XRP Staking Guide: Best Yields & Platforms in 2025

Summary: Staking XRP refers to earning yield through external platforms, as the XRPL layer 1 network currently lacks native staking. Common approaches include centralized earn programs, lending wrapped XRP, or tapping into yield flows tied to real-world asset activity.

Centralized exchange platforms offer predictable yields (up to 10% APY), while XRPL’s emerging real-world asset markets provide yield opportunities tied directly to real-world assets.

Binance offers XRP holders simple, custodial yield options through Flexible Savings and time-locked staking promotions, with competitive rates and seamless on-platform management.

Current APY Range

About 0.5% (Flexible) to 118%+ (Dual Investment)

Payout Frequency

Daily (Flexible), or End of Term (Locked)

Withdrawal Terms

Instant (Flexible), Fixed lock period (Locked)

What is XRP Staking?

XRP staking is a term commonly used to describe earning yield on XRP, but it doesn't reflect a native feature of the XRP Ledger. The XRPL operates on a consensus protocol, not Proof-of-Stake, which means there are no validator rewards or network-level staking mechanisms.

As a result, when people talk about “staking” XRP, they’re typically referring to third-party platforms that offer returns for locking or lending XRP. These services don’t secure the XRPL but function as financial products from centralized exchanges or decentralized finance protocols.

To earn yield on XRP, users can explore options like staking programs on centralized exchanges (CEXs), interest-bearing lending pools, or wrapping XRP onto networks that support staking-like mechanics. Each method varies in risk, reward, and structure, but all aim to grow passive XRP income.

Types of XRP Yield-Earning Methods

XRP doesn’t support native staking, but there are two core paths to earn yield: using wrapped XRP in smart contracts, or putting tokens to work through centralized exchange features. Let's examine both:

1. Wrapped XRP in DeFi

Wrapped versions of XRP let you move it onto networks that support smart contracts and yield protocols. These include cbXRP on Base, FXRP on Flare, and wXRP on Ethereum or Binance Chain.

- cbXRP on Base: Coinbase offers cbXRP on its Base Layer 2 network. Once converted, you can lend cbXRP, provide liquidity, or farm yield while still tracking the value of XRP.

- FXRP on Flare: Flare's FXRP is a non-custodial version of XRP that can interact with Flare’s DeFi ecosystem. Users can earn by supplying FXRP to AMMs, lending pools, or other dApps.

- Other Wrapping Options: XRP also exists as wXRP on Ethereum and BNB Chain, though these versions are less common. Always check who controls the bridge and whether the token secure.

- What to Watch For: DeFi can offer strong returns, but it carries risk. Vulnerable contracts, bridge failures, or liquidity losses can eat into what you earn.

2. Centralized Exchange Earn Programs

For users who prefer simplicity and familiarity, centralized crypto exchanges offer ways to earn on XRP without navigating DeFi. These options resemble savings accounts or lending desks more than traditional staking.

Common Methods Include:

- Flexible Savings: Earn interest with no lock-up, offered by platforms like Binance and Uphold.

- Locked Staking: Commit XRP for a fixed term to receive higher yields, often during promotional periods.

- Lending Pools: Lend XRP to other users or institutions and earn variable interest based on demand.

- Promotional Offers: Time-limited events with boosted XRP yields, usually capped and first-come-first-served.

These methods are generally easier to use but come with trade-offs. Yields tend to be lower than DeFi, and you're giving up full control of your XRP to a custodial platform.

Top Platforms for XRP Yield

Different platforms approach XRP yield in their own way; some prioritize simplicity and accessibility, others focus on deeper interactions with decentralized protocols.

What sets them apart is how they handle custody, reward structure, user control, and risk exposure. Below is a breakdown of key platforms offering XRP yield and what makes each one unique.

1. Binance - Simple Earn (Flexible & Locked)

Binance features two main ways to earn with XRP: Flexible Savings and Locked Staking. Flexible lets you earn daily interest with full access to your funds, while Locked offers better rates if you commit your XRP for a set period.

How to use it:

- Go to the "Earn" tab and select XRP under Flexible or Locked options.

- Choose the amount to deposit and confirm your subscription.

- Optional: Enable Auto-Subscribe so future XRP deposits start earning automatically.

Example: 1,000 XRP at 0.5% APR earns ~5 XRP/year on Flexible; 30 days locked at 2% earns ~1.64 XRP.

Tip: Watch for limited-time promotions under “Earn Wednesdays” for higher rates.

2. Bitrue - Power Piggy and Promo Pools

Bitrue supports flexible XRP interest through Power Piggy and higher-yield, short-term lockups through promo staking pools. It’s popular among XRP holders for its simplicity and frequent events.

How to use it:

- Stake XRP in Power Piggy for ~1.5% APY with daily interest and full withdrawal access.

- For higher returns, join promo pools offering 5%-50% APY for 7 to 30-day lockups.

- Promo pools are limited and fill fast, so act quickly.

Example: Staking 2,000 XRP in Power Piggy earns ~0.082 XRP/day.

