experience as a financial analyst. At Datawallet, he serves as the lead content editor and fact-checker, dedicated to maintaining the accuracy and trustworthiness of our insights.

.webp)