Bybit vs MEXC: Which Exchange is Better?

.webp)

Summary: Bybit and MEXC are leading global exchanges with millions of users. Bybit is the second-largest platform with 76 million customers, offering deep liquidity for 2,100+ assets. MEXC has over 40 million clients and offers 1,800 spot and 1,000 futures pairs, along with derivatives leverage up to 500x.

While both platforms appeal to international traders, Bybit is often favored by professionals seeking liquidity and advanced features, whereas MEXC attracts those looking for the widest access to emerging tokens.

Bybit vs MEXC Overview

Bybit was founded in 2018 by Ben Zhou and is the second-largest exchange on CoinMarketCap. It is known for its advanced trading platform and spot, derivatives, and options markets. It serves over 76 million users across 200 jurisdictions, with low fees, high liquidity, fast order execution, and strong security measures, including cold storage, 2FA, and proof of reserves.

MEXC was founded in 2018 and is the seventh-largest exchange on CoinMarketCap, operating in 170 countries with a user base of 40 million. It provides a wide range of services: spot trading, derivatives, margin trading, staking, and new token launchpads. MEXC is known for listing thousands of assets and for its high performance, processing over 1.4 million transactions per second.

Below is a comparison table of Bybit and MEXC, highlighting their fees, features, security, and more.

Bybit vs MEXC Products

Bybit and MEXC are both leading crypto exchanges that go well beyond basic trading. Let’s see how their product offerings compare.

Bybit Features

Bybit delivers a mix of trading depth and investor-focused tools, offering multiple markets, yield products, and extras appealing to both active traders and long-term holders.

- Spot Trading – Allows users to buy and sell cryptocurrencies instantly at the current market price. Ideal for long-term holders or traders looking to buy and sell quickly.

- Derivatives & Leverage – Enables trading contracts whose value is derived from the price of an underlying asset, rather than owning the asset itself. Bybit offers perpetual and futures contracts with leverage up to 200×.

- Options Trading – Gives traders the right, but not the obligation, to buy or sell a cryptocurrency at a set price before a certain date. Options are useful for hedging risk or speculating with a defined downside.

- Trading Bots – Tools that automate trading, like setting up “grid bots” that buy and sell around set price intervals, or dollar-cost averaging (DCA) bots that invest gradually. Helps users who prefer passive or semi-automated approaches over constant manual trading.

- Copy Trading – Lets you replicate the trades of more experienced or popular traders automatically. If someone you follow opens, adjusts, or closes a position, your account mirrors that action proportionally. Good for learning or leveraging others’ strategies.

