Coinbase vs Bybit: Features, Fees, Security & Regulations

Summary: Coinbase is an American, publicly listed crypto exchange with over 100 million users in 100+ countries, offering access over 400 crypto assets. Bybit serves over 70 million users in 160 countries, specializing in derivatives, advanced trading tools, and access to over 1,900 coins.

The key differences lie in regulation and product depth. Coinbase emphasizes compliance, safety, and simplicity, while Bybit offers greater trading flexibility, faster token access, and a broader feature set for active traders and investors with higher risk appetite.

Bybit wins against Coinbase with low fees, deep derivatives, and rapid access to emerging crypto assets, making it the preferred choice for active and advanced traders.

Available Assets

1,900+ tokens including spot, futures, and options

Trading Fees

Starting from 0.10% spot and 0.02% / 0.055% futures

Security

Multi-signature cold storage, KYC, and proof-of-reserves

Coinbase vs Bybit Overview

Coinbase serves over 100 countries and handles hundreds of billions in quarterly trading volume, emphasizing security, regulatory compliance, and simplicity for beginners and institutional users. Founded in 2012 and headquartered in San Francisco, it became the first crypto exchange to go public on NASDAQ.

Bybit has more than 70 million users worldwide and holds the second largest share of derivatives trading volume. Founded in 2018 and headquartered in Dubai, it is known for offering high leverage up to 125x, deep liquidity, and a wide variety of perpetual contracts and new listings.

The following table compares and contrasts each of Coinbase's and Bybit's features:

Coinbase vs Bybit Products

Both Coinbase and Bybit offer a wide range of cryptocurrency products, but they differ significantly in scope and specialization. Coinbase emphasizes simplicity, compliance, and ease of access, while Bybit focuses on advanced trading tools, derivatives, and crypto-native features.

Coinbase Features

Coinbase is designed to offer a streamlined experience with secure access to core crypto services, making it ideal for beginners and institutional users alike.

- Spot Trading: Lets users buy and sell hundreds of cryptocurrencies through both a simple interface and an advanced trading terminal with over 300 pairs.

- Perpetual Futures: Offers BTC and ETH perpetual contracts via its International Exchange with limited leverage and regional restrictions.

- Coinbase Derivatives Exchange: Provides a small set of regulated futures products like nano Bitcoin contracts for institutional and US qualified investors.

- Staking & Earn: Allows staking of assets like ETH, ADA, and SOL, plus rewards for learning about crypto through Coinbase Earn.

- Fiat Support: Supports quick fiat deposits and withdrawals via ACH, SEPA, FPS, SWIFT, PayPal, and cards across major currencies including USD and EUR.

- Coinbase Wallet: A standalone, self-custody wallet for NFTs and DeFi access, linked directly to the main Coinbase account.

- Coinbase Card: A Visa debit card that converts crypto to fiat at point-of-sale and earns rewards like Bitcoin cashback.

- Base (L2 Blockchain): Coinbase’s own Ethereum Layer 2 network designed for on-chain app development and dApp exploration.

- Institutional Services: Includes Coinbase Prime, custody systems, and an audited trading venue used by major institutions including BlackRock's Bitcoin ETF IBIT.

Bybit Features

Bybit delivers a high-performance, trader-focused platform packed with tools for advanced users, margin traders, and crypto-native investors.

- Spot Trading: Offers a wide range of listed tokens with frequent updates through Launchpad and early access to new listings.

- Derivatives Depth: Supports futures, inverse perpetuals, and USDC/USDT-margined contracts with up to 125x leverage and advanced order types.

- Dual TP/SL Orders: Enables traders to set both take-profit and stop-loss orders simultaneously on the same position for better risk control.

- Copy Trading: Lets users automatically mirror trades of top-performing Master Traders, complete with stats and risk management tools.

- Trading Bots: Includes built-in grid, DCA, and Martingale bots with customizable parameters, with no external setup needed.

- Bybit Earn: Offers structured yield options like dual-asset investing, flexible staking, liquidity mining, and promotional high-yield products.

- Bybit Card: A MasterCard-powered debit card in select markets, enabling users to spend crypto directly from their exchange balance.

- Web3 Wallet: A smart-contract-based, non-custodial wallet connected to the main account for on-chain staking, DeFi, and NFT interaction.

- Launchpad & Pre-Market: Provides early token access through project sales, allocation events, and pre-listing trading to discover price before public release.

Coinbase vs Bybit Futures Trading

Bybit’s flagship products are perpetual futures with no expiry, quarterly futures, and USDC options on BTC and ETH, with leverage up to 125x that decreases with larger positions. It supports USDT and inverse perpetuals and features advanced tools like cross-margin and multi-asset collateral.