Tip: Holding BTR (Bitrue’s token) may unlock better access or boosted rewards.

3. Uphold - Flare-Powered Yield (Upcoming)

Uphold is testing an XRP yield program that integrates with Flare’s F-Asset system, letting users earn without managing DeFi wallets. XRP is wrapped into FXRP automatically and deployed into Flare’s protocols.

How it works:

- Deposit or buy XRP on Uphold.

- Opt into the Flare network yield program when live.

- Yield may be paid in XRP or Flare tokens, depending on the setup.

Example: Staking 500 XRP may return 8-10% APY via Flare.

Tip: Check for lock-up terms or withdrawal restrictions once the feature launches.

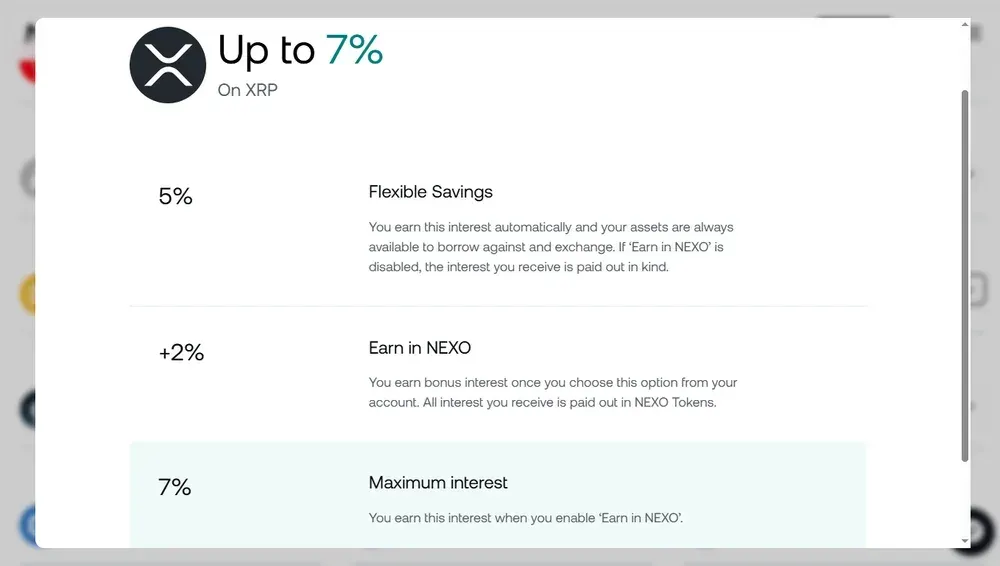

4. Lending Platforms (Nexo, YouHodler, MEXC)

Lending platforms allow you to earn interest by supplying XRP to institutional borrowers. Some platforms require holding their token to unlock the best rates.

How to use it:

- Create an account on Nexo, YouHodler, or another trusted platform.

- Deposit XRP to start earning automatically or select a specific lending term.

- Choose to earn in XRP or in a platform token (e.g. $NEXO) for higher returns.

Example: 1,000 XRP earning 6% APY on Nexo = ~0.16 XRP/day or 5 XRP/month.

Tip: Review payout schedules, minimums, and whether interest is fixed or variable.

5. DeFi with Wrapped XRP (Flare, Base, Ethereum)

For users comfortable with DeFi, wrapped XRP variants (FXRP, cbXRP, wXRP) can be used in lending pools, AMMs, and farms on smart contract networks.

How to use it:

- Wrap XRP via Coinbase (cbXRP), Flare Portal (FXRP), or another verified bridge.

- Connect a DeFi wallet (e.g. MetaMask or Bifrost) to the relevant network.

- Provide wrapped XRP to liquidity pools or lending protocols and track your rewards.

Example: Pairing $50 in FXRP with $50 in cbBTC in a Aerodrome AMM targeting 781% APY (at the moment).

Tip: Start with small amounts to test the process and avoid unaudited crypto bridges or risky farms.

Alternative Ways to Earn Yield from XRP

Beyond centralized exchange products, XRP holders can earn yield through DeFi strategies such as liquidity provision or yield farming. These methods can offer higher returns but come with greater complexity and risk.

Liquidity Pools on XRPL Native DEXs

XRP can be used in liquidity pools to earn a share of trading fees, especially on XRPL’s native AMM or platforms like Sologenic’s DEX.

- Provide XRP to a trading pair (e.g. XRP/USDT) and earn passive income from every trade executed in the pool.

- Some pools also offer extra incentives, such as bonus tokens from partner protocols or LP rewards.

Rewards can vary from 2-8% APY, but impermanent loss is a real risk if XRP’s price fluctuates significantly. Always track your pool performance.

Yield Farming with Wrapped XRP (wXRP, FXRP, cbXRP)

If you're comfortable with smart contracts and bridging assets, you can deploy wrapped versions of XRP into DeFi ecosystems.

- On Flare: Stake FXRP in liquidity farms or lending platforms and earn yield in Flare-native tokens.

- On Base: Use cbXRP in DeFi protocols to earn lending interest or farm governance tokens.

