Justin Sun's Tron Slashes Network Fees by Sixty Percent

GM. Justin Sun’s Tron community has approved a 60% cut in network fees, aiming to boost stablecoin activity on one of crypto’s busiest payment rails despite short-term revenue declines.

Meanwhile, El Salvador splits its Bitcoin reserve across 14 wallets, investors drop a lawsuit against Strategy, and Elon Musk’s attorney is set to chair a $200 million Dogecoin treasury.

The week opens with the following crypto stories. 👇

Justin Sun's Tron Slashes Network Fees by Sixty Percent

Tron token holders approved a proposal to cut network fees by 60%, with implementation taking effect Friday at 20:00 GMT+8. Founder and crypto billionaire Justin Sun announced the vote on X, saying the change would directly benefit users across the Tron ecosystem.

Developers cited rising transaction costs as motivation, with average fees recently around $1.70 and peaking near $2.50 in December. Tron underpins sizable stablecoin flows, hosting roughly $82 billion in supply; nearly 30% of the global total and second only to Ethereum.

Sun acknowledged profitability would decline initially as fee revenue shrinks, but predicted higher user activity and transactions would strengthen long-run economics. Officials said the cut will boost competitiveness versus alternative rails used for stablecoin transfers, payments, and decentralized finance applications.

TRX, the network’s native asset and tenth-largest cryptocurrency, traded near $0.34 after slipping about 2% over the past day. Backers expect a 60% fee reduction to attract additional stablecoin issuers and users, reinforcing Tron’s position in cross-border settlement corridors.

El Salvador Splits Bitcoin Reserve into 14 Wallets

El Salvador’s National Bitcoin Office announced it distributed nearly 6,300 BTC into fourteen separate blockchain addresses. Officials said splitting the holdings limits exposure to potential quantum computing risks, though analysts believe such threats remain decades away. President Nayib Bukele’s government claims to purchase one Bitcoin daily, maintaining the nation’s strategic cryptocurrency reserve program.

The move follows earlier reports contradicting official claims of daily Bitcoin purchases under terms agreed with the IMF. Each new address holds under 500 BTC, strengthening resilience by reducing the impact of individual wallet compromise. The announcement emphasized proactive risk management, even as independent economists question the accuracy of El Salvador’s reported accumulation.

MSTR Investors Drop Lawsuit Over Profitability Dispute

A group of investors dismissed their class-action lawsuit accusing Bitcoin-focused company Strategy of misleading profitability expectations. Plaintiffs initially claimed the firm, co-founded by Michael Saylor, overstated the benefits of adopting fair value accounting for its $68 billion Bitcoin reserve. The case was voluntarily withdrawn with prejudice in federal court, preventing future refiling on identical claims.

Strategy’s accounting change allows marking Bitcoin prices directly, replacing older impairment methods that underreported rising asset values. Despite BTC’s surge, the company still announced a $4.22 billion quarterly loss earlier this year. Shareholder frustration has persisted, with critics alleging misleading comparisons between Strategy’s performance and mainstream technology companies like Apple or Nvidia.

Elon Musk’s Attorney to Chair $200M Dogecoin Treasury

Elon Musk’s lawyer Alex Spiro has been named planned chairman of a $200 million Dogecoin ($DOGE) treasury company, according to Fortune. The entity, backed by House of Doge, seeks to raise capital as a public vehicle holding Dogecoin. Investors would gain stock-market exposure to the memecoin without directly purchasing or storing digital tokens themselves.

The initiative reflects growing corporate interest in meme coin treasuries, joining earlier efforts by firms in Canada and the US. Spiro, a Quinn Emanuel partner, has represented Musk in high-profile cases including Dogecoin-related litigation dismissed in 2024. Market watchers view Dogecoin treasuries as experimental, yet symbolic of rising demand for unconventional cryptocurrency investment structures.