Coinbase’s futures are limited to BTC and ETH perpetuals on a Bermuda-regulated platform, with leverage capped at 5x and no options or inverse contracts. A big plus for Coinbase is its plan to launch perpetual futures for US clients in 2025, opening access to one of the largest leveraged trader communities.

Coinbase vs Bybit Supported Cryptocurrencies

Coinbase supports hundreds of assets, prioritizing regulatory-compliant tokens and established projects, with over 300 trading pairs available. Its listings are selective and often exclude newer or higher-risk tokens that don’t meet internal or regional standards.

Bybit offers access to over 1,900 cryptocurrencies, including trending altcoins, meme tokens, and early-stage projects through Launchpad and pre-market listings. Its faster listing pace appeals to traders seeking broader exposure and early access to emerging assets.

Coinbase vs Bybit Security

Coinbase and Bybit both prioritize asset protection, but their security frameworks reflect different philosophies shaped by regulation and platform design.

Coinbase holds 98% of customer crypto in secure storage backed by crime insurance protecting against theft, but it is not FDIC-insured and does not guarantee against loss from account breaches. Bybit uses a multi-signature cold wallet system with batched withdrawals and publishes proof-of-reserves via Merkle tree audits.

On the compliance side, Coinbase operates with full regulatory oversight, enforces strict KYC/AML rules, and integrates tools like address whitelisting, 2FA, and hardware key support for user accounts.

Bybit also mandates full identity verification, blocks sanctioned jurisdictions, and offers layered user protections such as anti-phishing codes, withdrawal delay mechanisms, and a transparent insurance fund and ADL system for derivatives trading.

Coinbase vs Bybit Fees

Fees are a crucial factor in choosing a crypto exchange, especially for active traders where even small differences can add up fast. Coinbase and Bybit follow very different fee models, with Bybit focusing on low trading costs and Coinbase offering fee-backed convenience and compliance.

Coinbase Fees

Coinbase’s fees are tiered by volume and geared more toward casual and compliance-focused users.

- Spot Trading Fees: Standard users pay up to 0.60% taker and 0.40% maker, with volume-based discounts that lower fees gradually over time.

- Futures Trading Fees: Coinbase lists a wide range (0-0.60%) depending on volume; casual users can expect ~0.2-0.5% per trade unless eligible for institutional programs.

- Crypto Withdrawals: Coinbase passes on the blockchain network fee with no added markup, which can be cheaper than fixed-fee models for small withdrawals.

- Fiat Deposits & Withdrawals: ACH (USD), SEPA (€0.15), and Faster Payments (UK) have low or no fees; card withdrawals may cost ~2%, and PayPal transfers are free.

- VIP & Loyalty Benefits: Retail users can subscribe to Coinbase One for zero trading fees (up to limits), while institutional clients may qualify for maker rebates or custom arrangements.

- Fee Promotions: Occasional promos (e.g., USDC fee-free pairs) offer temporary savings, though overall base fees remain higher than most competitors.

Bybit Fees

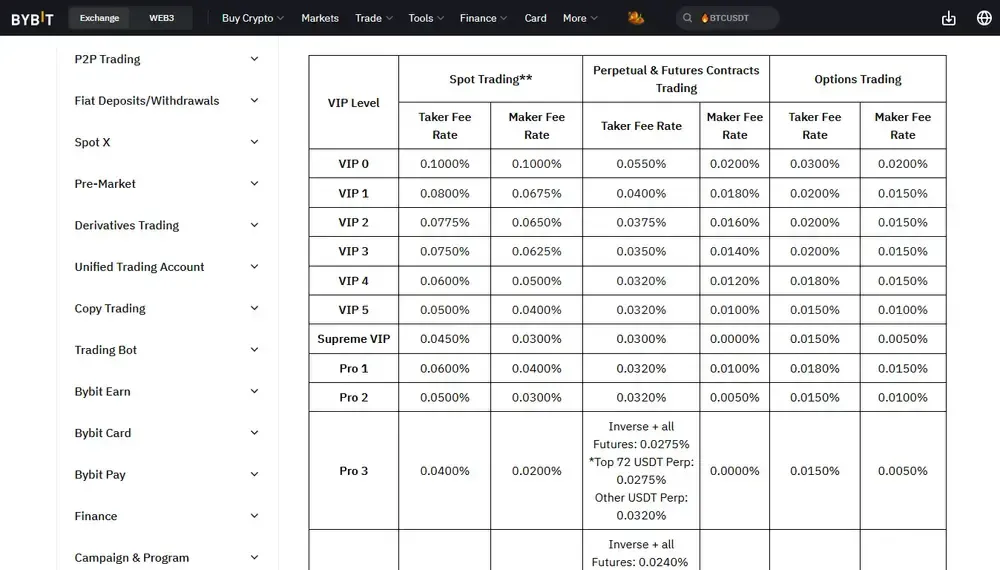

Bybit’s fee structure is built to attract volume traders and offers aggressive discounts through VIP tiers.