- On Ethereum or BSC: Provide liquidity with wXRP on DEXes like Uniswap or PancakeSwap.

Yield farming can reach double-digit APYs but requires regular monitoring and comes with exposure to smart contract bugs and volatile reward tokens. Recommended only for experienced users.

Security and Risk Management for XRP Yield Strategies

Earning yield on your XRP can be rewarding, but it comes with risks that shouldn’t be overlooked. Protecting your funds requires awareness, smart habits, and understanding how different yield strategies expose you to different types of risk.

Here are the key risks to manage before committing your XRP:

- Custodial risk: You are trusting the platform with your XRP, so if the exchange is hacked, freezes withdrawals, or collapses, your funds could be lost.

- Smart contract risk: Bugs or exploits in DeFi code can drain your wrapped XRP, even on audited or high-profile platforms.

- Impermanent loss and market risk: Providing XRP liquidity can result in lower returns if XRP’s price changes significantly versus the paired asset.

- Lock-up risk: Staking or fixed-term products limit access to your XRP, which can hurt during emergencies or rapid market shifts.

- Regulatory and tax risk: Yield earnings may be taxed and regulations can impact platform availability or legal compliance in your region.

- Insurance limitations: Platform or DeFi insurance may exist but often comes with fine print, limited coverage, or delayed payouts.

- Personal security threats: Weak passwords, phishing links, and fake staking sites can lead to account compromise or total loss of funds.

Real-World Asset Tokenization as a Yield Path for XRP Holders

Tokenization of real-world assets (RWAs) on the XRP Ledger is unlocking new ways for users to earn yield tied to real economic value. XRP holders can participate by providing liquidity, trading asset-backed tokens, or engaging with stablecoin flows that support these financial products.

Ripple’s recently launched RLUSD stablecoin plays a key role, already seeing adoption in pilots like real estate deed tokenization with the Dubai Land Department. These projects set the stage for on-chain income distribution, where rent or interest payments flow to token holders.

As XRPL infrastructure expands around RWAs, XRP may be used as collateral, in payment rails, or as liquidity for trading tokenized assets. Each of these roles presents a potential yield stream generated by real utility rather than protocol staking.

Final Thoughts

XRP holders have heard it all, from price memes to the constant “is it even useful” digs, but 2025 tells a different story. Native staking might still be missing, yet the yield options emerging around XRP are finally giving it real economic function.

Whether through lending, DeFi, or supporting real-world asset flows, your XRP can now do more than just sit and hope. It may not be the moonshot people joke about, but at least it earns something while it waits.

Frequently asked questions

What does “XRP staking” actually mean? Can you explain common terms in simple language?

"Staking XRP" is often used loosely in the crypto world. Here's a quick glossary to clarify key concepts:

- XRP Ledger (XRPL): The blockchain that XRP runs on, using a consensus protocol instead of Proof-of-Stake.

- Wrapped XRP (wXRP, FXRP, cbXRP): Versions of XRP issued on smart contract platforms to enable DeFi functionality.

- Yield Farming: Earning rewards by supplying tokens to DeFi protocols, often by providing liquidity to trading pairs.

- Liquidity Pool (LP): A pool of tokens you deposit into a decentralized exchange, earning a share of trading fees.

- RLUSD: Ripple’s stablecoin, often used in RWA use cases and payment settlements on XRPL.

- Impermanent Loss: A potential loss you face when the token prices in your liquidity pool diverge during holding.

- Custodial Risk: The danger of trusting a platform (like an exchange) with your funds instead of self-custody.

What are the best ways to earn passive income with XRP in 2025?

Beyond centralized exchange programs, some of the most promising methods include participating in DeFi with wrapped XRP, providing liquidity to real-world asset token markets on XRPL, and exploring platforms integrating Flare or Base network functionality.

The ideal strategy depends on your risk tolerance, technical comfort, and whether you prioritize flexibility or higher returns.

Can I use XRP in real-world DeFi applications like mortgages or real estate?

Yes, XRP is increasingly being used in RWA-based DeFi use cases such as tokenized real estate, where assets like property deeds are issued on-chain and settled using XRP or XRP-backed stablecoins.

These systems may allow users to earn yield through rental distributions or collateral-based participation, connecting crypto directly to tangible asset flows.

How does wrapped XRP compare to native XRP in terms of earning potential?

Wrapped XRP (wXRP, FXRP, cbXRP) offers access to DeFi protocols that support smart contracts and yield farming, making it far more versatile for earning yield than holding native XRP onchain.

However, it comes with added risks such as bridge security, smart contract vulnerabilities, and custodial trust depending on the wrapping service used.

%2520(1).webp)

Written by

Antony Bianco

Head of Research

Antony Bianco, co-founder of Datawallet, is a DeFi expert and active member of the Ethereum community who assist in zero-knowledge proof research for layer 2's. With a Master’s in Computer Science, he has made significant contributions to the crypto ecosystem, working with various DAOs on-chain.

.webp)

.webp)

.webp)