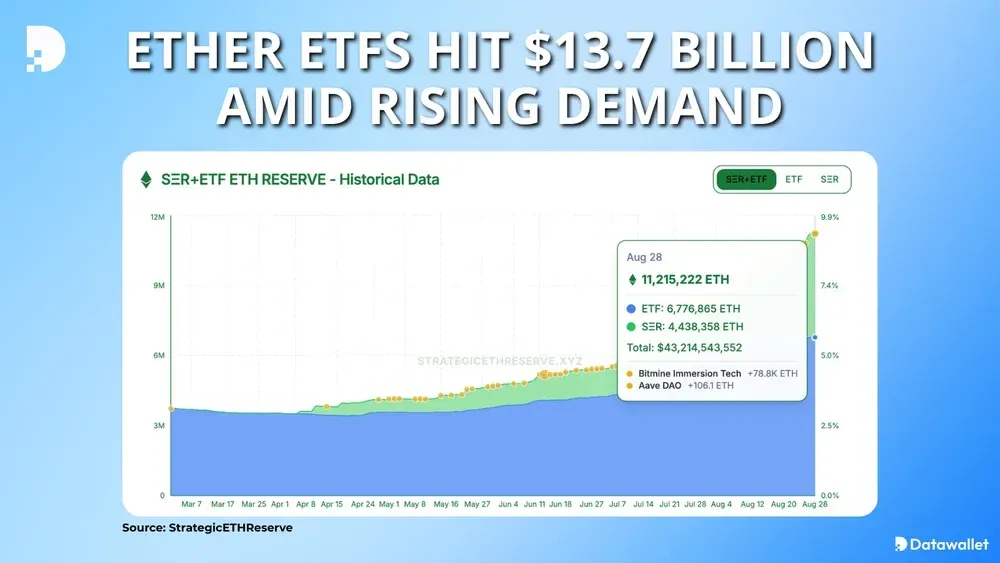

Data of the Day

Ether spot exchange-traded funds reached $13.7 billion in cumulative inflows, according to SoSoValue research. Analysts attribute the surge in ETH ETFs interest to renewed institutional demand following Ethereum’s underperformance compared with Bitcoin earlier this year. Corporate treasuries also increasingly adopt Ether, further reinforcing perceptions of the asset’s long-term institutional viability.

StrategicETHReserve data show companies now hold 4.4 million Ether worth $19.18 billion, equal to nearly four percent of the supply. Supported by these inflows, Ether’s price rose 27% in August, reaching $4,316 from $3,406 earlier. Experts argue ongoing upgrades and regulatory clarity are fueling confidence, cementing Ethereum’s status as an institutional settlement network.

More Breaking News

- Ethena’s USDe supply surged past 12 billion dollars, fueled by leveraged loops on Pendle and Aave that amplified yields through recursive borrowing.

- Japan prepares to launch yen-backed stablecoins as Bank of Japan rate hikes loom, boosting demand for yen-denominated digital assets worldwide.

- Eric Trump predicted Bitcoin will hit 1 million dollars, citing limited supply, growing institutional demand, and expanding utility across financial services.

- Hyperliquid captured nearly 14% of Binance’s derivatives volume, signaling decentralized protocols can meaningfully compete with centralized platforms in liquidity and performance.

- PumpFun bucked broader bearish trends with aggressive buybacks that reduced supply, driving a 17% weekly gain for its native PUMP token.

- Pudgy Penguins and Mythical Games launched Pudgy Party, a mobile Web3 game blending casual multiplayer chaos with blockchain-based asset ownership and rewards.

- Solana launchpad Heaven quickly grabbed 15% market share using its “God Flywheel” model, routing revenue into LIGHT token buybacks and burns.

- Eliza Labs sued Elon Musk’s X, alleging the platform copied its AI agents and unfairly deplatformed them to promote competing xAI products.

- DeFi Development Corp expanded to the UK through a London acquisition, marking its first overseas Solana-focused treasury vehicle with five more planned.

- An Indian court sentenced fourteen people, including eleven police officers and a former BJP legislator, to life imprisonment for Bitcoin-related extortion.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

.webp)

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.