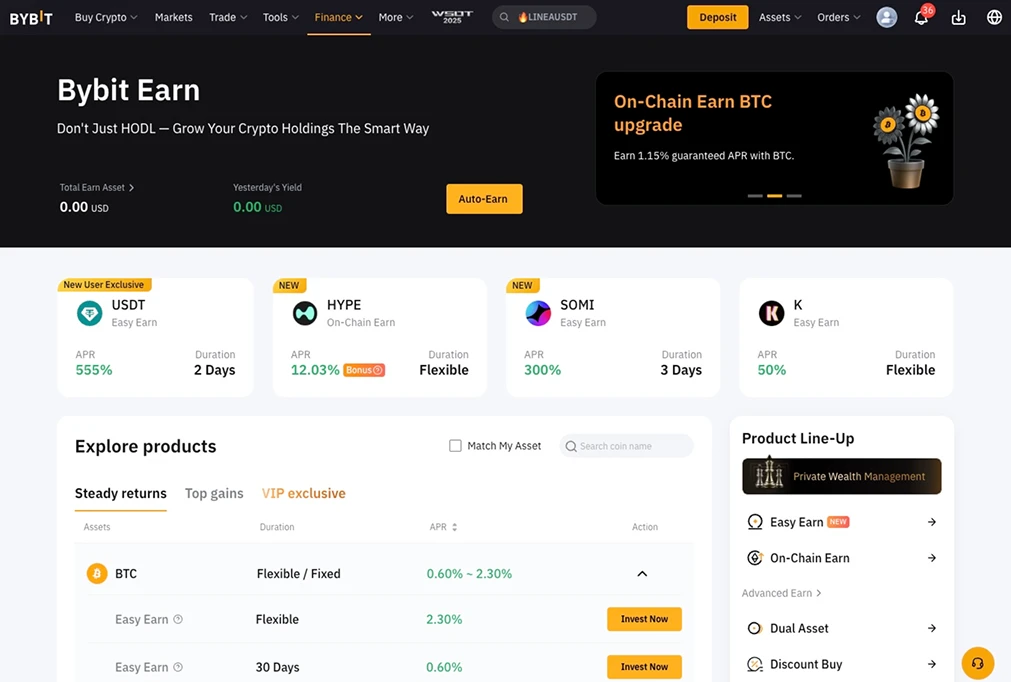

- Bybit Earn – Provides ways to earn rewards on assets you hold by staking, saving, or participating in yield-earning products. Instead of trading, you can “park” assets to earn interest or rewards.

- NFT Marketplace – Platform to buy, sell, and collect non-fungible tokens. Helps users interact with digital art, collectibles, or their own NFT holdings. Adds a layer beyond just financial products.

- Bybit Crypto Card – This card is a crypto-to-fiat debit card that lets you spend your Bybit account balance at merchants and ATMs where Mastercard is accepted, converting crypto to local currency at checkout.

- Demo Account – A practice environment where users can trade with virtual funds instead of real money. Useful for learning how derivatives or leverage work, experimenting with strategies before risking capital.

MEXC Features

MEXC stands out for its vast token coverage and competitive pricing, pairing an extensive coin selection with trading and earning tools built for global users.

- Spot Markets – Trade major coins and new listings with market, limit, and trigger orders. The broad pair coverage reduces the need to switch between assets and supports price discovery on emerging tokens.

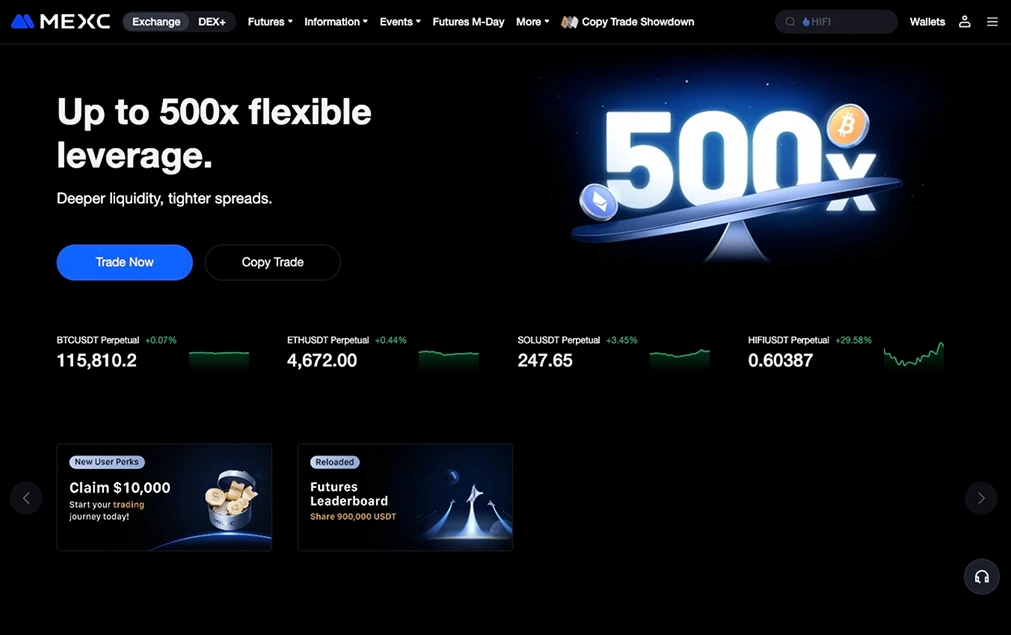

- Futures & Perpetuals (up to 500x) – Go long or short with USDT-M, COIN-M, and USDC-M contracts. MEXC advertises 0% maker and 0.02% taker fees on futures, plus adjustable leverage by pair.

