Stripe Launches "Tempo" Layer 1 Blockchain on Testnet

GM. Stripe and Paradigm unveiled Tempo, a payments-focused L1 blockchain now in testnet with partners like OpenAI, Nubank, and Deutsche Bank, expected to power stablecoins.

Meanwhile, public company Bitcoin holdings surpass one million BTC, Lagarde urges closing EU stablecoin loopholes, and Uniswap votes on forming a Wyoming legal entity.

The week ends with big launches, bigger balances, and regulations still catching up. 👇

Stripe Launches "Tempo" Layer 1 Blockchain on Testnet

Stripe and Paradigm presented a payments-focused blockchain called Tempo, now in private testnet with major corporate partners. Stripe CEO Patrick Collison described Tempo as a payments-oriented layer-1 optimized for high-scale, real-world financial services applications across global markets.

The project has secured collaborations with Anthropic, Deutsche Bank, DoorDash, Nubank, OpenAI, Revolut, and Shopify, according to Collison’s announcement. Tempo builds on Stripe’s $1.1 billion acquisition of stablecoin infrastructure firm Bridge last October and earlier integrations with Coinbase’s Base network.

Paradigm co-founder Matt Huang, serving as Tempo’s leader, said the blockchain is purpose-built for stablecoins and payments infrastructure. He emphasized Stripe’s global payments expertise combined with Paradigm’s crypto knowledge positions Tempo uniquely for mainstream adoption.

Tempo seeks to streamline stablecoin payment acceptance, cross-border payouts, remittances, microtransactions, tokenized deposits, and AI-driven “agentic” payments directly onchain. The platform will operate independently, with Stripe and Paradigm as initial investors.

Public Company Bitcoin Holdings Pass One Million BTC

BitcoinTreasuries reported that public company holdings of Bitcoin have surpassed one million BTC, worth about $111 billion. More than 100 firms now hold the asset, with pioneers like Strategy inspiring others including GameStop and Semler Scientific. Executives say this milestone highlights corporate accumulation strategies, though institutional adoption is still considered relatively early.

Analysts argue the structural supply-demand imbalance is deepening as companies continue shifting cash reserves into Bitcoin. Nasdaq-listed CIMG recently raised $55 million specifically to purchase BTC, underscoring ongoing Bitcoin treasury adoption. At Thursday’s trading price of $110,142, Bitcoin has gained more than 90% compared with the previous year.

Lagarde Urges Closing EU Stablecoin Regulatory Loopholes

European Central Bank President Christine Lagarde told a regulatory conference that EU lawmakers must tighten stablecoin oversight. She called for equivalence regimes requiring foreign issuers to meet EU standards and maintain cross-border safeguards. Lagarde warned that without international cooperation, risks would migrate toward jurisdictions with weaker rules and limited reserve protection.

Italian securities regulator Federico Cornelli stressed cryptocurrencies cannot be legal tender, affirming only the euro qualifies officially. Officials noted MiCAR allows redemptions globally, creating risk of sudden runs on EU-based reserves. Lagarde said robust safeguards were needed to prevent destabilization if investors concentrated withdrawals within the eurozone’s financial system.

Uniswap Community Votes on Wyoming Legal Entity

Uniswap token holders are voting on a proposal to form a Wyoming-based entity supporting off-chain governance operations. Called DUNI, the organization would manage contracts, hire providers, and meet tax obligations while preserving decentralized decision-making. The plan aims to protect governance participants from legal exposure or liabilities resulting from collective protocol actions.

A preliminary temperature check already showed unanimous support, with final voting scheduled to close September 8. Developers said the step reduces risk without undermining decentralization or Uniswap’s UNI token. Community leaders emphasized DUNI would create essential legal protections while maintaining the project’s open, community-led governance framework.

Data of the Day

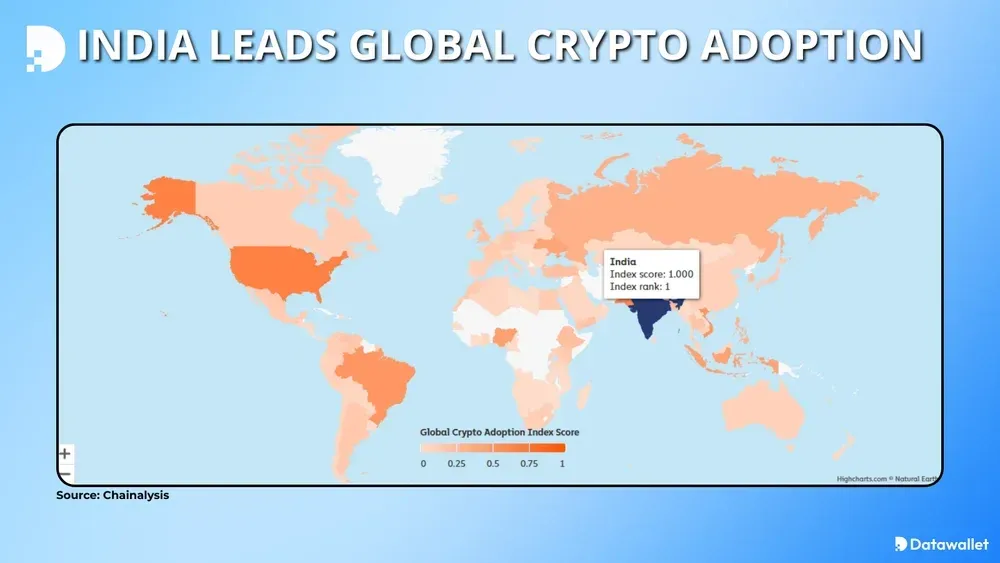

India ranked first in Chainalysis’ 2025 Global Crypto Adoption Index, marking its second consecutive year as leader. The United States moved to second place, while Pakistan, Vietnam, Brazil, and Nigeria also ranked within the global top ten. Analysts said adoption growth reflects remittance reliance, stablecoin demand, and mobile-first finance products across emerging economies.

Chainalysis reported Asia-Pacific was the fastest-growing region, with transaction volume up 69% year-over-year to $2.36 trillion. North America and Europe followed, posting $2.2 trillion and $2.6 trillion respectively, supported by regulatory clarity and ETF launches. Researchers concluded institutions and retail adoption are expanding simultaneously, reinforcing crypto’s integration into global financial systems.

More Breaking News

- The UK Treasury proposed AML rule changes for crypto firms, lowering change-in-control thresholds and targeting evolving risks like digital identity abuse.

- Australian self-managed retirement funds trimmed crypto exposure by 4% year-on-year, despite Bitcoin rising 60%, with analysts calling the data undercooked.

- World Liberty and American Bitcoin dropped over 20% on Thursday, as Nasdaq reportedly increased scrutiny on crypto-funded public companies raising capital.

- Figma expanded its Bitcoin holdings to $91 million, positioning it as a treasury asset without embracing maximalist or speculative investor narratives.

- Brian Armstrong, the CEO of Coinbase, wants AI to generate half of all daily code by October, pushing developers toward aggressive automation adoption.

- Arbitrum launched a $40 million DeFi incentives program targeting loopers, betting risky yield strategies will revive slumping onchain market activity.

- Ethereum smart contracts are being used to hide malware in GitHub repos, allowing attackers to evade detection through decentralized command infrastructure.

- Charles Hoskinson demanded an apology from the Cardano Foundation after an audit cleared him of stealing $600 million during 2021’s hard fork.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

.webp)

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.