Crypto Rebounds After Historic Flash Crash Liquidation

GM. Bitcoin rebounded to $113,000 after the weekend’s historic $19.5 billion liquidation, with altcoins mounting sharp recoveries as markets shook off the deepest flash crash in crypto history.

Meanwhile, Trump’s reported consideration of a CZ pardon, a Nobel Prize betting probe tied to Polymarket, and Kalshi’s $300 million raise kept prediction markets in the spotlight.

Volatility’s back, momentum’s heating up… get ready to find out if it'll be Uptober or Octover. 👇

Crypto Rebounds After Historic Flash Crash Liquidation

Bitcoin bounced back to $114,400 by October 12, erasing part of the weekend wipeout as bargain hunters flooded volatile markets. Ethereum recovered near $4,100 while Solana and XRP posted double-digit gains, signaling a rapid V-shaped rebound across leading altcoins.

The turnaround followed the most brutal single-day liquidation in crypto history, which erased $19.5 billion in over-leveraged long positions. Analysts pointed to cascading stop-losses and margin calls as thin liquidity transformed tariff headlines into a full-blown capitulation spiral.

During the crash, BTC fell 15% to $102,000, ETH 18% to $3,373, while SOLa sank 26% and XRP lost 64% intraday. Altcoins, including APT, ARB, and TAO endured catastrophic 80% drawdowns, with ATOM (which wicked to $0.001) briefly printing near-zero ticks on illiquid decentralized exchange order books.

Relief arrived as Bitcoin ETFs inflows topped $2.7 billion and markets priced 98% odds of immediate Federal Reserve cuts. Traders now eye Bitcoin’s $110,000 zone as critical support, with the leveraged purge setting a cleaner backdrop for potential late-year rallies.

Trump Reportedly Considers Pardoning Binance's CZ

White House officials are debating whether President Donald Trump will pardon Binance co-founder Changpeng Zhao, according to Fox News. Sources close to the matter said discussions have intensified as insiders argue the fraud case against Zhao was weak. Supporters believe a pardon could enable Zhao’s return to Binance, though advisers remain wary of political optics.

Zhao previously applied for a presidential pardon following his prison release for failing to maintain anti-money laundering controls. His plea deal included a lifetime ban from leading the exchange, despite retaining majority ownership. Prediction market Kalshi recorded a sharp increase in odds following the reports, reflecting renewed market confidence in his reinstatement prospects.

Polymarket Trades Spark Nobel Prize Investigation

Norwegian authorities are probing potential information leaks after suspicious wagers appeared on Polymarket before the Nobel Peace Prize announcement. Investigators discovered several accounts betting heavily on Venezuelan activist María Corina Machado, who ultimately won the award. The profitable trades disrupted normal market balance and raised concerns about insider access within the selection process.

Officials from the Nobel Institute confirmed an active review but did not specify potential disciplinary actions against implicated traders. The trades generated roughly ninety thousand dollars in combined profits across three newly created wallets. Regulators have previously scrutinized Polymarket for sensitive-event trading, and the platform now faces renewed scrutiny despite its recent US licensing.

Kalshi Raises $300 Million at Valuation of $5 Billion

Prediction market Kalshi secured $300 million in new funding, boosting its valuation to five billion dollars. The company said it will expand services to more than one hundred forty countries following rapid user growth. Investors include Sequoia Capital, Andreessen Horowitz, Paradigm, and Coinbase Ventures, signaling major institutional support for event-based trading.

Kalshi recently overtook Polymarket in global market share, reaching sixty percent of prediction volumes worldwide. The firm aims to integrate with retail trading apps like Robinhood and Webull to broaden accessibility. Executives said the funding underscores confidence in Kalshi’s compliance-first strategy and growing dominance across sports, politics, and financial prediction markets.

Data of the Day

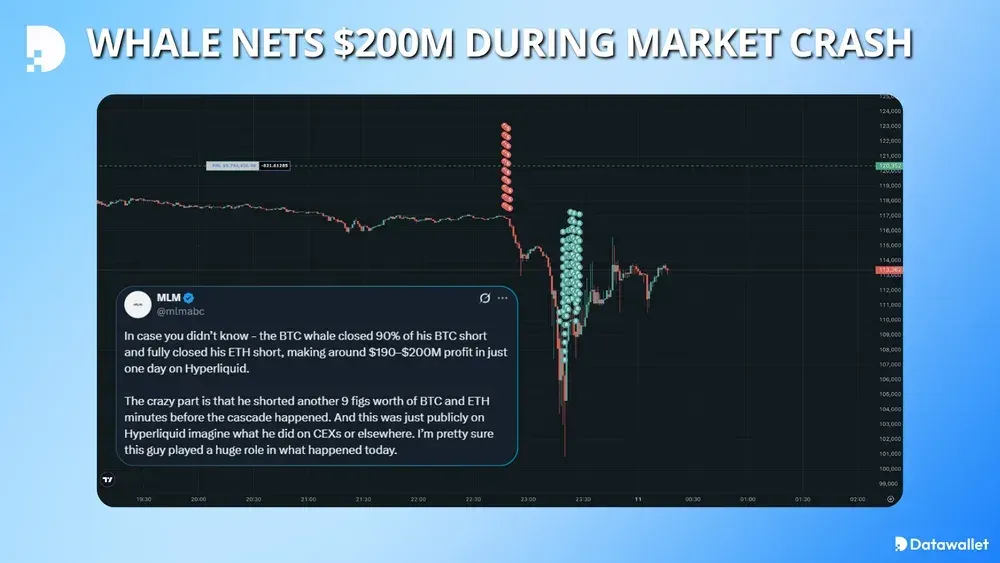

Minutes before the tariff shock hit, an anonymous Bitcoin veteran opened a $1.1 billion leveraged position onto Hyperliquid and shorted both BTC and ETH. On-chain data shows they opened $752.9 million in BTC and $353.1 million in ETH shorts with near-perfect entry points. As prices plunged 15-18%, the whale closed most positions within hours, realizing about $190-200 million in profit.

Wallet analysis by @lookonchain and @mlmabc traced the activity to a 2011-era address once holding 86,000 BTC. The precise timing sparked insider trading chatter, though no regulator has confirmed an active investigation. The whale withdrew profits immediately through new wallets, leaving only a smaller BTC short still in play, before eventually reshorting the market for $161 million.

More Breaking News

- Early bitcoin investor Roger Ver reached a tentative $48 million settlement with the US Justice Department, potentially ending his long-running criminal tax case.

- Aster postponed its October airdrop to address data inconsistencies in user allocations after widespread community complaints surfaced online.

- Binance pledged compensation for users affected by Friday’s major market depegs, apologizing for latency issues and vowing to review cases individually.

- The European Banking Authority warned that crypto firms exploiting MiCA’s transitional period risk undermining EU financial integrity through regulatory arbitrage.

- India’s tax agency is probing more than 400 wealthy Binance traders suspected of evading up to 42% crypto profit taxes in recent years.

- Galaxy Digital secured a $460 million investment from a major asset manager to accelerate its Helios AI data center expansion in Texas.

- Tokenization leader Securitize is in talks to go public through a Cantor Fitzgerald SPAC merger that could value the firm above $1 billion.

- Morgan Stanley will allow all clients, including retirement accounts, to access Bitcoin and crypto funds beginning October 15, expanding retail exposure.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

.webp)

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.