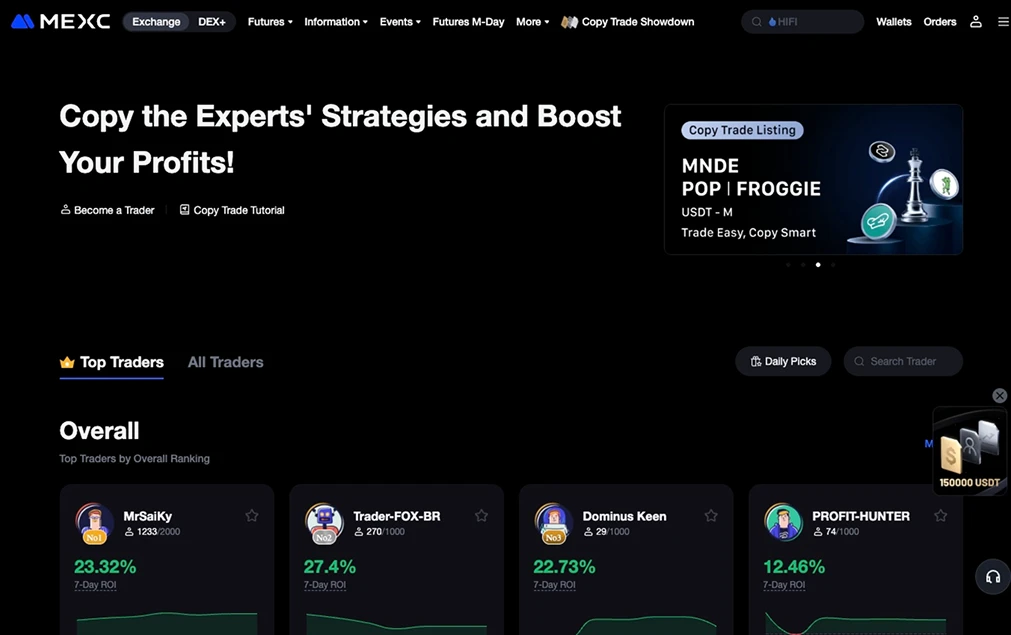

- Copy Trade – Mirror top traders in one click. The leaderboard surfaces ROI, PnL, win rate, and follower counts so you can set caps, stop-loss, and copy size before positions sync automatically.

- MEXC Earn – Generate passive yield through flexible savings and fixed-term products. Examples on-site include flexible USDT up to 12% and USDC up to 9.5%.

- Launchpad – Access token sales and discounted allocations for assets like BTC, ETH, SOL, and new projects. Commit USDT or MX during the subscription window and receive distributions after listing.

- Airdrop+ Campaigns – Join deposit or trading tasks tied to new listings and ecosystem partners. Prize pools, participant counts, and deadlines are posted on the Airdrop+ page for transparent tracking.

- On/Off-Ramps: Buy Crypto, P2P, Convert – Purchase crypto with cards or other supported methods, trade peer-to-peer in local currencies, or use Convert for instant quotes between assets without order-book complexity.

- DEX+ – A decentralized trading option within the MEXC ecosystem for users who prefer on-chain execution and wallet-based control, complementing the centralized exchange experience.

- Pro Tools (Demo Trading, Futures Big Data & Leaderboards) – Practice strategies in a sandbox, then study funding, long/short ratios, liquidations, and top-trader stats to refine entries, sizing, and risk.

Bybit vs MEXC Security

Bybit employs a multi-layered security framework designed to protect user assets and promote transparency. Its infrastructure includes cold, warm, and hot wallet systems, often managed with top custodians like Fireblocks and Copper, to limit exposure to risk. Regular third-party Proof-of-Reserves audits verify that user liabilities are fully backed above a 1:1 ratio.

MEXC prioritizes security through a layered approach, including cold wallet storage, two-factor authentication, anti-phishing codes, and address whitelisting. It also operates a $100 million Guardian Fund and a dedicated Futures Insurance Fund. On top of that, MEXC maintains real-time proof-of-reserves reporting to ensure all user assets are backed 1:1 or higher.