- Spot Trading Fees: Flat 0.10% maker/taker for regular users, which drops rapidly with volume (e.g., 0.0675% maker at VIP 1 and as low as 0% at high tiers).

- Futures Trading Fees: Perpetual contracts start at 0.020% maker / 0.055% taker, with inverse markets even lower; a top-tier traders may pay virtually 0% on limit orders.

- Crypto Withdrawals: Fixed fees per coin (e.g., 0.0005 BTC), better for larger withdrawals but costly in percentage terms for small amounts.

- Fiat Handling: Bybit charges no fees itself on fiat deposits, but relies on third-party processors or P2P, which can add ~1-3% depending on provider and region.

- VIP & Rewards Program: VIP status is easy to reach (starts at $1M 30-day volume) and offers lower fees, account manager access, and other platform benefits.

- Promotional Offers: Regular campaigns include zero maker fee events, trading competitions, and VIP trial upgrades to reduce effective trading costs.

Coinbase vs Bybit Regulations

Coinbase restricts access in OFAC-sanctioned regions including Russia, Iran, the UAE, and parts of South Asia, while facing ongoing legal scrutiny from the SEC. Meanwhile, it's fully licensed in major markets like the US (FinCEN, SEC), UK (FCA), and EU (MiCA via Ireland), serving users in over 100 countries.

Bybit operates in 160 countries and holds licenses in Kazakhstan, Cyprus, Georgia, and provisional approval in Dubai, but is barred in the US, UK, EU, and Singapore. It’s actively pursuing MiCA and Hong Kong licenses, but for now, its regulatory status remains limited and region-specific.

Final Thoughts

To sum up, Coinbase offers a secure, regulation-aligned environment ideal for users who value compliance, fiat access, and long-term trust. Bybit operates on the edge of crypto innovation, providing faster listings, deeper derivatives, and lower fees, though with fewer formal safeguards.

Choosing between them depends on your priorities, including risk tolerance, trading style, and geographic access. In practice, many users benefit from using both: Coinbase for stability and fiat connectivity, and Bybit for flexibility and advanced trading tools.

Frequently asked questions

Is Coinbase or Bybit better for crypto day trading?

Bybit is generally more suitable for crypto day trading due to its low fees, high leverage, and advanced order types. It offers tools like one-click TP/SL, grid bots, and copy trading, which are ideal for high-frequency strategies.

Coinbase, while reliable, is better suited for lower-volume trades or longer-term positions due to higher base fees and limited leverage.

How do Coinbase and Bybit differ in how they store your crypto?

Both use cold storage, but the methods and transparency differ.

- Coinbase stores 98% of user funds in geographically distributed cold wallets and provides FDIC insurance on USD balances.

- Bybit uses multi-signature cold wallets with batched withdrawals and publishes proof-of-reserves to verify 1:1 user asset backing.

While both have never suffered a major hack, Coinbase operates under stricter custody regulations.

Can you use Coinbase and Bybit in the same crypto strategy?

Yes, many advanced users combine them for a hybrid strategy. Coinbase can be used for fiat onboarding, compliance, and long-term holdings, while Bybit can serve as the active trading venue for futures, altcoins, or early token access. This approach lets users balance security and flexibility.

What are the key terms to know when comparing Coinbase and Bybit?

Here’s a quick crypto glossary to understand key terms used when evaluating these exchanges:

- Spot Trading: Buying or selling cryptocurrencies for immediate delivery.

- Perpetual Futures: Derivatives with no expiry date, commonly used on Bybit.

- KYC (Know Your Customer): Verification process to comply with financial regulations.

- Cold Wallet: Offline storage method to protect crypto assets from hacks.

- Maker/Taker Fees: Fees based on whether you add liquidity (maker) or take it (taker) from the order book.

- Leverage: Trading with borrowed funds to amplify exposure, offered at high levels on Bybit and conservatively on Coinbase.

- Proof of Reserves: A transparency mechanism where an exchange proves it holds user assets 1:1.

%25201%2520(1).webp)

Written by

Emily Shin

Research Analyst

Emily is passionate about Web 3 and has dedicated her writing to exploring decentralized finance, NFTs, GameFi, and the broader crypto culture. She excels at breaking down the complexities of these cutting-edge technologies, providing readers with clear and insightful explanations of their transformative power.

.webp)

.webp)

.webp)

%2520(1).webp)

%2520(1).webp)