Justin Sun Demands Unfreeze of WLFI Tokens

GM. Justin Sun is demanding World Liberty Financial unfreeze his WLFI tokens after his wallet was blacklisted, sparking suspicion as transfers through HTX and Binance wallets.

Meanwhile, Hyperliquid faces controversy over its USDH stablecoin proposal, an early Ethereum ICO whale stakes $645 million in ETH, and Solana treasury firm gets a Nasdaq listing.

The week kicks off with freezes, fights, and big treasury moves. 👇

Justin Sun Demands Unfreeze of WLFI Tokens

Tron founder Justin Sun demanded that World Liberty Financial unfreeze his WLFI tokens after his wallet was blacklisted last Thursday. Sun, a $75 million early investor and advisor, claimed the tokens were “unreasonably frozen” and his rights were violated.

Blockchain tracker Arkham showed Sun’s address transferred 50 million WLFI, worth $9 million, toward an HTX-linked hot wallet before the freeze. The tokens were subsequently routed through additional addresses, with another 60 million WLFI later reaching HTX’s Gnosis Safe Proxy, intensifying market suspicion.

Coinbase’s Conor Grogan reported a Binance deposit wallet linked to Sun received 60 million WLFI, worth $12 million. Nansen also flagged heightened deposits from HTX, BitGo, and Flowdesk, adding extreme selling pressure that coincided with WLFI’s 24% price plunge.

Sun denied selling, insisting transfers were “general exchange deposit tests” with small amounts and no market impact. Critics argued he likely had verbal agreements restricting sales, while community frustration mounted over perceived insider privilege and collapsing investor confidence.

Hyperliquid Pushes Forward With USDH Stablecoin Proposal

Hyperliquid opened submissions on Friday for a native USDH stablecoin, boosting liquidity and accelerating network adoption. Validators have five days to review proposals before voting, unlocking deployment rights and ecosystem growth. Paxos proposed a GENIUS-compliant USDH, stressing regulatory clarity, global scale, and revenue sharing aligned with Hyperliquid’s expansion.

Analysts projected USDH could drive $191 million annually in HYPE buybacks, strengthening token value and confidence. Supporters highlighted Paxos’ framework ensures transparent governance and validator incentives, encouraging sustainable decentralized finance growth. Validators now decide if Hyperliquid becomes the leading hub for compliant, large-scale stablecoin issuance.

Ethereum ICO Whale Stakes $645 Million in ETH

Onchain analysts EmberCN reported that an Ethereum whale from 2015 staked $645 million worth of ETH from three wallets. The whale originally acquired one million ETH in the ICO and still holds roughly $1.1 billion. Analysts said the move signals confidence in Ethereum’s long-term trajectory amid strong institutional demand and growing inflows into Ethereum ETFs.

Ethereum recently traded near $4,300, climbing over 70% in three months and briefly setting record highs above $4,900. Prediction markets show 73% odds the asset surpasses $5,000 by year-end, despite ongoing volatility. Analysts noted whale staking aligns with declining exchange balances, suggesting long-term holders continue positioning through uncertain macroeconomic conditions.

Solana Treasury Firm SOL Strategies Wins Nasdaq Listing

SOL Strategies, a Canadian Solana treasury and infrastructure firm, confirmed it received approval to list shares on Nasdaq. Trading is expected to begin on September 9 under the ticker STKE, expanding institutional visibility and partnership opportunities. The firm will also delist from OTCQB, with shares converted automatically to the Nasdaq registration.

Executives said the listing strengthens shareholder access and creates deeper capital markets interest for Solana infrastructure projects. SOL Strategies currently holds 435,000 SOL in treasury and oversees three million staked SOL through validators. CEO Leah Wald said Nasdaq's credibility supports long-term growth and places the company alongside top public innovators.

Data of the Day

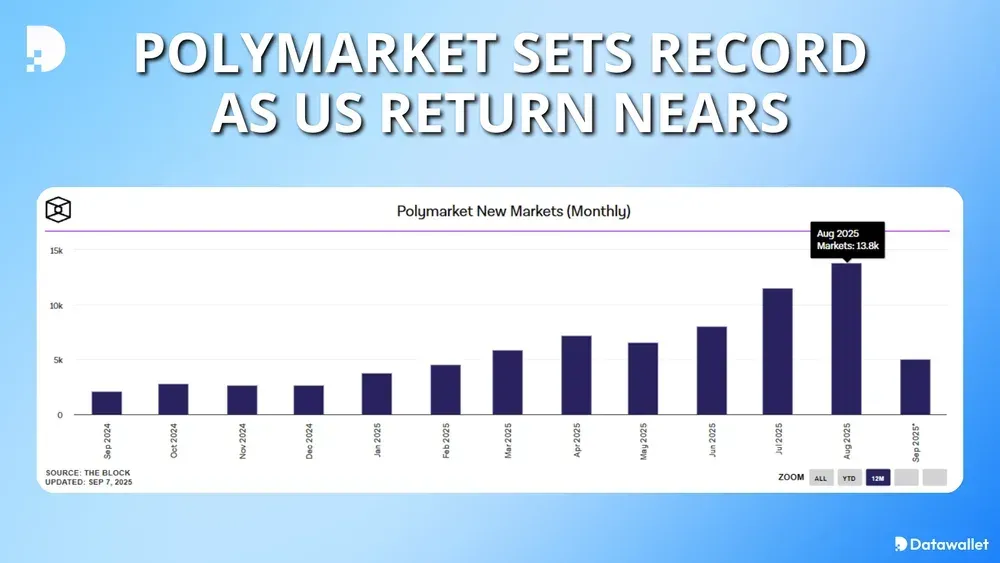

Decentralized prediction market Polymarket reported a record 13,800 new markets created in August, surpassing July’s previous milestone. The platform lets users wager with crypto on future events and gained notoriety during the 2024 election. CEO Shayne Coplan said regulators have cleared its path for US re-entry through the acquisition of derivatives exchange QCEX.

Polymarket has high-profile backers, including Donald Trump Jr. and Elon Musk’s X, but overall trading activity has slowed. Active traders dropped to around 227,000, while volumes plateaued near $1 billion after earlier peaks. Executives believe the US relaunch could reignite growth, though competition and regulatory oversight remain key hurdles ahead.

More Breaking News

- Trump Media finalized the purchase of 684 million in CRO tokens from CryptoCom, forming a $6.4 billion joint treasury focused on platform integration and user rewards.

- A new Senate crypto bill proposes an SEC-CFTC joint body, protects DeFi developers, exempts DePINs, and clarifies airdrops, staking rewards, and tokenized asset classifications.

- Michael Saylor gained $1 billion in 2025 and entered Bloomberg’s Billionaire Index, as Strategy’s Bitcoin holdings climbed to over $72 billion in value.

- Tether may invest directly in gold mining after building an $8.7 billion gold reserve and calling the metal “Bitcoin in nature” at a conference.

- Bitcoin mining difficulty hit a record 134.7 trillion, squeezing solo miners and raising concerns that industrial operators could centralize control of the network.

- Bullish Europe won a MiCA license from BaFin, unlocking its ability to passport crypto services across the entire European Union under EU-wide oversight.

- EU lawmakers raised privacy concerns over the ECB’s digital euro plan, warning it may destabilize commercial banks and expand government control over savings.

For the latest updates on digital asset markets, follow us on X @Datawalletcom.

.webp)

Written by

Jed Barker

Editor-in-Chief

Jed, a digital asset analyst since 2015, founded Datawallet to simplify crypto and decentralized finance. His background includes research roles in leading publications and a venture firm, reflecting his commitment to making complex financial concepts accessible.