Both exchanges have demonstrated resilience in addressing risks, giving traders confidence that their assets remain secure under industry-grade protections.

Bybit vs MEXC Futures Trading

Bybit and MEXC are two of the most active futures trading platforms, each offering deep liquidity, high leverage, and a suite of tools designed for both retail and professional traders. Here’s how they compare:

Bybit Futures

- Contract Types: Supports USDT-margined, USDC-margined, inverse perpetual, and dated futures contracts, alongside options for more advanced hedging strategies.

- Leverage: Users can access up to 200× leverage, with adjustments in line with position size and risk tiers.

- Fees: Maker fees start at 0.02%, while taker fees are 0.055%, with reductions for high-volume or VIP traders.

- Tools: Offers risk limit systems, margin calculators, dual margin modes (cross/isolated), and an insurance fund to protect against extreme volatility.

- Available Markets: Over 600 futures markets covering major cryptocurrencies and altcoins.

MEXC Futures

- Contract Types: Provides USDT-M, USDC-M, and Coin-M perpetual contracts, plus futures settled in underlying crypto assets for broader collateral flexibility.

- Leverage: Supports up to 500× leverage on select contracts, making it one of the highest leverage offerings in the industry.

- Fees: Maker orders are free (0%), while taker orders start at 0.02%. Additional fee discounts apply when using the MX token.

- Tools: Includes cross and isolated margin, one-way and hedge position modes, trailing stops, and big data analytics on long/short ratios and liquidations.

- Available Markets: More than 1,000 futures markets with a strong focus on fast token listings and liquidity depth.

Bybit vs MEXC Supported Countries

Bybit and MEXC both serve large international user bases, though their global reach differs in scope and regulatory compliance. Bybit is accessible in 200+ countries and supports trading in 15 languages, but restrictions apply in several major markets. To adapt, it has rolled out region-specific platforms, such as bybit.eu, to align with local frameworks.

MEXC is available in over 170 countries with a strong footprint in Asia-Pacific, Europe, and Latin America. It is unavailable in certain regulated markets, including the U.S. and a number of sanctioned jurisdictions. The platform offers multilingual support in 48 languages, ensuring accessibility for diverse users.

Both exchanges maintain broad availability across continents, but their regional limitations highlight the impact of evolving regulatory requirements on global crypto platforms.

Bybit vs MEXC Fees

Trading fees play a direct role in net returns, making them an essential factor when weighing Bybit against MEXC. Both exchanges offer competitive pricing, but their structures differ in key areas.

Bybit Charges

Bybit’s fee structure is built for derivatives traders while still remaining straightforward for spot users, with significant reductions available through its VIP program.

- Spot Fees: Standard spot trades carry a 0.1% maker and taker fee. Higher VIP tiers can reduce this to around 0.03% for makers and 0.045% for takers.

- Futures Fees: Maker fees begin at 0.02% and can fall to 0% for top accounts. Taker fees start at 0.055% and drop to roughly 0.03% at VIP levels.

- Options Fees: Options trading incurs a 0.02% maker fee and a 0.03% taker fee, with discounts scaling down further for VIP users.

.webp)

