TRUMP's Team to Launch Crypto Wallet & Trading App

GM. Trump’s team is launching a crypto wallet and trading app tied to his $TRUMP token, with multi-chain support, a $1M giveaway, and deeper integration via Magic Eden.

Meanwhile, Robinhood closes its Bitstamp acquisition, Ripple’s stablecoin gets approved for Dubai payments, and a Nasdaq-listed firm is raising $500M to buy Solana.

Full details below. 👇

TRUMP's Team to Launch Crypto Wallet & Trading App

President Trump’s memecoin team has launched a crypto wallet tied to his $TRUMP token, debuting Tuesday in partnership with NFT marketplace Magic Eden. The project opened a public waitlist and confirmed eligibility for users to win a portion of a $1 million TRUMP token giveaway.

The wallet rollout follows a series of headline-grabbing crypto ventures by Trump and his family, including a $2 billion Bitcoin treasury raise and stablecoin-backed projects. According to the terms, entrants who refer friends before July 4 qualify for a $100,000 token raffle on Independence Day.

The app will also support BTC, ETH, SOL, ADA, and other tokens, expanding far beyond meme coin speculation. Magic Eden, which powers the wallet via Slingshot, said, “We’re working on a much larger project now with Trump Wallet.”

TRUMP token spiked 3% on the news, even as critics blast the president’s crypto initiatives for blurring lines between politics and promotion. Despite the backlash, Trump’s crypto brand keeps doubling down on giveaways, NFTs, and onchain perks.

Robinhood Closes Bitstamp Acquisition For $200 Million

Robinhood has finalized its $200 million acquisition of Bitstamp, giving the trading app access to institutional crypto markets and international customers. Bitstamp, founded in 2011, adds licenses across the EU, UK, and Asia, along with 85 tradable assets and deep liquidity. The deal introduces Robinhood’s first institutional crypto division and fulfills its expansion timeline set last year.

The acquisition includes Bitstamp’s full team and retains its brand under the new name “Bitstamp by Robinhood.” Robinhood executives said Bitstamp's long-term resilience and regulatory reputation made it a strategic asset. With crypto trading becoming a core business line, Robinhood plans to integrate tokenized assets and expand its global financial infrastructure.

Ripple Stablecoin RLUSD Approved For Dubai Use

Ripple’s RLUSD stablecoin has been authorized for payments inside Dubai’s main financial zone, the DIFC. Approved by the Dubai Financial Services Authority, RLUSD will power cross-border settlements for 7,000 registered firms. The move deepens Ripple’s presence in the UAE after securing broader payments licensing in the country.

Ripple has partnered with banks and fintech platforms in the region, aiming to embed RLUSD into real estate and digital infrastructure systems. Executives cited growing institutional interest in regulated crypto payments and tokenized assets. RLUSD, backed 1:1 by USD reserves, currently holds a $310 million market cap in the competitive stablecoin sector.

Nasdaq's Classover is Raising $500 Million to Buy Solana

Classover Holdings, a Nasdaq-listed edtech firm, signed a deal to issue up to $500 million in convertible notes for building a Solana treasury. The company said 80% of funds must be used to purchase SOL, with $11 million expected in the first closing. This follows an earlier $400 million equity agreement that also targets SOL accumulation.

CEO Stephanie Luo said the treasury initiative aligns with a strategy to embed blockchain into corporate finance models. The announcement sent Classover stock up nearly 40% before a minor after-hours dip. Classover joins several companies using Solana holdings to diversify reserves and reposition around digital asset infrastructure.

Data of the Day

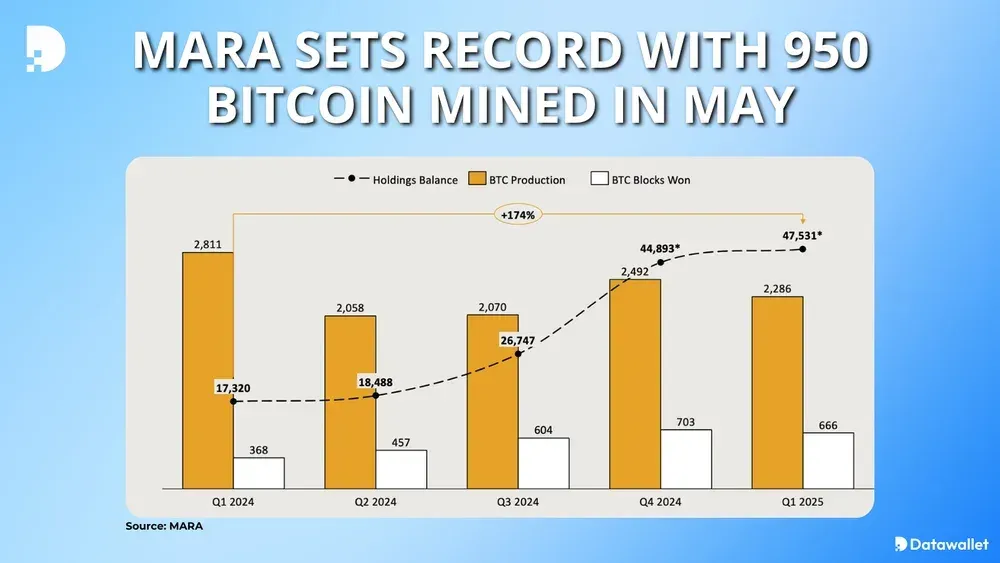

Crypto miner MARA Holdings produced a record 950 Bitcoin in May, a 35% increase from April, and expanded its hashrate to 58.3 exahash per second. The company said it won 282 blocks and benefited from above-average block reward luck. May’s output adds to a growing BTC reserve now totaling 49,228 Bitcoin worth $5.3 billion.

CEO Fred Thiel credited network performance and pool efficiency for MARA’s mining edge. Unlike its rival Riot, which sold most of its mined BTC, MARA retained all holdings. The company’s market cap is now level with the value of its Bitcoin reserves, boosting investor confidence in its compound mining strategy.

More Breaking News

- Vitalik Buterin said Ethereum should scale 10x over the next year, improving speed and cost even as Layer 2s gain market share..

- Meta shareholders rejected a Bitcoin treasury proposal, with just 0.08% of votes cast in favor of adding BTC to reserves.

- James Wynn opened a second $100M Bitcoin long on Hyperliquid and claimed he's being targeted by a 'market-making cabal' after last week’s liquidation.

- Strategy announced a new share sale called 'Stride' to raise funds for its ongoing Bitcoin accumulation and general operations.

- FCA-registered BCP Technologies launched a pound-backed stablecoin called tGBP, branding it a “live test” for future UK rules.

- Kraken introduced Kraken Prime, a white-glove crypto brokerage service offering institutional clients unified trading and custody.

- Revolut’s job posting indicates a crypto perpetuals expansion, as it seeks to build a platform to serve its 50 million global users.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

.webp)

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.