MEXC Charges

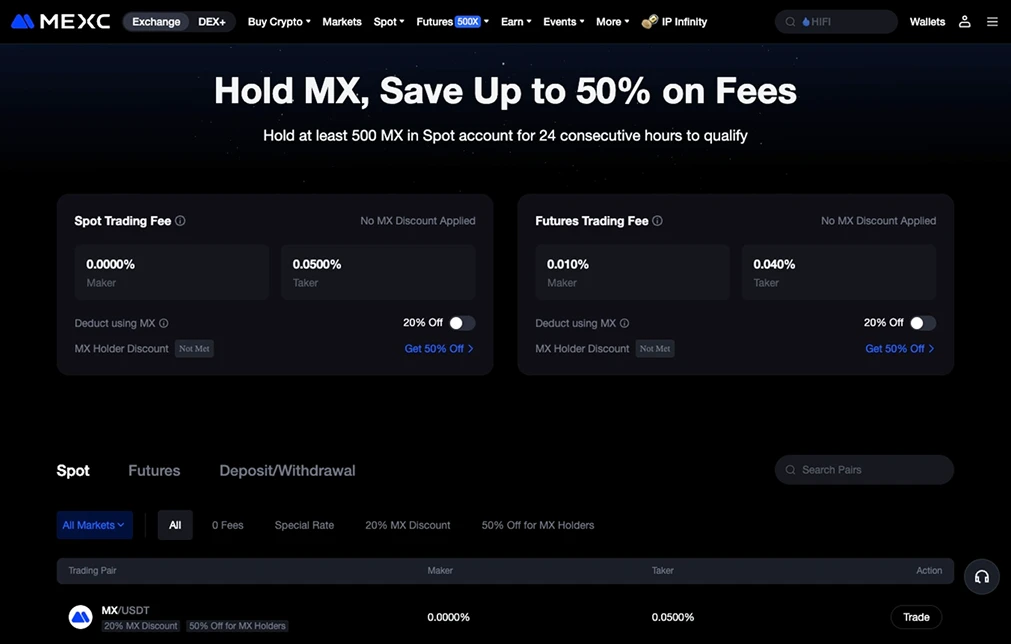

MEXC’s fee schedule offers one of the lowest costs, particularly for futures, where it offers zero maker fees across the board.

- Spot Fees: Maker fees are set at 0%, while taker fees start at 0.05%. Holding at least 500 MX tokens in your spot wallet for 24 hours can unlock discounts of up to 50%, bringing taker fees down to as little as 0.025%–0.04%.

- Futures Fees: All futures contracts feature 0% maker fees and a base taker fee of 0.02%. Special rate pairs may carry taker fees in the 0.04% range, and MX holders can apply token deductions for an extra 20% discount.

Is Bybit better than MEXC?

Bybit and MEXC are both major global exchanges, but they cater to traders with different priorities. Bybit has built its reputation around derivatives, offering a wide selection of perpetual and futures contracts, strong liquidity, high leverage, and advanced risk management tools.

MEXC, on the other hand, is recognized for its massive token coverage, competitive fee structure, and fast listings of new projects, making it a popular choice for users seeking access to emerging coins alongside established markets.

For derivatives-focused traders who value stability, deep liquidity, and structured risk controls, Bybit may feel like the better fit, while MEXC appeals to those looking for low costs and one of the broadest spot and futures selections available.

Final Thoughts

Choosing between Bybit and MEXC comes down to your trading priorities: Bybit is better suited for professionals who want deep liquidity, advanced risk tools, and a structured derivatives market, while MEXC is the go-to option for traders chasing low fees and early access to a wide range of tokens.

Before deciding, evaluate your goals, risk tolerance, and preferred markets to ensure the platform you pick matches your trading style.

Frequently asked questions

Does Bybit or MEXC have better liquidity for high-volume trading?

Bybit generally offers deeper liquidity across major futures pairs, making it attractive for high-volume traders, while MEXC provides strong liquidity on a wider range of newly listed tokens.

Which exchange is more beginner-friendly, Bybit or MEXC?

MEXC’s broad spot markets and low entry fees make it approachable for beginners, while Bybit’s structured tools and demo account help new traders practice before entering live markets.

Can I stake tokens on both Bybit and MEXC?

Yes, both exchanges support staking and savings products. Bybit offers flexible and fixed-term Earn programs, while MEXC provides Simple Earn, New Token Mining, and savings options with varying yields.

How do Bybit and MEXC handle proof of reserves?

Bybit uses third-party audits and Merkle Tree verification to prove 1:1 backing of user assets, while MEXC provides real-time proof-of-reserves reporting alongside its $100 million Guardian Fund for added assurance.

Written by

Emily Shin

Research Analyst

Emily is passionate about Web 3 and has dedicated her writing to exploring decentralized finance, NFTs, GameFi, and the broader crypto culture. She excels at breaking down the complexities of these cutting-edge technologies, providing readers with clear and insightful explanations of their transformative power.